Solutions for Complex Payroll

Tackle Your Toughest Payroll

Challenges with Greenshades

We provide solutions for the most complex aspects of your pay run, eliminate the risk of errors from manual calculations or workarounds and save valuable time.

Eliminate Manual Deductions

Plan for and set up automatic payroll deductions to save your team from the daunting task of manual calculations.

Proper Overtime Calculations

Precisely calculate overtime and overtime premiums, even if your employee has different earnings in a pay period.

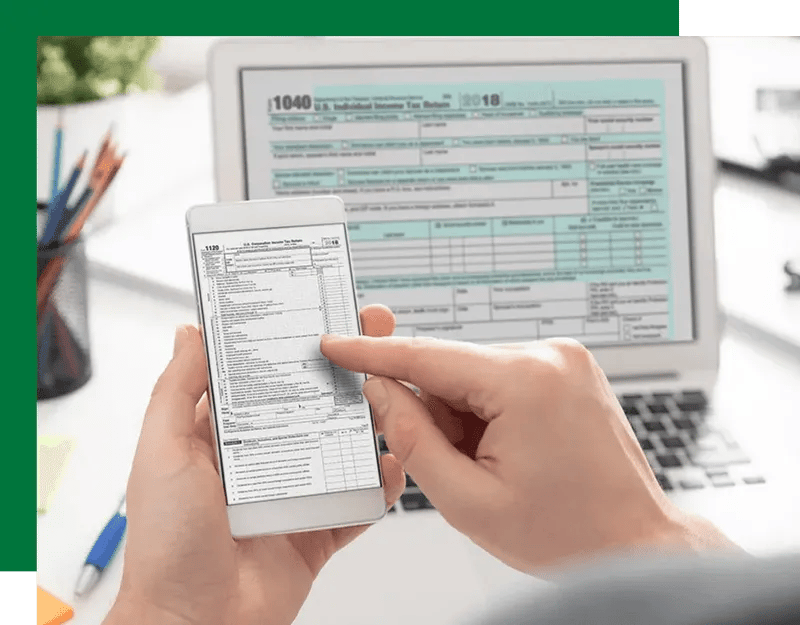

Garnishments Made Easy

Accurately calculate and prioritize all types of garnishments as well as multiple garnishments.

Error Free Tax Automation

Your business is unique and unfortunately so are your taxes. We make it easy to file and automate uncommon taxes.

Automatic Minimum Wage Management

When an employee falls below the payment threshold, the minimum wage credit will be automatically applied to ensure your employees are paid properly.

Full Support from a Team That Cares

Get the care and support your company needs. Experience the difference of working with the industry leaders in payroll solutions.

How it Works

HCM Built for Payroll Complexity

Greenshades payroll wizard is designed to automate the most challenging payroll scenarios, providing solutions that maintain compliance with local, state, and federal regulations in real-time.

Automatic Tax Codes

Most systems require controllers to manually assign employee tax codes and update them whenever employees or job sites change, but not Greenshades. Our payroll process assigns the correct tax code automatically at the time of payroll: federal, state, and local. Save time and eliminate incorrect withholdings.

Compliant and Accurate Overtime Calculations

Overtime is made simple by automatically calculating OT and OTP allocations, even for employees with shift differentials or any other situations that may cause different earnings in a single pay period. Blended overtime and complex state-specific overtime rules are handled out of the box, no extra manual configuration is needed.

Unlimited Garnishments

Our platform supports all employee garnishments at no extra charge. We can easily handle employees with multiple garnishment orders and types (child support, IRS tax levy, student loans, etc.), and they are prioritized and deducted in the applicable order, following federal and state guidelines.

Disposable Earning and Maximum Deduction Calculations

Stay compliant by automatically calculating an employee’s disposable income, thus determining wages subject to, and excluded from garnishment calculations. Protect all parties - your employee, the garnishment recipient, and your company - by ensuring compliant garnishment calculations.

Automatic Support for Minimum Wage Compliance

Employees falling below minimum wage (this is especially important with tipped employees) will automatically have the minimum wage credit applied to ensure employees are not underpaid.

Built-In Support for Uncommon Taxes

Greenshades Payroll natively supports most unusual or uncommon location-specific taxes. This includes taxes based on headcount, industry specific taxes, taxes based on a percentage of payroll expense, commuter taxes, and more.

Our Customers Say It Best

“Employees are always very quick to respond, and if they are unable to assist, forward to the appropriate person. Always very friendly.”

ARC of Southern Maryland

"Greenshades reduces the time required to accomplish certain tasks and makes the process more efficient and organized. This, in turn, frees up time to dedicate to the process improvements that sustain the company’s growth."

Angelo Tremolada

Corporate Controller, CPA, CGMASEFA

Solve Your Complex Payroll Needs

Request a demo today and see how Greenshades can empower your business!

Discover Why Our Customers

Love Using Greenshades Payroll!

Self-Managed In-House Payroll

Instantly calculate, preview, edit, and run payroll results.

Solutions for Complex Payroll

Automate tax codes, automatically apply pay rules, and more.