01/13/2026

Auto-Calculated Overtime Premium

Payroll Clients Can Now Add Calculations to Box 14 for 2025 W-2s

Table of Content

This update applies to Greenshades Payroll clients preparing 2025 W-2s.

If you use Greenshades Year-End Forms only (YEF) or another product without payroll, skip ahead to the “Options for Non-Payroll/YEF-Only Clients” section below.

What’s New

Greenshades Payroll has released a new enhancement that automatically calculates the FLSA overtime premium and places it in Box 14 of the Form W-2 during the 2025 W-2 creation process.

Read now: Leveraging Box 14 for 2025 - How Employers Can Support Tip & Overtime Deductions

This supports the IRS’s transitional guidance for tax year 2025, where employees may need access to their qualified overtime premium to claim the new above-the-line deduction.

How it Works

When creating 2025 W-2s, the overtime premium is now calculated and handled automatically:

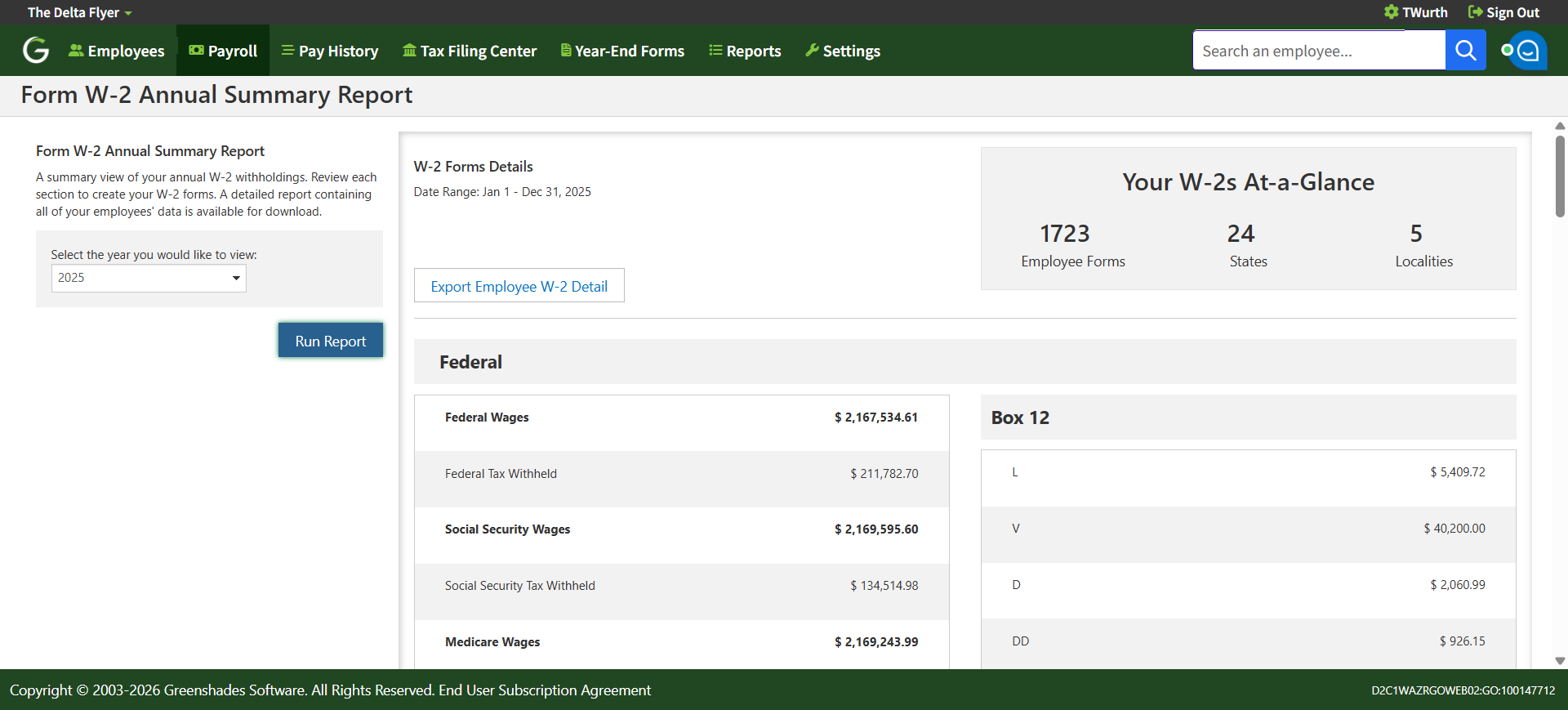

- Navigate to Payroll > Tax Generation > W-2

- Select Tax Year 2025

- Click Run Report

You’ll now see a Box 14 entry labeled “OT PREM”, which represents the total qualified overtime premium for the year.

Additional details:

- By downloading the W-2 Detail Report, you can view the overtime premium amount by employee

- Once you create W-2 forms, the overtime premium is automatically populated in Box 14 for each employee who had qualifying overtime during the year

- You can download, review, and edit the data before final submission

- The amount is informational only and does not change taxable wages or withholding

This removes the need for manual premium calculations or spreadsheets during year-end. Employees use the information provided to determine eligibility on their individual tax returns.

Why this Matters

Under IRS guidance, only the FLSA overtime premium portion (generally the extra 0.5× paid on hours worked over 40 in a workweek) qualifies for the 2025 overtime deduction.

That distinction has created extra work for payroll teams. This update helps by:

- Automatically identifying and calculating the premium portion

- Providing a clean, consistent value employees can reference

- Supporting optional Box 14 reporting for 2025

- Preparing payroll processes for mandatory overtime reporting beginning in 2026

Options for Non-Payroll/YEF-Only Clients

If you use Greenshades Year-End Forms or another product without payroll, the overtime premium is not auto-calculated. However, you still have supported options for 2025:

- Calculate the qualified overtime premium externally using your payroll system or reports

- Upload the premium amount into Year-End Forms using the standard import templates

- Manually enter or batch-edit Box 14 values once data is in the system

- Choose how to present the information:

- Box 14 of the W-2 (recommended for 2025), or

- A separate year-end statement for employees

This mirrors current workflows while allowing flexibility during the 2025 transition year.

Important Reminder

Due to recent USPS operational changes, postmark timelines may vary. To allow enough time ahead of the January 31 deadline for W-2s and other forms, we recommend submitting Print & Mail requests by January 23.

Our latest articles, thought leadership, and more

Get the latest updates from our company by subscribing to our newsletter. Stay up-to-date with our content, receive news about our products, and gain industry insights from our experts. Don't miss out on this valuable resource - sign up today!

By subscribing to our email updates, you agree with our Privacy Policy.

You May Also Like