Streamline Payroll and HR for Casinos

Keep Your Casino Running

Smoothly with Greenshades

Greenshades provides payroll and HR services for casinos, allowing you to focus on your workforce operations. Our HCM solutions streamline back-office tasks, giving you more time to focus on providing excellent customer service on the casino floor.

Run Payroll in Minutes

Cloud-based solution that automates your complex payroll calculations in real-time.

Automate HR Processes

Centralize all your HR processes in one secure platform.

Simplify Benefits Management

Make the process of open enrollment and benefits management easy for employees and your payroll team.

Labor Management Made Easy

Manage your workforce labor using our robust timesheets and flexible methods for clocking in and out.

Streamline Compliance Processes

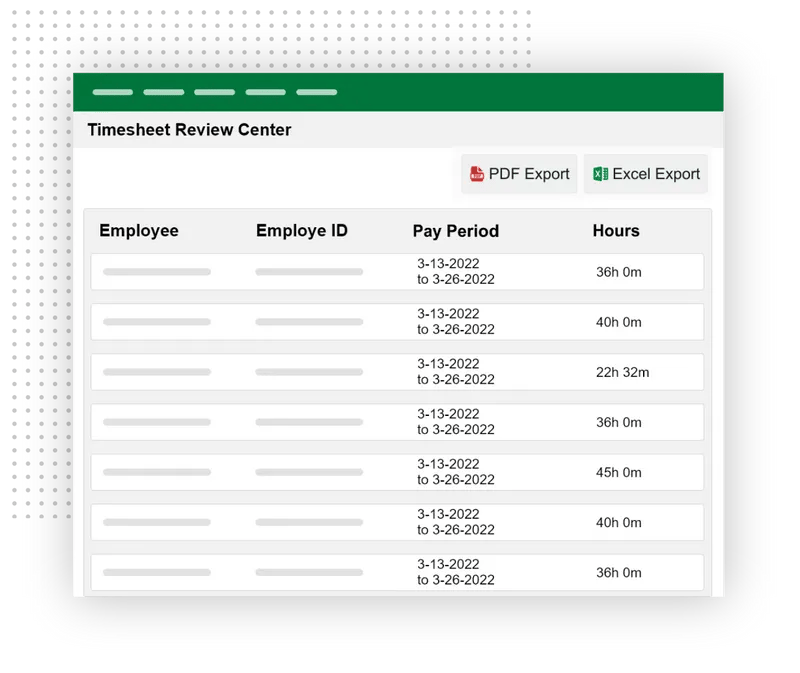

Automatically abide by FLSA guidelines and manage ACA compliance in a detailed dashboard.

Complete Year-End Filing Quicker Than Ever

Be alerted of upcoming yearly and quarterly filing deadlines. Quickly identify areas of concern and distribute forms with ease.

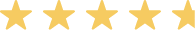

Spend Less Time Running Payroll

Don't take a chance with payroll, automate your processes to ensure accuracy.

Our software simplifies the process of calculating payroll taxes and ensuring compliance with regulations, including FLSA guidelines for overtime and minimum wage and federal, state and local regulations. Instead of spending hours calculating payroll for each employee inside the casino, easily process it in one standard workflow.

Be alerted to areas needing reviewing, process instant calculations, and validate employee timesheets before submitting payroll. Once payroll is completed, general ledger batches are automatically created and available for download.

