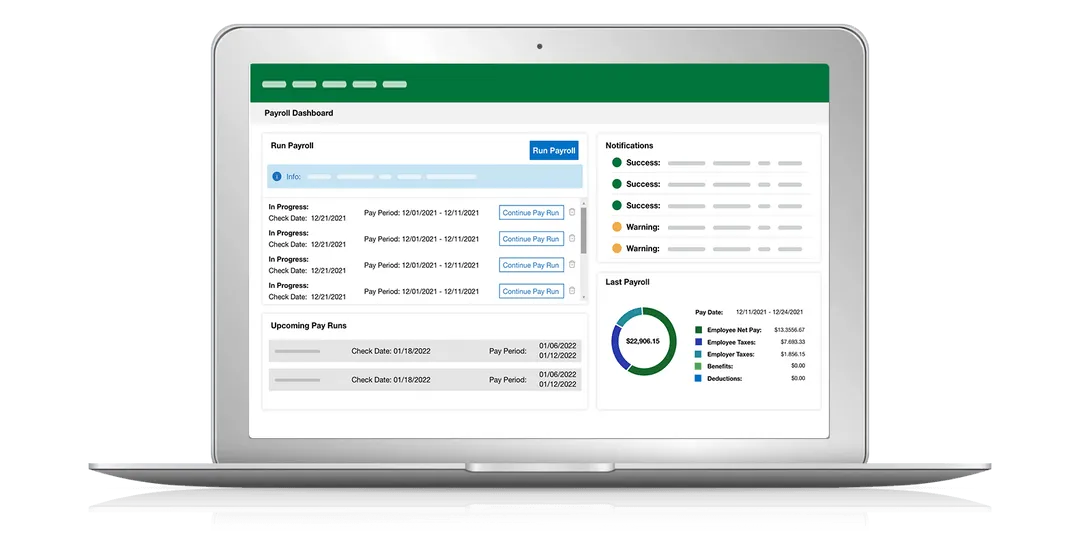

Payroll and HR Software for the Healthcare Industry

Payroll and HR for the Healthcare Industry

Complex Timekeeping Simplified

Managing a variety of schedules can be difficult for healthcare administrators. Track overtime and travel time, adhere to compliance rules based on jurisdiction, manage shift differentials, and more using Greenshades.

Turnover Can Be Off the Charts, We Make it Easy

Make a lasting impression on new hires through a simple and engaging onboarding experience that allows employees to upload documents, verify information, and enroll in benefits with ease.

Painless Compliance

The healthcare industry already faces complex compliance demands, this is why Greenshades gives you the tools needed to relieve the burden of payroll taxes and workforce-related compliance.

Payroll and HR solutions designed to meet the unique needs of healthcare teams.

Stay Connected with Healthcare Workers on the Go

Today more than ever, traveling nurses and home healthcare workers play a critical role in our healthcare system. Greenshades is proud to support the complex needs of these healthcare heroes through time tracking for travel and on-call needs, per diem management, and tax assignment support… even if the worker’s area of support spans various towns or multiple states. We also deliver simple management of multiple company records, simplifying even the most complex needs.

- 350 US mid-market healthcare customers served

- 260,000 healthcare employees supported

- 1,322 healthcare EINs

Solutions for Clinics, Specialized Care, and Private Practice

Like most small businesses, independent healthcare providers operate within an environment of high stress and constant change where personnel time is at a premium. That’s why we designed our Payroll and HR platform to automate complex back-office tasks such as employee benefit support, license and certification management, and so much more.

Automate Multiple Tax Assignments

Accommodating the complex interplay of federal, state, and local payroll tax calculations have never been easier. With Greenshades, we automate tracking employee time across multiple locations and applying the appropriate tax conditions unique to each geo. From tax code assignments to tax reciprocity agreements and everything in between, Greenshades has you covered.

Administrative Flexibility

Built-In

Security and confidentiality are critical, so Greenshades makes it easy for administrators to configure visibility, access, and control. With simple permission settings accessible directly through the platform, Greenshades makes it easy to keep employee data safe while maximizing the productivity of your payroll and HR teams.

Healthcare Compliance Issues Off the Chart? Let Greenshades Help

The worlds of payroll and HR are in a constant state of flux. Policies and practices change on a regular basis and employers with workers across multiple states face an even greater challenge in keeping track of it all. With Greenshades, however, you have a payroll expert in your corner. From ACA to wage and hour regulations, we handle it all. As a result, you can comply with confidence.

Complicated Pay Made Simple

Shift differentials, per-diem pay, 8/80 overtime, tuition/learning reimbursement, and other complicated payroll calculations are built into the Greenshades payroll system by default. We simplify complex calculations, so you spend less time on administrative tasks and more time with your team.

Integrations

Get Started & Sync to Your

Favorite Platforms

Testimonials

What Our Customers Say

“End user friendly, Administrator friendly, good technical support, excellent price/value, very little down time are the primary reasons for the rating.”

Bear River Health Dept

“Great customer service. Anytime I contact Greenshades for assistance, the response is immediate and situation is rectified. Don't have to contact them a lot, but the customer service is what keeps us as Greenshades customers.”

Prestera

“Great product with exceptional customer service (prompt, professional and knowledgeable)”

Southern Medical Corporation

“Greenshades made our 1099 process seamless! It was a pleasure to use.”

