Confident Year-End Filing Starts Here

Leverage a curated library of guides and resources to prepare, file, and deliver W-2s, 1099s, and other year-end forms—on time and with confidence.

Mastering Year-End Forms: Tips for a Smooth Filing Process

Perfect your W-2 and 1099 preparation, and streamline data management for a smooth, compliant year-end.

6 Expert Tips for Year-End Payroll Tax Reporting

2026 HR & Tax Calendar

Webinar Recap

Your 2025 Year-End Gameplan

Start year-end right with a clear checklist and plan.

Webinar Recap

Year-End Filing Essentials

What you need to know about key filing rules.

Webinar Recap

The 1099 Deep Dive

Master the different 1099 forms and file with ease.

Webinar Recap

Ask the Greenshades Experts

Your year-end questions, answered live by experts.

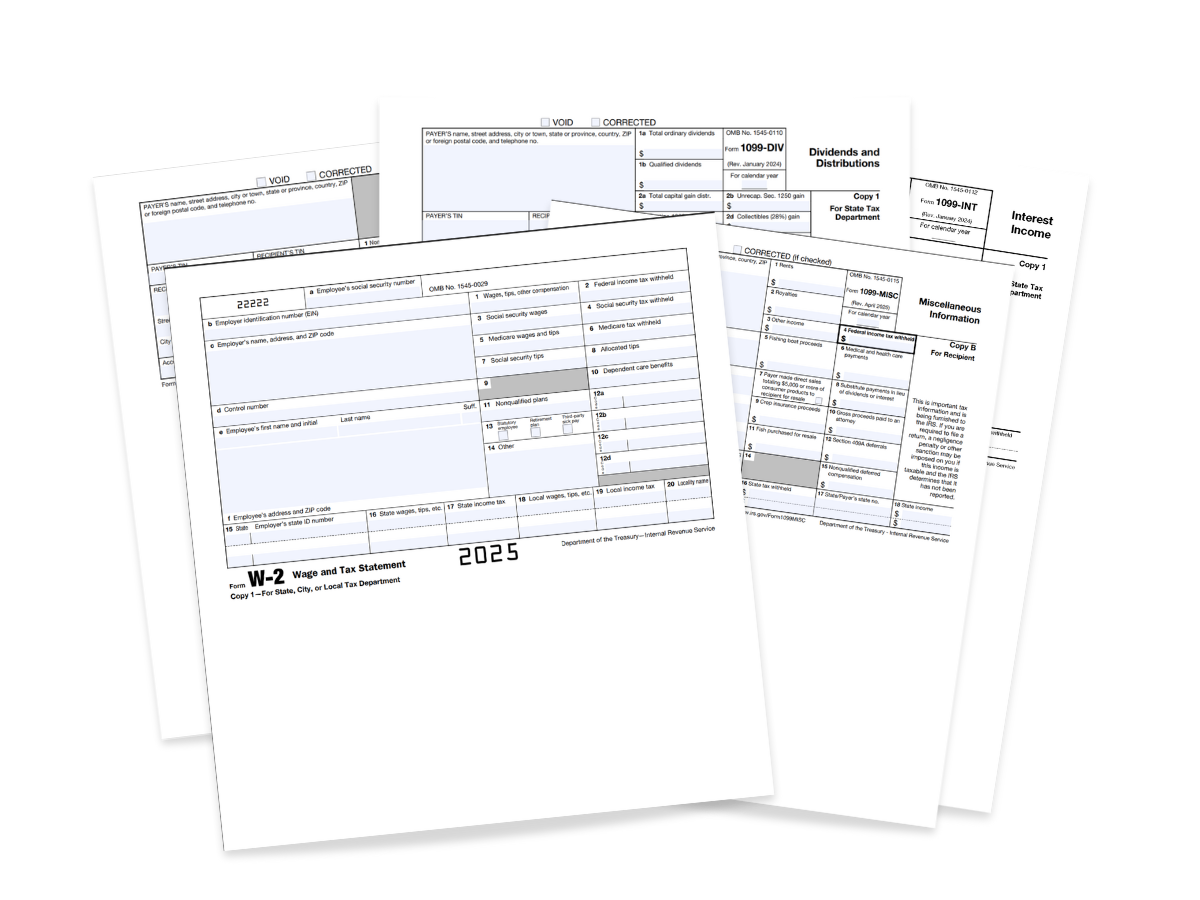

| Purpose: Reports employee wages and the taxes withheld during the year to both the IRS and employees. |

Deadlines: (Requirements can vary by form type)

|

|

Get Started |

|

Prep Your Data |

|

Dive Deeper |

| Purpose: Reports payments made to non-employees (such as contractors, vendors, or freelancers). |

Deadlines: (There are multiple types of 1099s with different rules and deadlines - this is general guidance)

|

|

Check Form Type |

|

All About 1099s |

| File with Ease Guide to Filing 1099s |

| Purpose: Reports quarterly federal income tax, Social Security, and Medicare taxes withheld from employees’ pay. |

Deadlines: (These are the deadlines that fall in tax year 2026)

|

|

Know the 900 Forms

|

|

Prep Your Data |

| Master 941 Reporting Perfecting Quarter-End Payroll Tax Reporting |

| Purpose: Reports employer-provided health coverage information to the IRS and employees. |

Deadlines: (These are the deadlines that fall in tax year 2026)

|

|

There are many other forms due for year-end filing.

|

|

Check Filing Requirements

|

|

Download a Calendar to Stay on Track

Get Your Copy of Greenshades 2026 HR & Tax Calendar |

Ready to complete your year-end forms? Greenshades makes year-end filing simpler.

Stay Up-to-Date Throughout Year-End

Get the latest updates from our company by subscribing to our newsletter. Stay up-to-date with our content, receive news about our products, and gain industry insights from our experts. Don't miss out on this valuable resource - sign up today!

By subscribing to our email updates, you agree with our Privacy Policy.