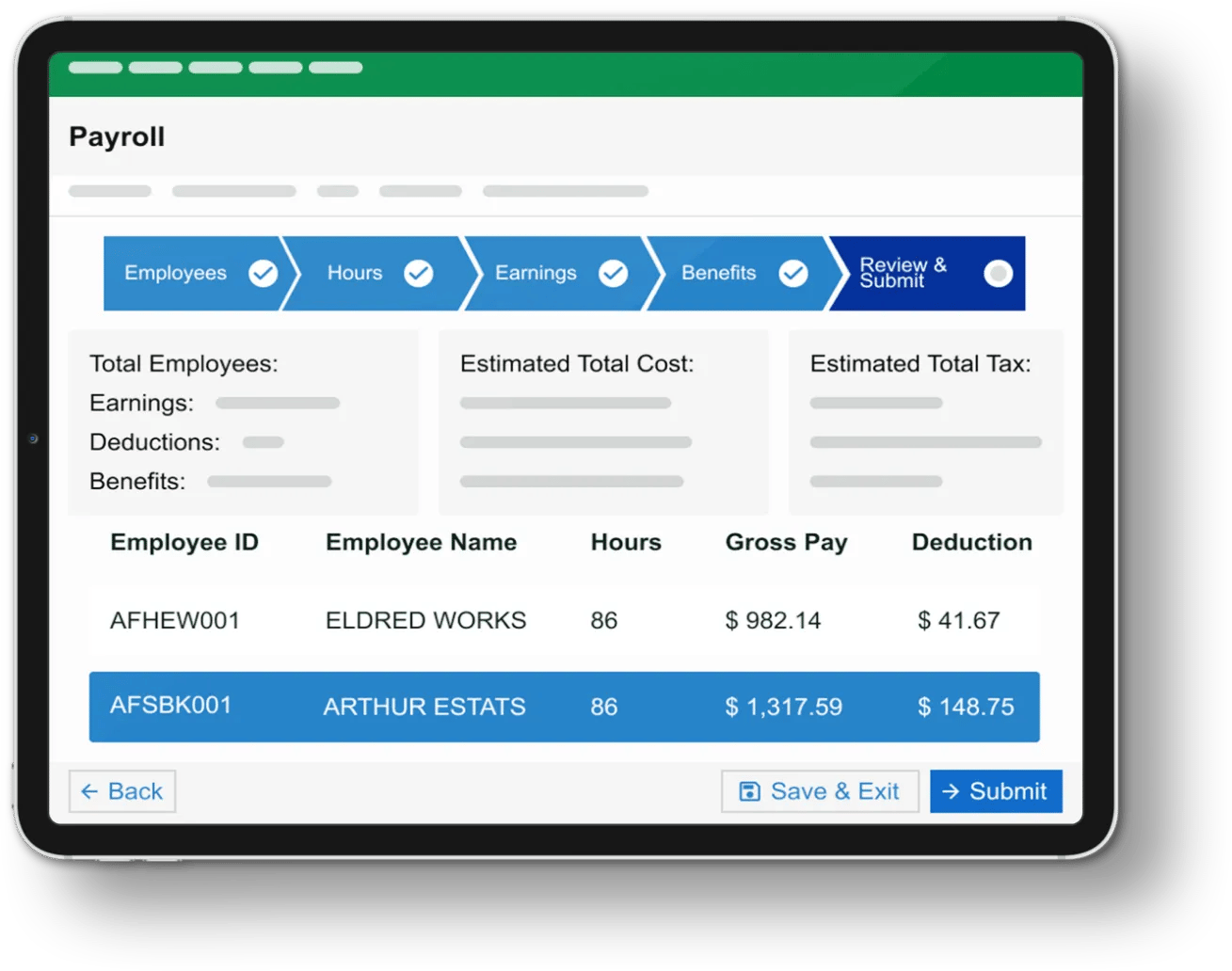

Flexible Labor Management

Managing schedules and tracking labor hours for a business with numerous departments that typically runs 24/7 and 365 days a year can be difficult. Greenshades timesheets track more than just hours worked, our robust timesheets keep track of the following:

- Overtime

- Double time

- Shift Differentials

- Shifts crossing midnight

- Adhere to location specific break-rules

- Clocking into a specific department

- Paid time off

Time Management

Timekeeping is flexible depending on your organization’s needs. Employees can clock in using the Green Employee portal on their desktop or mobile. Through our partnership with Lathem, your organizations can choose from a wide variety of time clocks. You can choose from various types of time clocks, including the traditional clock, as well as advanced options such as facial recognition, fingerprint identification, and employee badge-based systems.

Handle Your Casino HR Needs in One, Secure Location

Efficiency is important when it comes to casino HR operations. The Greenshades platform streamlines recruiting, onboarding, benefits administration, certification tracking, license tracking and centralizes HR document management. Remove the need for paperwork and spreadsheets by using cloud-based technology and add an extra layer of security for your confidential HR operations.