Compassion First Pet Hospitals

“I've used the Greenshades Tax Filing Center for 6 years and I love it. For the few issues I've had, Support was always so helpful and quick to get the problem resolved.”

Wilmington Health Associates Inc.

“Greenshades payroll, timeoff, and tax services products are what we use. It's user friendly and the customer service is outstanding”

VNA Community Healthcare

“The 1099 filing link to GP has helped me for ten years, and the customer service I've received along the way has been fantastic.”

PDR Network, LLC

Try Greenshades Today

Get a demo and see how Greenshades Payroll gives your healthcare company flexibility in your payroll processing timelines.

Highest Rated Payroll and HR Softwarefor the Healthcare Industry

FREQUENTLY ASKED QUESTIONS

Discover the most commonly asked questions about Payroll and HR software for healthcare companies.

What are the HR challenges facing healthcare?

There are many challenges facing the HR teams for healthcare. Here are 4 challenges the healthcare industry faces today:

High turnover: In the healthcare industry there are so many jobs becoming available, that employees feel more comfortable leaving their job because they feel as though they have ample opportunities. Hiring and onboarding new associates can be very time-consuming, using a provider that offers strong onboarding software can help make the process easy. Allow new hires to review information, upload important new hire documentation, and create a welcoming experience for new hires. Look for providers, like Greenshades, that offer off-cycle paychecks, unlimited pay runs, and trouble-free termination pay. If you have any emergency situations, you can ensure your employees are paid.

Skill shortage: The nursing shortage has been felt nationwide and continues to present challenges in the healthcare industry. Many nursing is reaching retirement at a time when the number of patients is increasing, so it is important to retain skilled workers. Raising wages to remain competitive with the market is a great way to retain skilled workers. Nurse’s salary has been on the rise, and it is important to keep your wages competitive, offering great benefits is also highly sought after. As the baby boomer generation is reaching retirement, the millennial workforce is coming in and they want more from their job, so travel nursing has become very attractive.

Having strong payroll and HR software can help you easily manage your payroll and HR operations during the skill shortage. The skill shortage has an impact on how you run your payroll and HR operations. The increase in travel nurses leads to more complex payroll processing, you now must account for location-specific tax withholdings and location-specific overtime and break rules. Overtime and shift differentials may be used to cover the gaps in the workforce, your software should be able to track overtime and once you set the shift differentials, it should automatically apply to the shifts worked.

Training and development: Medical staff must stay up to date on their training and certifications. Using a strong cloud-based system you can keep track of training needs. Alert employees when training is due so they can stay in line with important deadlines.

Burnout: Healthcare workers are feeling the pressures of the staffing shortage, they are now working harder than ever to cover the gaps leading them to burnout. There are measures HR can take to help combat the feeling of being overworked. Rewards and recognition can help employees feel gratitude from their employers, they feel as though their hard work is truly valued. Get creative with benefits and offer time off and mental health benefits so employees can have time to breathe and get their thoughts together. Lastly, invest in their future with training and development. This gives them a break from the “every day,” giving them a chance to do something different while enhancing their skills.

What are the compliance issues facing healthcare?

Healthcare compliance issues can cover a wide range of topics that are meant to protect employers, employees, and patients.

- Ransom Attacks: A common threat to the healthcare industry. There have been providers who have experienced ransom attacks demanding a sum of money or they threaten to expose sensitive data.

- Medical laws: Healthcare providers must be up to date on constantly evolving healthcare laws and regulations.

- Ethical Code: There are ethical rules set in place to protect patients like having that patients have the right to know the truth about their medical condition, doctor-patient confidentiality, malpractice, and more.

- Health and safety: Drivers go through a DOT background check that includes an alcohol test and drug test. Drivers also must go through a background search of their driving records from the past 3 years. Once drivers pass the various background checks and screenings, they must continue drug and alcohol screenings. It is crucial companies complete thorough and accurate background checks.

One aspect of compliance that is often overlooked but can have a big impact on your healthcare facility is payroll and HR compliance. Staying in line with federal, state, and local rules and regulations and meet important filing deadlines is critical to avoid costly fees and penalties. It is important to consider implementing payroll and HR software that can help you adhere to rules and regulations set in place to protect your workforce.

What are common payroll mistakes in healthcare?

When processing payroll manually you increase the risk of making errors in payroll calculations. Using payroll software can greatly decrease this risk by automating your daunting calculations and allowing you to quickly identify areas for concern. Some of the most common payroll errors include.

- Employee misclassification: It is crucial to classify employees correctly, so they are not underpaid or overpaid. One common kind of misclassification includes entering an employee as a contract employee instead of a regular employee, or vice versa. In the healthcare industry, there are many contracted employees, so it is important to classify your employees correctly.

- Incorrect overtime/shift differential calculations: With the staffing shortage employees in the healthcare industry are working longer hours and looking for higher wages. It is important to do accurate calculations

- Incorrect time tracking: If you have employees traveling it is crucial you track their travel time. Healthcare workers often work overnight or through their breaks and lunches; it is important that time is captured along with their regular shifts.

- Incorrect tax withholdings: Tax rates are always changing, and it is important you keep track of these changes. With federal taxes, state taxes, SS taxes, and more it can be difficult to do correct calculations.

- Missing or incomplete records: According to the guidelines set by the FLSA employers must keep pay records for up to 3 years. With high turnover rates in the healthcare industry, it can be difficult to keep track of employee records.