In this latest installment of the Greenshades Year-End Power Sessions, we turned the spotlight on your most pressing year-end questions during our "Ask the Greenshades Experts" session.

Led by our panel of Greenshades experts, this interactive session was filled with practical advice, real-world examples, and compliance tips to help you navigate year-end complexities with clarity and confidence.

⚠️Note: This information is for informational purposes only and does not constitute formal tax, legal, or compliance advice. Always consult with qualified tax advisors, legal counsel, and your organization’s internal teams for guidance specific to your situation. Additional regulations may apply. For the most accurate and up-to-date information, refer to official government resources and regulatory agencies.

You can watch the full session here:

Session Q&A

⚠️Reminder: This information is for informational purposes only and does not constitute formal tax, legal, or compliance advice. Always consult with qualified tax advisors, legal counsel, and your organization’s internal teams for guidance specific to your situation. Additional regulations may apply. For the most accurate and up-to-date information, refer to official government resources and regulatory agencies.

| Question | Answer |

|---|---|

|

Why does the Archival Settings window keep popping up in the W2 checklist? Why is there an incorrect Medicare alert? |

These were confirmed as system bugs that were identified and corrected shortly after the question was submitted. The Greenshades team addressed both items promptly once flagged. |

|

This is our first year offering a Roth 401(k). Is Roth reported in Box 12 using code AA? |

Yes. Roth 401(k) contributions are reported in Box 12 using Code AA. Roth contributions are post-tax and remain included in Box 1 wages, unlike traditional pre-tax 401(k) deferrals. Other Roth plans (such as 403(b)) use different Box 12 codes, so employers should confirm payroll configuration. Review our blog and check out section #4, Understanding W-2 Form Boxes, where we have linked the full W-2 instructions. https://go.greenshades.com/blog/5-things-about-the-w-2-your-company-needs-to-know |

|

Can you help verify SSNs before filing W-2s? When can I submit this information? |

Yes. SSN verification can be performed once W-2s are loaded into Greenshades and also applies to 1095 forms. For year-end-only clients, verification is available once forms are uploaded, typically opening in late December. For payroll and Tax Filing Center clients, Greenshades now offers ongoing SSN verification throughout the year, helping prevent filing delays. |

|

What exactly qualifies as “qualified overtime,” and what portion should be reported? |

Qualified overtime applies only to FLSA-mandated overtime (hours worked over 40 in a week). Only the premium portion (0.5× the regular rate) qualifies — not the full 1.5× overtime wage. Regular wages remain fully taxable and are still reported normally on the W-2. |

|

How should qualified overtime or tips be labeled and reported on the W-2? |

For tax year 2025, qualified overtime premiums and qualified tips should be reported in Box 14 (Other Information). Clear labels such as “Qualified OT 2025” or “Qualified Tips 2025” are recommended so employees understand the purpose of the amount. This is federal guidance only and does not change payroll withholding. |

|

How should employers explain qualified overtime reporting to employees? |

Employers should explain that only the overtime premium portion is reported separately, not total overtime pay. Wages will not change on the W-2, but the Box 14 amount is provided so employees can determine eligibility for deductions on their personal returns. |

|

How is Greenshades handling the OBBBA reporting this year? |

As part of the new IRS guidance, employees can deduct their qualified overtime premium for 2025, but many will need help identifying that amount. Greenshades is stepping in to make that as simple as possible. For payroll clients, once you complete year-end processing for W-2s, Greenshades will automatically calculate the FLSA overtime premium for each employee. We will add it to box 14 automatically. They can download the data and do mass edits if they want to change or zero it out and re-upload it back into Year End Forms. For non-payroll or Year-End-Forms-only clients, you’ll upload the calculated information into the year-end system just like you do today. From there, you can decide how to present that premium to employees — the recommended method is to use Box 14. This was covered this in deeper depth during our 'All About W-2s' Power Session in December. Check out the recap here: https://go.greenshades.com/blog/all-about-w-2s-webinar-recap |

|

We pay medical bills for testing and workers’ compensation. Should these be reported on a 1099-MISC or a 1099-NEC? |

Payments for medical services such as drug testing or medical evaluations related to workers’ compensation are reported on 1099-MISC under medical and healthcare payments. Actual workers’ compensation benefits paid through insurance are not reportable by the employer. IRS resource: https://www.irs.gov/pub/irs-pdf/i1099mec.pdf page 6, Box 6- Medical and Health Care Payments $600 or more |

|

How do we determine whether a payment belongs on a 1099-NEC versus a 1099-MISC? |

1099-NEC is used for non-employee compensation (services). 1099-MISC is used for other income types. For 2025, excess golden parachute payments moved from MISC to NEC. Certain items like legal settlements and direct sales depend on payment type and IRS definitions, so classification matters to avoid rejections. Instructions for Forms 1099-MISC and 1099-NEC: https://www.irs.gov/pub/irs-pdf/i1099mec.pdf |

|

Can you clarify attorney reporting requirements — when does it go on 1099-NEC vs 1099-MISC? |

