Introduction

Explore the complexities of year-end form reporting in Greenshades' latest installment of our Year-End series, “Cracking the Code of 1095 Reporting." Featuring our in-house tax expert Hannah Walk and HR and Benefits expert Katie Roy, this webinar goes deep into the nuances of 1095 forms. Designed to equip you with the necessary tactics to confidently handle ACA compliance and year-end reporting.

Watch the full webinar above or download the complete webinar deck here.

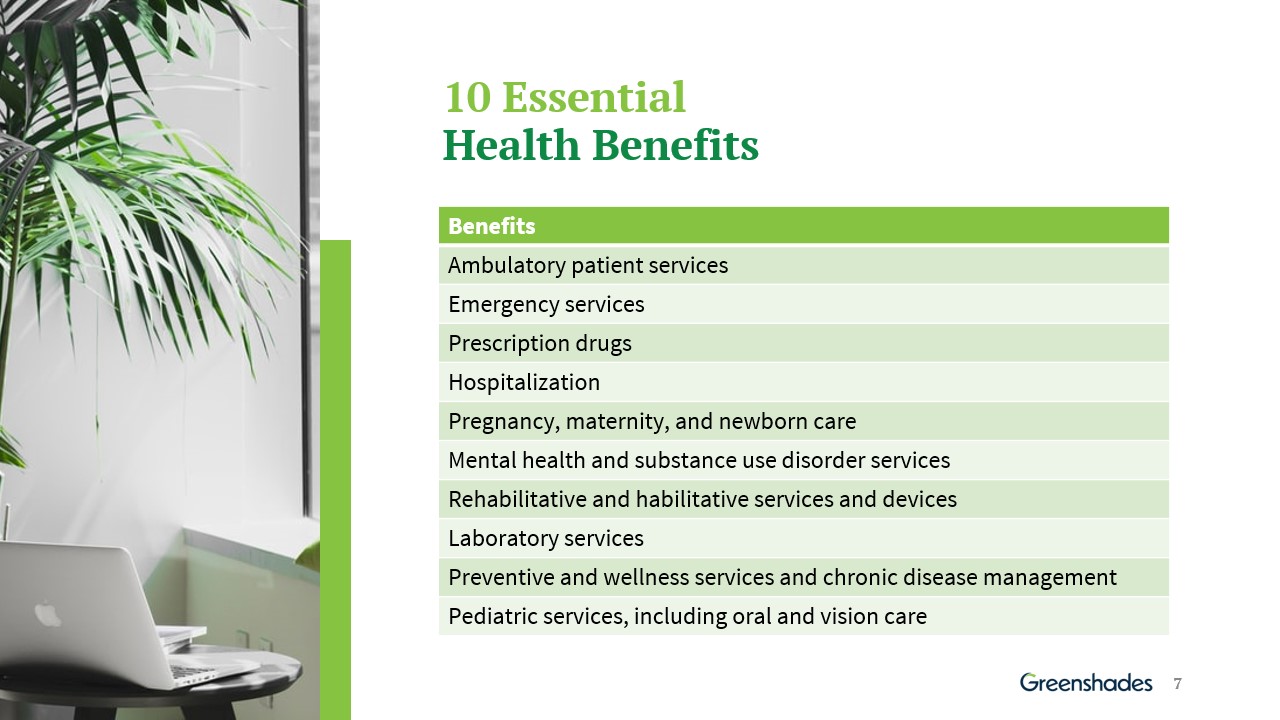

Ensuring Medical Benefits Meet ACA Coverage Standards

It is critical to align medical benefits with ACA Coverage Standards. All insurance plans, including Marketplace, job-based plans, Medicare, Medicaid, and Children's Health Insurance Program (CHIP), must comply with the Affordable Care Act's health coverage requirements. Employer-sponsored plans should cover a minimum of 60 percent of the total allowed benefits cost, noting that the affordability threshold for the 2023 plan year is 9.12%. The importance of these standards in ensuring comprehensive health coverage for employees.

