Comprehensive Tax and Information Reporting

Easily Oversee Your Tax and Information Returns

With Greenshades, manage your tax and information returns effortlessly, including withholding, unemployment returns, 1099 forms, ACA reporting, new hire reports, and more. Stay compliant with location-specific deadlines and regulations while optimizing your processes.

Centralize Your Tax Filings

Consolidate and simplify your tax and information returns in a single location for streamlined operations.

Meet Critical Deadlines

With Greenshades, stay on top of multiple deadlines with ease. You will receive alerts for upcoming deadlines, allowing you to submit your filings on time without any worries.

Easy-To-Use Solution

Managing payroll tax forms is simple. With a few clicks, you can easily upload, edit, submit, and track all returns.

How it Works

A Robust Library of Returns

Simplify tax return management with Greenshades' centralized tax filing center. Create and submit new e-file returns, while also accessing your historical returns with just a few clicks. Our user-friendly interface makes tax return management a breeze.

All Payroll Taxes

Greenshades supports all Payroll tax returns at the Federal, State, and Local Level. This includes reporting of withholding (941s and W-2s), unemployment returns (SUTA/SUI), 1042-S, and much more.

Local W-2s are fully supported, including all Pennsylvania Act 32 reporting requirements.

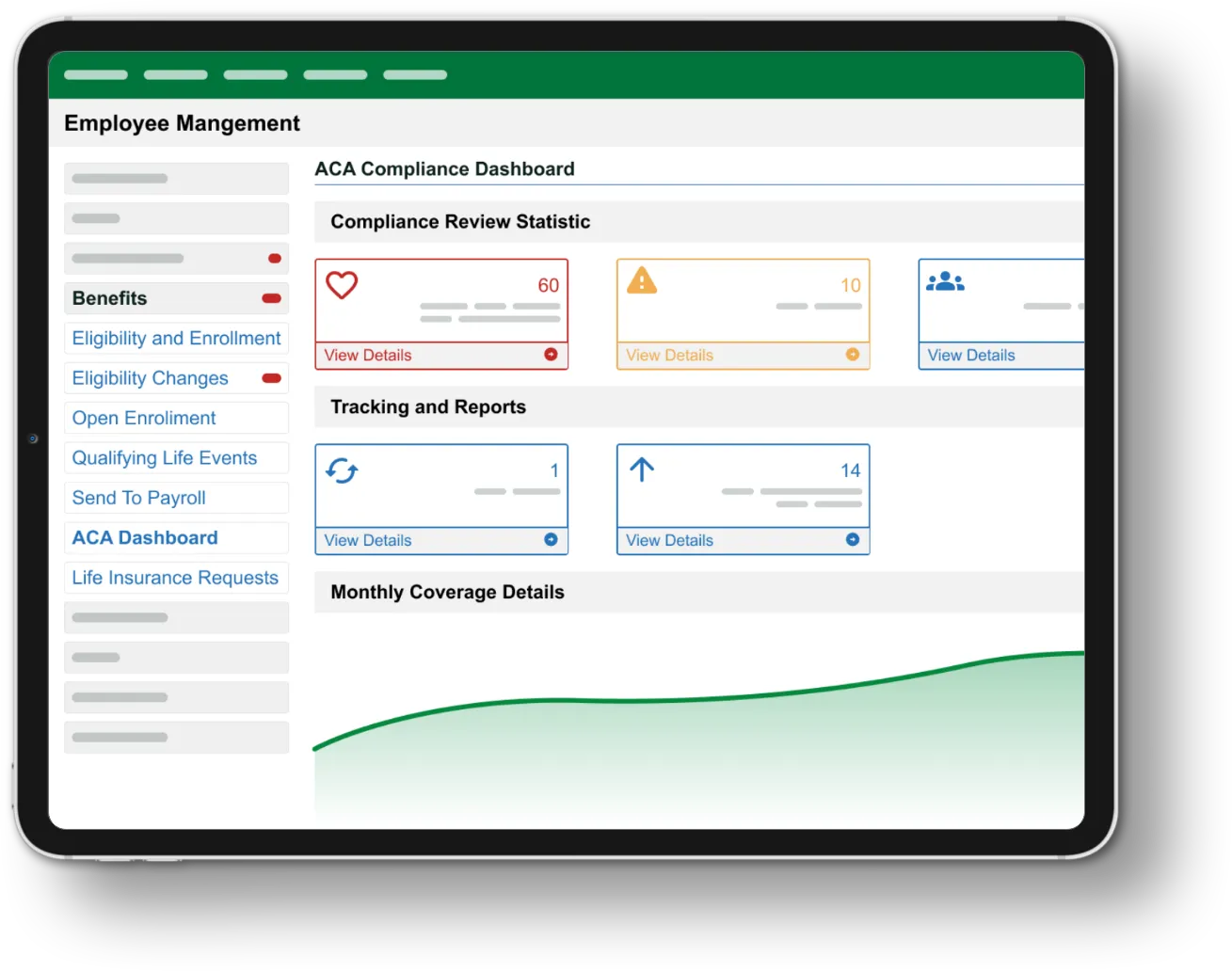

Complete ACA Reporting Solution

In addition to monitoring ongoing compliance with the Affordable Care Act, Greenshades will also generate year-end 1095-C forms to be distributed to your employees as well as Federal and State Level 1095-C returns.

Every 1099 Imaginable

With Greenshades, you can manage every type of 1099 form, including related forms like W-2G and 1098. Simplify the distribution of forms to recipients and efficiently handle the government filing process using Greenshades.

New Hire Reports

Greenshades supports reporting new hires to all 50 states as well as the combined new hire reporting program.

401(k) and Other Retirement Contribution Spending

Greenshades is connected with the major banks and retirement fund providers, enabling our software to create the ongoing eligibility and enrollment data reports.

Employment Compliance Reports

Greenshades’ library also includes reports for the Bureau of Labor Statistics (BLS) and Equal Employment Opportunity Commission (EEOC).

Our Customers Say It Best

“Employees are always very quick to respond, and if they are unable to assist, forward to the appropriate person. Always very friendly.”

ARC of Southern Maryland

"Greenshades reduces the time required to accomplish certain tasks and makes the process more efficient and organized. This, in turn, frees up time to dedicate to the process improvements that sustain the company’s growth."

Angelo Tremolada

Corporate Controller, CPA, CGMASEFA

Try Greenshades' Comprehensive Tax Solution

Request a demo today to learn more.

Discover Why Our Customers

Love Using Greenshades Payroll!

Comprehensive Tax and Information Returns

Access an incredible library of resources for all your tax form needs.