Explore Nonprofit Payroll Management for Your Organization

Efficient Payroll and HR Built for Nonprofits

Easy Payroll Calculations

Although nonprofits are given tax breaks, there are still payroll taxes that must be calculated. We make calculating taxes easy by automating it and giving you the tools needed to quickly review and submit your payroll.

Stay on Top of Compliance

Maintain compliance with ACA regulations, payroll taxes, overtime, and break compliance, and more using Greenshades software.

Manage your Budget

With Greenshades, you do not have to worry about surprise fees, and with support and implementation at no extra cost, you can easily stay in line with your budget.

Payroll and HR designed to keep up with the hard work of nonprofit teams.

Focus on Your Mission, Not Compliance

As a nonprofit organization, your energy and attention should be focused on your mission, not worrying about regulatory compliance. With Greenshades, you’ll receive automatic alerts of potential compliance issues related to ACA, new hire reporting, garnishment orders, wage adjustments, and more. We’ll also proactively address common issues such as duplicate entries so you can prevent issues before they can cause a problem. And if you ever need help, we’re just a call away!

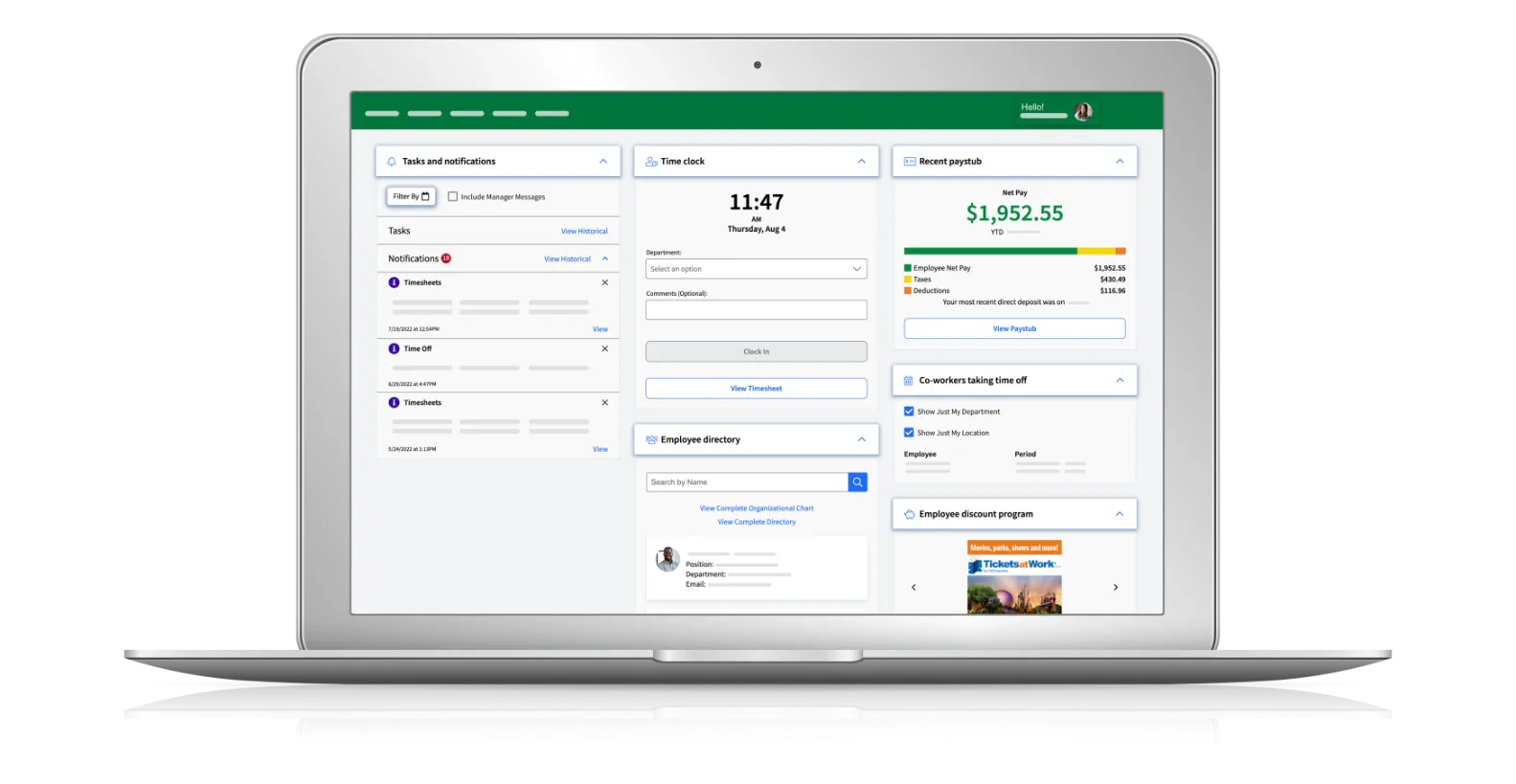

User-Friendly Platform

We’ve designed the Greenshades Payroll and HR platform to be easy to configure, easy to use, and easy to manage… even if you have many employees or complex pay conditions.

- 374 Nonprofit organizations served

- 260,000 Employees Supported

Unlimited Pay Types

Our Payroll and HR platform is flexible enough to accommodate your unique work conditions, not force you to change your operations to accommodate the platform. An unlimited number of pay types, assigned at the time of hire or project start, are easy to access and configure. And project dates automatically drive whether pay types are active or not within the system. Less manual work means more time available for those that you serve.

Integrations

Get Started & Sync to Your

Favorite Platforms

Testimonials

What Our Customers Say

“Love the ease of the software and the attentive, informed customer service team.”

Second Baptist Church

“Greenshades is a convenient one-stop system that makes our tax filing much easier.”

Dale Rogers Training Center

“I have always had good results with Greenshades any issues etc. always very helpful great system great staff.”

The Bair Foundation

“Love the employee portal, tax services, dashboard, and reports. Greenshades is user friendly!”

Great Plains Health Alliance (GPHA)

Try Greenshades Today

See how Greenshades gives Nonprofit companies the tools to process withholdings, automate tax calculations, and simplify payroll.