Extend HR Functions to Your Employees

With Green Employee, casino employees have the ability to access essential HR functions at any time and from any location. This eliminates the need for them to spend their work hours seeking out managers, submitting requests, or trying to reach the HR department. The platform enables employees to easily access HR functions such as:

- Checking timesheets to ensure all punches are accurate

- Benefit plan enrollment and management

- Insights to pay history and paystubs

- Access to tax filing forms and important HR documents

- The ability to update personal information

- Manage business expenses

- Receive important updates and notifications

The self-service functionality is up to your organization, you can easily configure the functions that employees have access to. Through our partnerships, expand your HR suite through partners like applicant tracking through JazzHR and learning management using LearnUpon.

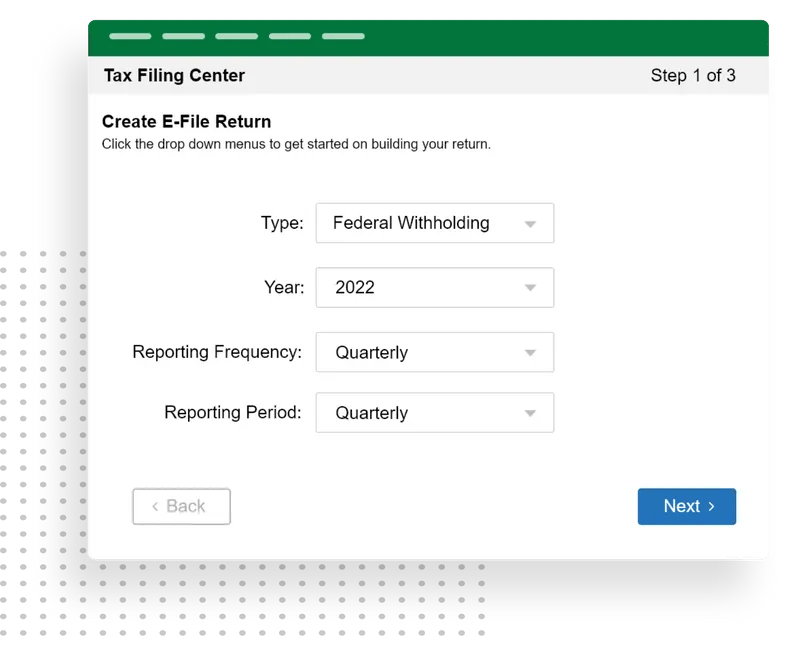

Process Year-End and Quarterly Forms with Ease

Handle all your quarterly and year-end reporting with Greenshades. We support all forms of federal and state unemployment submissions as well as, W-2s and 1099s reporting, ACA reporting, and more. Our software collects and validates the information to create forms. The dashboard makes it easy to review forms, handle bulk updates, and verify SSNs. Once forms are completed, we distribute them digitally or through print and mail to your employees and vendors.