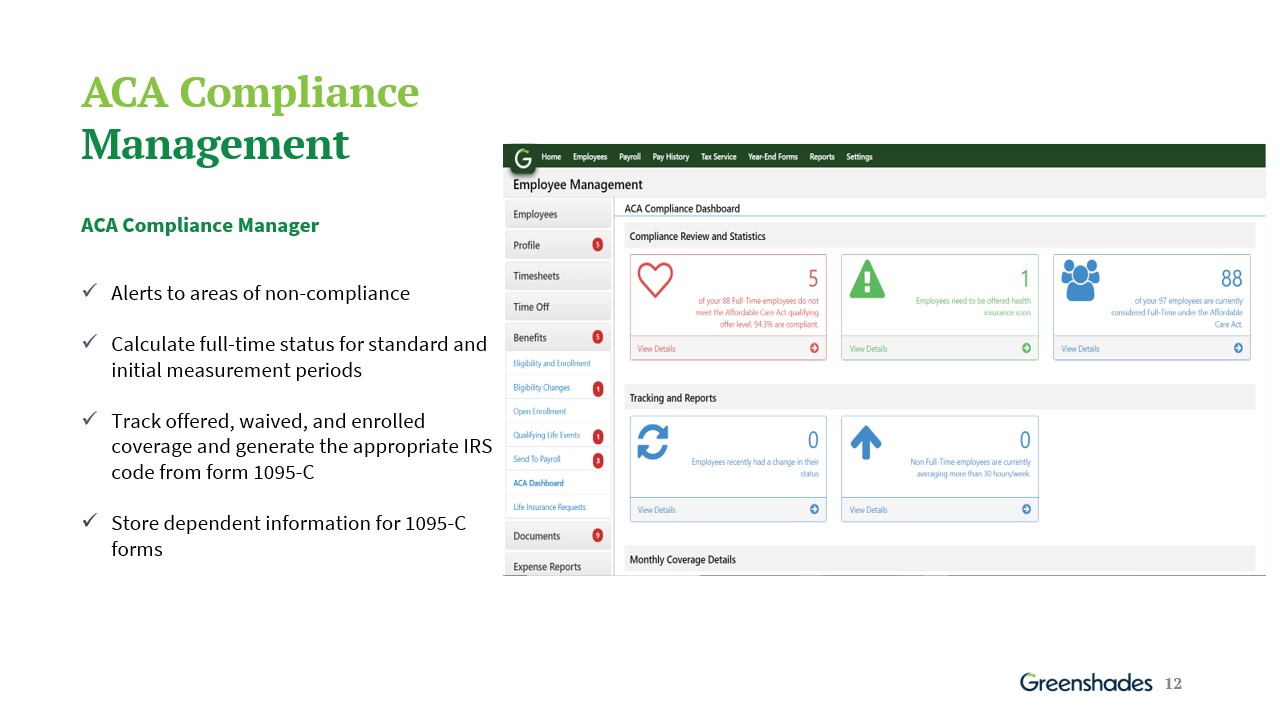

ACA Compliance Management

Next the webinar dove into the complexities of ACA compliance, a crucial aspect for employers with 50 or more full-time employees. Katie outlined the necessity of filing specific forms, expanding Medicaid for lower-income adults, and adopting innovative healthcare delivery methods. It is also important to track employee hours, maintain accurate Social Security Numbers, and plan for form distribution. Benefits technology helps maintain compliance with these regulations by automating processes and helping to uphold compliance.