Payments for legal services are reported on 1099-NEC Box 1. Gross proceeds paid to an attorney, such as settlement amounts, are reported on 1099-MISC Box 10. This is regardless of whether the attorney is incorporated. Check out page 2: https://www.irs.gov/pub/irs-pdf/i1099mec.pdf. Another resource that has more information on Reporting of Gross Proceeds Payments to Attorneys: https://www.irs.gov/pub/irs-regs/10531298.pdf |

|

What types of medical or healthcare payments are reportable on the 1099-MISC, and what is excluded? |

Include payments made by medical and health care insurers under health, accident, and sickness insurance programs. If payment is made to a corporation, list the corporation as the recipient rather than the individual providing the services. Payments to persons providing health care services often include charges for injections, drugs, dentures, and similar items. In these cases, the entire payment is subject to information reporting. You are not required to report payments to pharmacies for prescription drugs. The exemption from issuing Form 1099-MISC to a corporation does not apply to payments for medical or health care services provided by corporations, including professional corporations |

|

What types of awards or prizes require 1099 reporting, and when do they become reportable? |

Gambling-related prizes and winnings are reported on Form W-2G, not a 1099. Reportable winnings and thresholds vary by prize type and are outlined in the W-2G instructions: https://www.irs.gov/pub/irs-pdf/iw2g.pdf page 1-2, Reportable Gambling Winnings |

|

If a vendor is paid by credit card or third-party processor, who issues the 1099? |

The credit card company or third-party processor issues Form 1099-K. Employers should not issue a 1099-MISC or NEC for those payments to avoid duplicate reporting. We do a deep dive into the differences between the 1099-K, NEC, and MISC in this blog: https://go.greenshades.com/blog/1099-confusion-heres-who-gets-what |

|

Can you explain the recent box changes on 1099-NEC and 1099-MISC for 2025? |

For tax year 2025, excess golden parachute payments moved to 1099-NEC. Box 14 on 1099-MISC is reserved for future use and is expected to change in later years. |

|

Are there step-by-step instructions for submitting information to have 1099-NEC and 1099-MISC forms printed and mailed through Greenshades? |

Greenshades provides a guided Print & Mail wizard that walks users through selecting forms, excluding records with warnings, choosing delivery options, reviewing costs, and submitting. While we do not have a specific document outlining how to do 1099 Forms in Greenshades, this checklist walks you through some of the basic steps you will see when you use the Year-End wizard to do your filings. https://go.greenshades.com/greenshades-information-pdf/greenshades-year-end-forms-checklist |

|

Is Greenshades using IRIS, and how does the FIRE phase-out affect customers? |

Greenshades currently uses IRIS for high-volume 1099 forms and FIRE for others. FIRE will be fully decommissioned after 2026, at which point all forms will move to IRIS. No action is required from customers. |

|

When and where are year-end import templates available? |

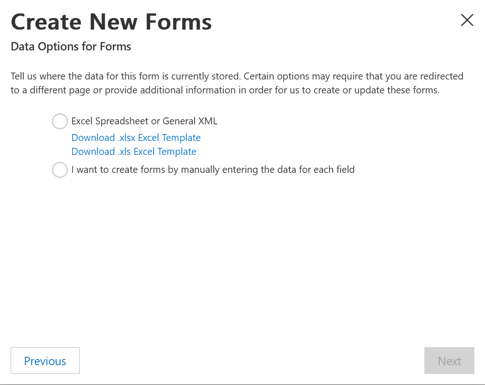

Import templates become available in-platform once finalized. When starting a filing in Greenshades Online, users are prompted to download the correct template for that form type. Using the in-platform template ensures accuracy. For Tax Year 2025, all Year End forms are ready for import and Print and Mail services are now open for client submissions! When you use the Year End Wizard, this is the popup box that will have the template to download. We recommend using the .xlsx version.

|

|

What is the print & mail cutoff date? |

For forms due January 31 (February 2 this year), Greenshades recommends submitting print & mail requests by January 23. Earlier submission is encouraged. Due to recent USPS rules and operational changes announced in late December, postmark processing timelines may vary. To allow sufficient time for printing and postmark application ahead of the January 31 deadline, we recommend submitting forms for print and mail on or before January 23. |

|

What kind of support does Greenshades provide during year-end? |

Support options include live chat, email, ticketing through the support portal, and assigned representatives for Payroll Tax Service and managed payroll clients. Support levels vary based on service tier. |

|

What is the surcharge effective 1/18/25 for the mailing service? |

A 25% surcharge applies after January 18, increasing to 50% after January 23, due to peak print and mail volume. The updated pricing model is designed to be more predictable overall. |

|

Does Greenshades assist with State filing for 1099s? |

Greenshades supports federal 1099 filing, which includes participation in the Combined Federal/State Filing (CF/SF) program for states that accept 1099 data through that process. We do not support any direct 1099 state filings. |

|

Where is the pre-validation step located? |

Pre-validation happens during the import process for supported forms. Once you upload your data, the pre-validation occurs and will alert you to any issues within your dataset. |

|

We just got signed up with Greenshades and were wondering how to get started processing 1099s. We are currently using 3E for our accounting software if that impacts anything. |