Highest Rated Payroll and HR Softwarefor Nonprofits

FREQUENTLY ASKED QUESTIONS

Discover the most commonly asked questions about Payroll and HR software for nonprofits.

What are 501cs?

To be tax-exempt under section 501c(3) the IRS states an entity must be “organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or other specified purposes. Tax-exempt organizations do not seek commercial or monetary profit for private interest, and they do not benefit from any net earnings. All funds collected by nonprofits go towards the organization’s purpose. Other forms of tax-exempt classifications include 501(c)(4), which covers social welfare organizations and 501(a) represents other nonprofit organizations.

Even if your organization is tax-exempt, you are still liable for payroll taxes. Nonprofit organizations must withhold federal income taxes, Social Security, and Medicare. They are also liable for federal unemployment taxes, organizations under the 501c(3) are not liable for Federal Unemployment taxes

What are HR challenges for nonprofit organizations?

Nonprofit operations greatly differ from for-profit organizations in how they gain profit and how they run their HR operations. Some of the HR challenges that are specific to nonprofits include:

- Cost Effective: Due to limited funding, nonprofits must keep overhead cost low. So, it may seem costly to think about utilizing a payroll and HR provider, however, providers like Greenshades have no surprise fees and can be a cost-effective solution. You also can save money by reducing the risk of costly fees and penalties that can come from incorrect calculations or missing important deadlines.

- Employee Classification: With both volunteers and normal employees it is important that they are classified correctly. Nonprofits may have employees who want to volunteer at special events, so it is important to understand the FLSA guidelines to understand the distinctions between volunteers and employees.

- Compliance: As a nonprofit begins to grow there are federal, state, and local laws that they must follow. Laws such as ACA require employers with more than 50 full-time employees to be offered health insurance. The FLSA requires employees to meet minimum wage requirements and be paid the correct overtime pay. Nonprofits must monitor the revenue and employee headcount to be sure they adhering to laws and regulations.

How do people get paid through nonprofits?

Employers can hire volunteers who offer uncompensated service or hire employees who must be paid at least minimum wage. Most nonprofit revenue comes from donations, grants, or selling goods or services and this revenue is used to pay employees. Like other employees, nonprofit employers provide benefits packages and fair compensation to their employees.