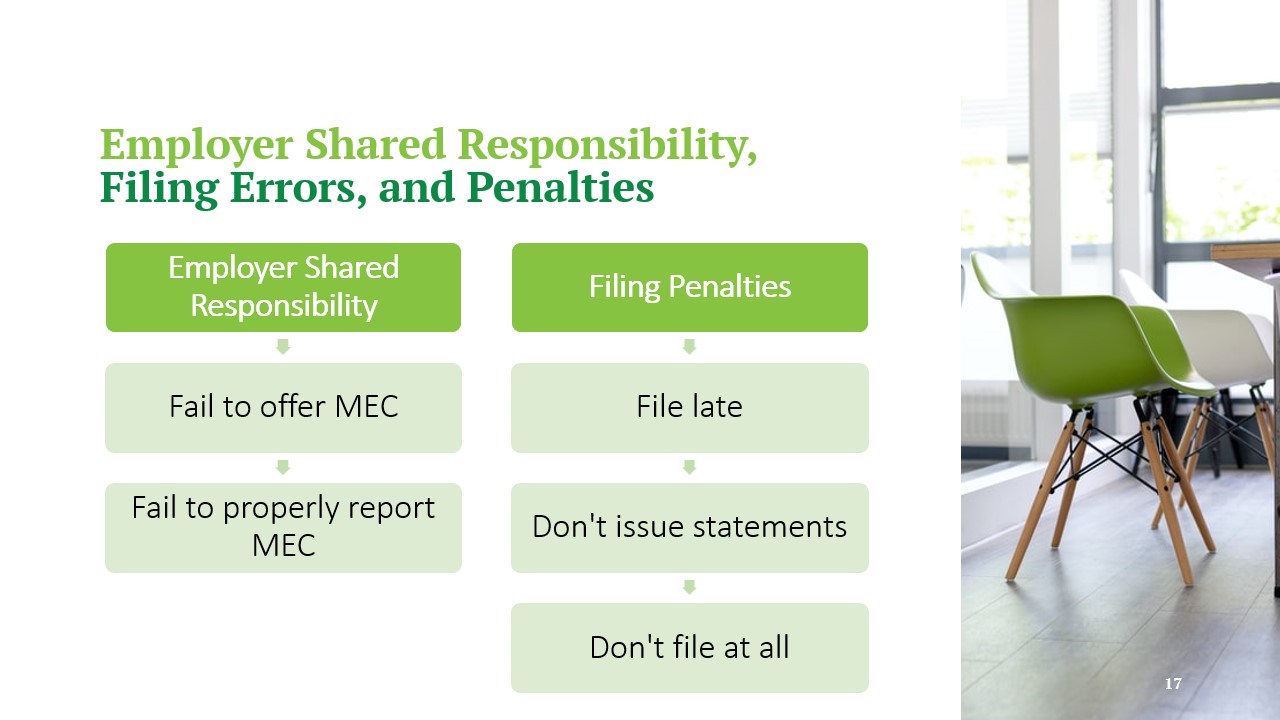

Overview of 1095

Hannah provided an in-depth look at 1095 forms. Form 1095-C includes details about the coverage, employee contributions, and the months covered. It is important to keep track of critical deadlines: recipient copies by March 4, 2024, paper copies by February 28, 2024, and e-file copies by April 1, 2024. Additionally, Form 1095-B verifies minimum health insurance coverage as per the Affordable Care Act, lists the policy subscriber, dependents, and coverage months.

Changes to E-File Requirements

With Greenshades, the recent changes in e-file requirements can be handled either by downloading and submitting e-file forms or managing the entire submission process. Along with e-file, Greenshades' efficient handling of printing and mailing tax forms, along with providing easy employee access through a self-service portal, makes e-filing an eco-friendlier option during the year-end filing season.

Conclusion

As we approach the year-end season, it's imperative to understand the importance of 1095 Forms for every organization. These forms are a testament to your commitment to employee welfare and legal compliance. Key takeaways to ensure you're on the right track include:

- Ensuring employees receive the correct benefits in line with ACA regulations.

- Using benefits software for year-round compliance assistance, offering both e-filing and print-and-mail options.

- Keeping abreast of the latest regulatory updates to ensure timely and accurate form filing.

Q&A

Filing 1095-Cs with Greenshades:

Greenshades is set to release the necessary templates for filing 1095-C in the coming weeks, ensuring ample time for year-end form submissions.

Filing 1095-Cs from California:

Greenshades can produce the file the 1095-C and can provide it for the client to file on their own or we can file on their behalf as a professional service.

Final 1095-C form by the IRS:

As of now, the IRS has not announced any further updates to the 1095-C form. Therefore, the template for the 2023 filing is expected to be the final version.