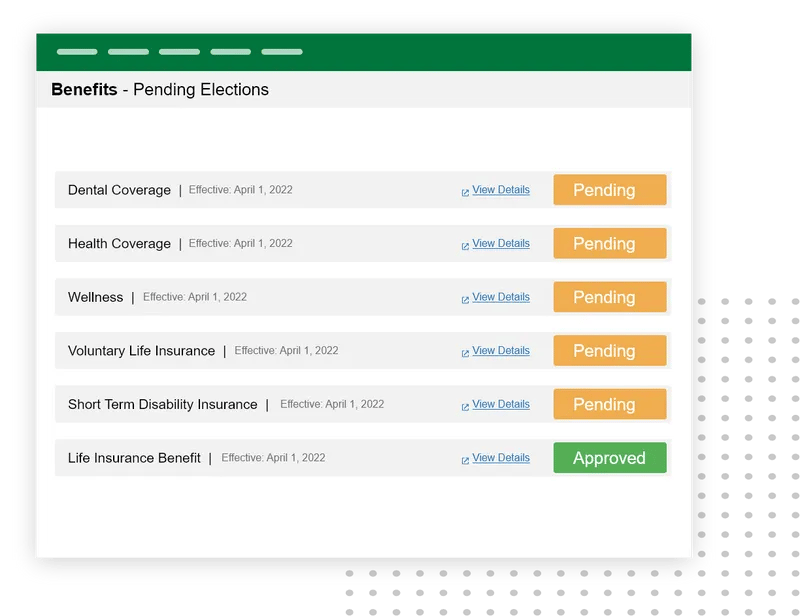

Get the Most out of Your Benefits

Streamline your benefits offerings through our benefits portal by housing all medical, dental, vision, 401k, voluntary benefits, in one location for easy management. Employees can quickly see the details of plans they qualify for through a simple workflow without the assistance of the HR department. Inside the Green Employee portal, they can easily manage and update benefits.

Managers are given oversight of the open enrollment process, and ongoing review of any updates employees make to their benefits package. Benefits that are applied to employees are automatically deducted during the payroll process, reducing the need for manual entry.

Try In-House Payroll & HR for Casinos

See how Greenshades can empower your business!

Our Customers Say It Best

“Employees are always very quick to respond, and if they are unable to assist, forward to the appropriate person. Always very friendly.”

ARC of Southern Maryland

"Greenshades reduces the time required to accomplish certain tasks and makes the process more efficient and organized. This, in turn, frees up time to dedicate to the process improvements that sustain the company’s growth."

Angelo Tremolada

Corporate Controller, CPA, CGMASEFA

FREQUENTLY ASKED QUESTIONS

Commonly asked questions about payroll & HR software for casinos and native tribes.

Are tribes required to file form 940?

If a tribe elects to participate in the State Unemployment (SUTA) system they are not required to file Form 940, aka Employer's Annual Federal Unemployment (FUTA) Tax Return. However, the state unemployment compensation laws must cover (with some exceptions) tribal employee services.

Tribes don’t need to file Form 940 if they meet the following conditions:

- You must be a Federally recognized tribe. Private businesses operating on tribal property do not qualify.

- The tribe must have complete control over the entity that operates under it; otherwise, the entity would not be exempt from the FUTA tax.

- The tribe must participate in the state unemployment system via one of these methods:

- Makes required payments to the state (tax contribution method)

- Reimburses the state for unemployment claims made by former employees

Does a tribe organization have an employment taxes?

Tribal organizations are responsible for payment of the employer's share of FICA tax on wages paid to employees. They must also withhold the employee's share of FICA and federal income taxes.

Are casino tips subject to tax withholding?

If casino worker receives tips totaling over $20 in a calendar month while working for their employer, then the tips are subject to FICA and FUTA federal tax withholding.

What are some Tribal HR challenges?

Like regular HR departments, tribe's face the challenges of:

- Labor shortages

- Employee Retention

- Training and development

- Budgeting and economic uncertainty

- Maintaining compliance

- Enforcing company culture

- Offering competitive benefits and compensation packages

Tribal HR departments differ because they must manage federal and state employment laws while still upholding tribal ordinances and policies can be difficult. Tribal organizations also have the unique challenge of finding qualified workers who understand cultural values and beliefs.

Do I need health insurance if I use IHS?

The Indian Health Service, IHS, is a part of the federal government that delivers health care to American Indians and Alaska Natives and provides funds for tribal and urban Indian health programs. The IHS receives funds from the U.S. Congress each year, so the budget can be limited to service the entire population. This means that funds are not always available to patients, and sometimes out-of-pocket costs are required.

The Indian Health Service is not an entitlement program like Medicare, Medicaid, insurance, or an established benefits package. There are two types of services provided by the IHS:

- Direct health care services through an IHS facility

- Through a purchased/referred care (PRC), which are provided by a non-IHS facility or provider through contracts with the IHS.

American Indians and Alaska Natives are eligible for all public, private, and state health programs available to the general population. Health insurance helps to combat health care costs, so the patient does not have to pay the full cost of health care services.

Employees find it beneficial to get health insurance from their employer for two reasons. The first reason is to be prepared for basic healthcare needs and unexpected health emergencies. Secondly, with the IHS, healthcare services offered are limited, and it can be hard to find a provider if you move outside the reservation. Health insurance gives you provider options.