01/13/2026

Leveraging Box 14 for 2025

How Employers Can Support Tip & Overtime Deductions

⚠️Note: This information is for informational purposes only and does not constitute formal tax, legal, or compliance advice. Always consult with qualified tax advisors, legal counsel, and your organization’s internal teams for guidance specific to your situation. Additional regulations may apply. For the most accurate and up-to-date information, refer to official government resources and regulatory agencies.

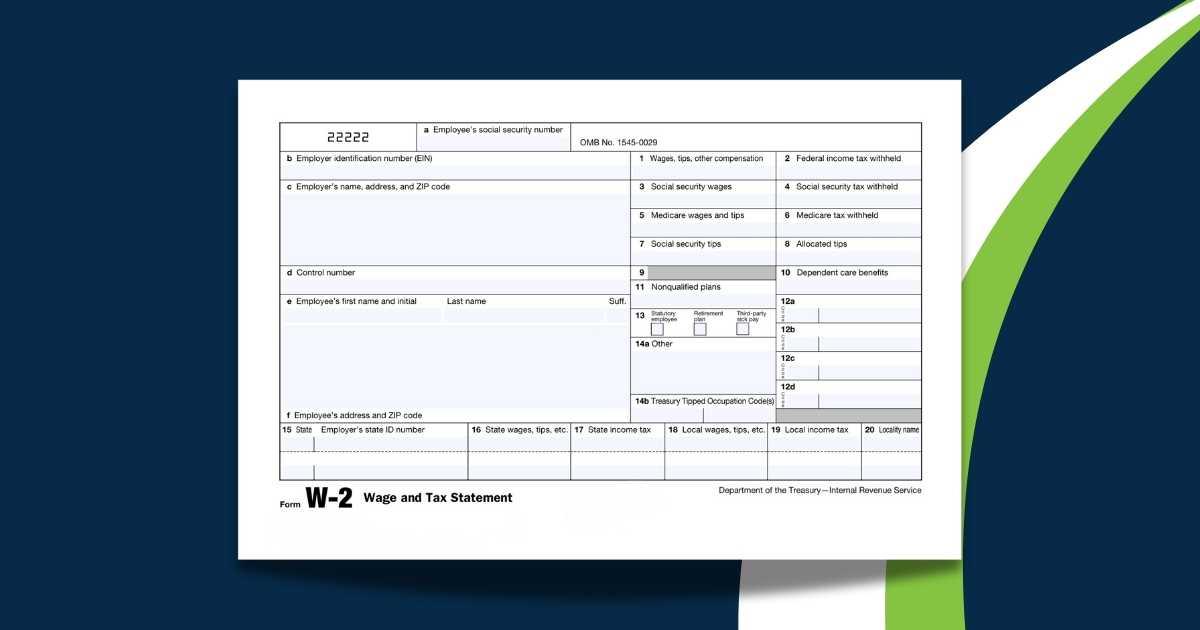

What Box 14 is

Box 14 on Form W-2 is an “Other” box employers may use to provide supplemental, informational amounts that do not have a dedicated W-2 reporting field.

Because the IRS does not assign standardized codes to Box 14, employers may use their own clear descriptions or abbreviations to explain what the reported amount represents.

Why Box 14 Matters for Tax Year 2025

With the new qualified overtime and qualified tip deductions enacted under the One Big Beautiful Bill Act, IRS reporting requirements are being phased in over time. The IRS confirmed that 2025 is a transition year, meaning:

- W-2 forms do not yet include dedicated boxes or codes for qualified tips or qualified overtime

- Employers are not required to separately report these amounts for 2025

Read Now: Handling Qualified Tips in 2025 and Handling the 2025 Overtime Deduction

That said, the IRS encourages employers to provide this information anyway, and Box 14 of the W-2 is an acceptable — and preferred — method for doing so.

Make sure to:

- Use clear, specific labels so employees and tax preparers understand what the amount represents

- Communicate that Box 14 is informational only and does not change taxable wages or withholding by itself

- Don’t combine multiple items into a single, unlabeled Box 14 amount

For payroll teams and tax preparers alike, Box 14 is often the cleanest and most practical way to give employees the documentation they need to claim these deductions.

Alternatives to Box 14

IRS Notice 2025-69 allows employers to furnish qualified tip and overtime information using other secure methods for tax year 2025. Acceptable alternatives include providing a separate written or digital statement, such as:

- A year-end earnings statement

- A printed letter

- A digital payroll summary or PDF via a payroll portal

- POS system tip totals

- Employer-maintained electronic or manual tip logs

These statements may include:

- Total cash tips

- Total qualified overtime compensation

- Occupation information

- Any additional details employees may need to substantiate their deductions

What Employers Should Do Now

Even though reporting is optional for 2025, IRS guidance strongly suggests that employers:

- Provide qualified tip and overtime information in Box 14, or

- Furnish a separate year-end statement with the relevant details

Doing so helps employees claim deductions of up to $25,000 for tips and $12,500–$25,000 for overtime, and positions your payroll process for mandatory, standardized reporting beginning in 2026.

Our latest articles, thought leadership, and more

Get the latest updates from our company by subscribing to our newsletter. Stay up-to-date with our content, receive news about our products, and gain industry insights from our experts. Don't miss out on this valuable resource - sign up today!

By subscribing to our email updates, you agree with our Privacy Policy.

You May Also Like

Handling Qualified Tips in 2025