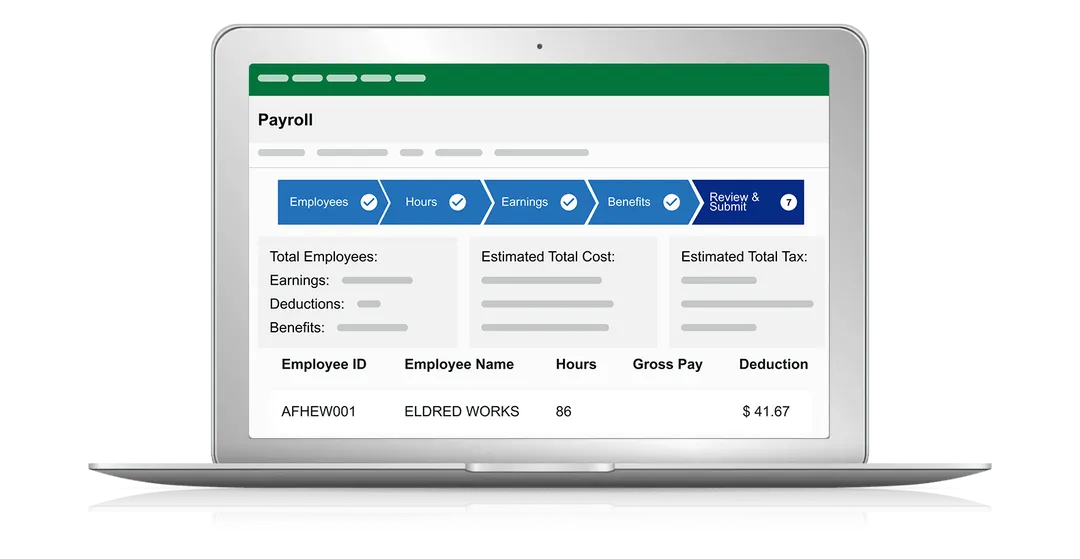

Payroll and HR Made Simple for the Construction Industry

Payroll and HR Constructed for your Business

Training and Development

Worker’s safety is critical in the construction industry. With Greenshades you can support continuous workforce training and safety training through Greenshades integration with LearnUpon.

Benefits Made Simple

When working in a high-risk environment, offering benefits can be a great incentive to retain skilled construction employees. Utilize Greenshades benefits administration to help educate employees on the plans they are eligible for during self-enrollment.

Complex Compliance

Maintaining OSHA compliance can already be a headache for construction companies. That is why we take the headache out of payroll and HR compliance needs. From ACA compliance and FLSA compliance, to payroll taxes and year-end reporting Greenshades has you covered.

Industry-leading payroll and HR solutions for construction teams.

Easily Manage ALL Employee Types with the Right Tool

Like most industrial operations, you probably hire a diverse array of employee roles and types. Hourly and salaried, exempt and non-exempt, office workers and deskless workers… they’re all vital to your business, and Greenshades can accommodate them all. We even support the unique needs of seasonal workers, rehires, and the off-cycle payroll runs they often require.

- 550 Construction Companies Served

- 330,000 Employees Supported

Stress-Free Compliance

Amidst an ever-evolving regulatory landscape, Greenshades helps you comply with even the most complex policies, payrules, and procedures. From ACA and wage-and-hour laws to garnishments and wage base adjustments, Greenshades helps you tackle it all with ease. As a Greenshades client, you’ll also have access to the best client support in the business, so help is just a call or email away.

Support for Complex Scheduling Built for Your Team

Many construction organizations have employees that work varying and unusual shifts, often overnight or across pay periods. These shifts can cause significant challenges for many payroll systems, but Greenshades handles your 24/7 shift and compensation needs with ease.

Automatic Tax Assignments

Don’t spend time looking up tax rates or remapping tax codes for your employees as they switch job sites. Your hourly workers can clock in or out to specific job sites, and the Greenshades Payroll engine will automatically apply the correct tax rates based on their job location. This saves time, eliminates manual workarounds, and avoids costly and time-consuming mistakes.

Integrations

Get Started & Sync to Your

Favorite Platforms

Acumatica

Acumatica QuickBooks

QuickBooks  Sage Construction

Sage ConstructionTestimonials

What Our Customers Say

“I have reports in over 20 states, and Greenshades makes quarterly and annual tax reporting a breeze. I also use the green employee and my people love it.”

Beco Inc.

“Very good product for what I do. And always get the needed assistance when needed.”

Culinaire International Consolidated

“I get help with anything I need and it is amazing.”

Centurion Stone

Try Greenshades Today

See how Greenshades Payroll gives you the tools to process multi-state projects with ease.

Highest Rated Payroll and HR Softwarefor Construction Companies

FREQUENTLY ASKED QUESTIONS

Discover the most commonly asked questions about Payroll and HR software for cannabis companies.

What is the role of human resources in construction?

The HR team in a construction company completes a wide range of administrative duties including:

- Recruiting: Seeking qualified full-time, part-time, and contract workers.

- Onboarding: Uploading important documents like i-9s, completing important information like W4s, and experiencing a welcoming first day.

- Training: Keeping both the employer and employees up to date on safety regulations, employee culture, mandatory training, and more.

- Compensation: The HR team works to ensure employees receive fair compensation.

- Benefits: HR managers provide information so employees can make the decision regarding their benefits package and 401k planning.

- Employee Retention: Help identify the areas that affect turnover, so they can come up with solutions to help retain employees.

- Compliance: HR has the task of upholding compliance through ACA requirements, W4 compliance, payroll compliance, and more.

- Payroll: Accurately calculating and processing payroll is a complex task, your HR team works hard to ensure you are paid correctly.

- Performance management: Tracking employee performance can help to make decisions regarding promotions and gives employees insight into areas they can improve and areas they’re doing well.

How do you keep track of construction employees’ hours?

Like any industry, there are two major ways to track employees’ hours worked.

- You can record employees' hours using paper or an Excel spreadsheet, an option often favored by smaller businesses and independent contractors. However, this manual method can be labor-intensive and carries a higher risk of calculation errors.

- Opt for a payroll and HR software solution. With cloud-based software, employees can clock in via their self-service portal, and with GPS capabilities the software can adhere to overtime and break rules. Additionally, clocking in through a kiosk is another available option.

How do construction workers get paid?

Constructions workers are often paid either hourly or in one lump sum. Constructions workers who are paid hourly punch in once they start work and punch out once completed. Hourly pay also comes with overtime pay, which is in line with federal and state laws. Workers can be paid in one lump sum for an entire project. So, the money made from the project is paid in one payment.