You will need reports from your accounting software to help you populate the excel templates for each form type you will file. You can download the templates for each 1098/1099 that Greenshades' supports from the YEF product to use as a guide. The header will provide additional information as to what type of information you should be putting in that column. As always, support is available if you request it. |

|

Is there a different form for 1099's when the recipient is a business? If so, how do you get the form once the data is uploaded? |

There is not a different form for 1099's when the recipient is a business. The only difference lies in the TIN (individuals provide a SSN, whereas a business uses an EIN). The EIN/SSN field may direct you to enter dashes to identify the TIN Type of the business. XX-XXXXXXX for EINs and XX-XX-XXXX for SSNs. |

|

How can we use Greenshades Tax Center wizard to generate a formatted W2 file for each individual state we are filing in? One that contains ONLY the records for the specific state. |

The product looks for the state Identifier field(s) in each employee record and gather the like states into state specific files. Then when you reach the step to select the electronic returns that were created, you should see files for those applicable states identified in your employee records. |

|

Are there any changes to what type of entities should receive a 1099 for 2025? |

There are no broad entity-eligibility changes for 2025. Standard IRS rules still apply, with the notable change that excess golden parachute payments moved to Form 1099-NEC. Entity-type exceptions (attorneys, medical providers) remain unchanged. |

|

How to prints copy of W2’s before we send them out? How to edit W2’s? |

There is a step in the YEF process to save your file as a PDF. This file will allow you to print and distribute the W-2s. YEF does allow for individual form edits, searching by employee and editing boxes within the YEF module, or batch edits via an export/reimport function for broader changes. Once edits are complete, you will have an option to download or print forms, even if you are sending to Greenshades for distribution, so that you have access for reprints or for recordkeeping. |

|

Separating and reporting FLSA overtime vs how company pays overtime, for income tax due to the Big Beautiful Bill Act. |

This a broader payroll question that will require a deep dive into your payroll setup. The main thing is that your team will need distinct earning codes for FLSA OT (eligible) and Non-FLSA OT (ineligible), in addition to your unique company overtime structure. Without a deeper understanding of your payroll setup, we cannot provide much more help than that. If you are a Greenshades payroll client, submit a support ticket and begin the discussion with our team to work out the details. Note: If you are a not a payroll client and are importing payroll data from another source, we may not be able to provide much guidance. |

|

is there documentation on year end forms, all I see relates to w-2's. I am looking for 1099 documentation |

If this question is asking for general education around 1099 forms, check out our year-end hub for some great resources https://go.greenshades.com/year-end-forms#filing If this question is related to year-end documentation from the Greenshades support side, our team is working on producing more information about this workflow! |

|

When I submit Form 941 & 940, why do I have to go through 'Incognito' to get form to download? |

Most often seen in clients with multiple workspaces, this can be caused by overlapping cached instances of Greenshades in different workspaces. Opening in incognito will bypass this, though sometimes clearing your browser cache can also resolve the issue. |

|

Do you have the table that give cost for filing? |

If you would reach out to sales@greenshades.com, they will quickly get you a copy of the pricing sheet for tax year 2025. |

|

cost of state filing. we have 25 states |

This year, our Year-End Forms pricing has changed structure to be by form amount. There are different bands of pricing depending on the amount of forms needed to file for those 25 states. If you would reach out to sales@greenshades.com, they will quickly get you a copy of the pricing sheet for tax year 2025. |

|

When will the last day to submit 1099s to Greenshades in order to be mailed out by the month end? |

Due to recent USPS rules and operational changes announced in late December, postmark processing timelines may vary. To allow sufficient time for printing and postmark application ahead of the January 31 deadline, we recommend submitting forms for print and mail on or before January 23. |

|

Can the OT premium amount be imported in Box 14 if a template or file is provided? |

Yes. Non-payroll clients can import the OT premium using templates or manual entry. Payroll clients receive auto-calculation. |

|

Would a scholarship award be reported on a 1099 form? |

Generally, scholarships are not reported on Form 1099. Taxable scholarship income may be reported on Form 1098-T by educational institutions or reported by the recipient on their individual return (1098-T, Box 5 Scholarships or Grants). Reporting depends on whether the payment is compensation for services |

|

Will there be a file available that shows the total number of forms submitted for vendor duplicate requests? |

Our apologies, we are not sure exactly what this question means. If you are a Greenshades client, please submit a ticket to the support portal and someone can assist further! |

|

Have the 1099-NEC or 1099-MISC forms been updated to include DBA (Doing Business As)? |

Yes. DBA information can be entered in the second vendor name field or template column and will flow through to forms. |

|

Are there changes to the W-2 for 2025 that employers should know about right now? |

Employers should review IRS W-2 instructions annually for updates. IRS instructions: https://www.irs.gov/instructions/iw2w3 |

.jpg)