Optimize Payroll Tax Processing

Refine Your Business Tax Management

Maximize efficiency and compliance with Greenshades' integrated tax solution. Simplify your business tax management with time-saving capabilities, compliance checks, and all the necessary features in one convenient place.

Save Time for Your Team

Eliminate the need for laborious manual data entry by integrating your ERP system with Greenshades payroll.

Stay Ahead of your Payroll Tax Compliance

Our built-in compliance checks alert you to any potential issues, allowing you to take action and resolve them before filing.

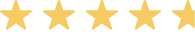

Manage All Returns in One Place

Handle all your of payroll tax returns, payments, historical data, and more in one location.

How it Works

Streamline your payroll tax process with Greenshades' automated system, designed to reduce manual entry and simplify compliance.

Connect Payroll

Your payroll information is sent to our tax software to reduce manual entry.

Review Information

Within the workflow effortlessly review and submit forms with one click.

Submit Easily

Streamline submission process with Greenshades e-filing.

Comprehensive Library of Tax and Information Returns

We have you covered for federal, state, and local tax returns, as well as many non-tax informational reports. See our complete tax coverage here.

Effotless Tax Filing Assistance

Our intuitive wizard-based system effortlessly guides you through each step of building and submitting tax returns. Say goodbye to the need for advanced training or certifications to file your corporate taxes. With Greenshades, our integrated jurisdiction calendar ensures timely submissions to every taxing agency with ease.

Seamless Integration with your Existing System

Duplicate data entry isn’t just a laborious waste of time, it’s also an extremely error-prone process. The Greenshades tax solutions include a direct integration to most ERP and Payroll Systems, allowing employee, payroll, and vendor information to flow directly from your system into our cloud-based reporting solution. It is a simple set up with no scripts, no manual upgrades, and no need to bother your help desk.

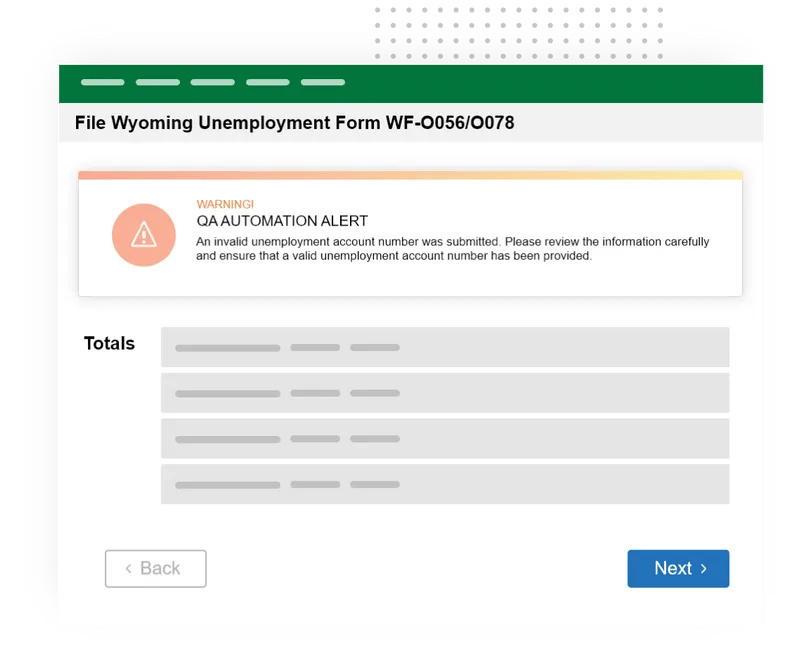

Built-In Compliance Checks

Greenshades has been filing taxes for mid-market companies for decades. We have seen every data problem imaginable and can anticipate how the government will react. Our smart compliance checks and deep reporting validation will alert you to problems before you file.

Our Customers Say It Best

“Employees are always very quick to respond, and if they are unable to assist, forward to the appropriate person. Always very friendly.”

ARC of Southern Maryland

"Greenshades reduces the time required to accomplish certain tasks and makes the process more efficient and organized. This, in turn, frees up time to dedicate to the process improvements that sustain the company’s growth."

Angelo Tremolada

Corporate Controller, CPA, CGMASEFA

Try Greenshades' Automated Tax Solution

Request a demo today to learn more.

Discover Why Our Customers

Love Using Greenshades Payroll!

Comprehensive Tax and Information Returns

Access an incredible library of resources for all your tax form needs.