Optimizing Payroll, HR, and Tax Processes for Cannabis and CBD Companies

In-House Solutions for Unique Business Needs

Retain Control Over Finances

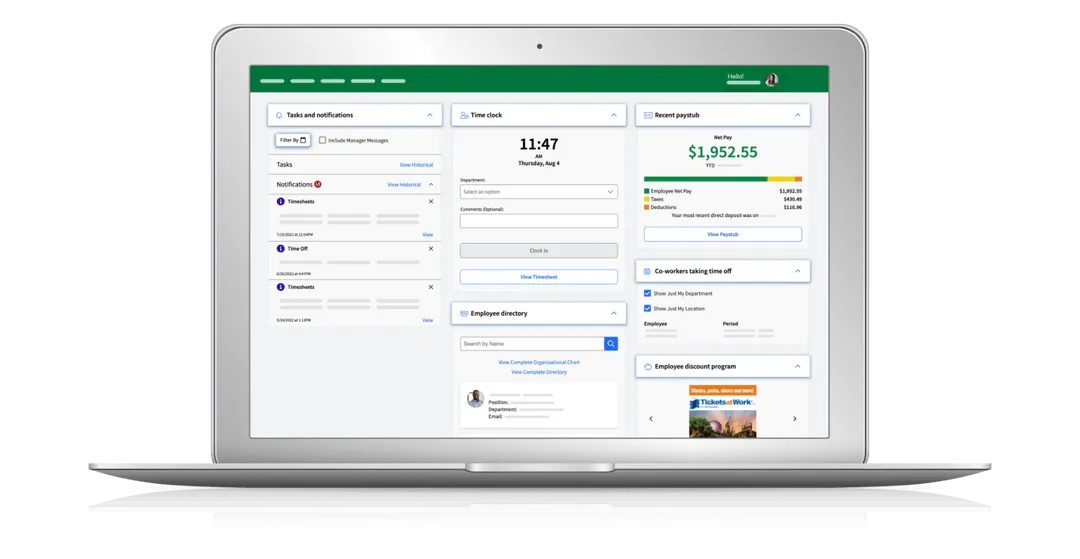

Gain complete control over payroll processes and take charge of your cash flow with our in-house payroll solution. Enjoy the freedom to choose any bank for your direct deposit system, without limitations.

Handle Reporting with Less Hassle

Use our payroll module to easily create and manage custom fields for reporting within the Greenshades solution as well as your accounting or ERP system. This powerful feature ensures your payroll data is accurate for 280e reporting and much more.

Manage All Levels of Compliance

Effortlessly navigate the unique complexities of the cannabis industry with comprehensive support of multi-state companies, overtime pay management, tax withholding, and more.

Payroll, HR, and Tax Solutions designed to support hardworking cannabis and CBD teams:

Refine Your Compliance Management

Our solution provides full support for union contracts, handles payroll tax calculations, and more, ensuring that you remain compliant with labor laws. Additionally, we offer a holistic solution that encompasses annual return 8027 support, facilitating efficient deductions management and tracking for your tipped employees.

Support Your Unique Payroll Needs

Confidently handle your unique payroll needs with the ability to manage complex pay schedules, unlimited earning codes, garnishments, and more. With multi-state support, our solution supports payroll processing for businesses with nationwide operations. Additionally, Greenshades integrates with virtually any ERP allows you to retain your current technology stack.

Attract and Retain Top Talent

in a Growing Industry

Empower your hiring managers to recruit and hire talent faster with our seamless integration capability, allowing smooth data flow between any Applicant Tracking System. By eliminating data silos and streamlining communication across platforms, you can dedicate your attention to the essential task of selecting the best candidates for your team.

Powerful Time Tracking for Payroll

Enhance your payroll operations and maintain compliance with labor regulations using Greenshades' timesheet solution. Our user-friendly platform simplifies employee time tracking, facilitates a streamlined timesheet review process, and handles complex pay calculations effortlessly. Through our integration partners, expand your timekeeping needs by choosing from a variety of timeclocks based on your organization's needs.

Integrations

Get Started & Sync to Your

Favorite Platforms

QuickBooks

QuickBooks  NetSuite

NetSuite Acumatica

Acumatica

Try Greenshades Today

See how Greenshades gives your cannabis or CBD company the flexibility to meet industry and government regulations.

Highest Rated Payroll and HR Software

eBooks & Helpful Information

See AllFREQUENTLY ASKED QUESTIONS

Discover the most commonly asked questions about Payroll and HR software for cannabis companies.

What are the benefits of using payroll, HR, and tax software for cannabis and CBD businesses?

Payroll, HR, and tax software can provide numerous benefits to cannabis businesses. Firstly, they can help businesses to comply with complex and ever-changing labor laws and tax regulations. This is particularly important in the highly regulated cannabis industry, where compliance is critical to avoiding legal and financial penalties.

Secondly, a comprehensive software can streamline and automate HR processes, including managing employee data, benefits, and performance. This can save time and reduce errors, allowing businesses to focus on other aspects of their operations.

Thirdly, payroll software can simplify the process of paying employees accurately and on time, while also ensuring compliance with tax regulations. Overall, the use of payroll, HR, and tax software can increase efficiency, reduce costs, and minimize compliance risks for cannabis businesses.

How does payroll, HR, and tax software help cannabis and CBD businesses stay compliant with labor laws and tax regulations?

Payroll, HR, and tax software helps cannabis businesses stay compliant with labor laws and tax regulations in several ways. These tools can automate complex payroll calculations, support union contracts, handle payroll taxes, and provide reporting and analytics to ensure compliance. They can also provide tools for tracking time and attendance, managing benefits, and onboarding new employees, all of which can help ensure compliance with labor laws.

Comprehensive payroll, HR, and tax solutions can also provide relief for cannabis businesses that must adhere to strict location-specific regulations. Advanced payroll software is programmed to handle the intricacies of each location and can automatically apply the correct calculations for taxes, withholdings, and other compliance requirements. By using such software, cannabis businesses can ensure they are always up-to-date with the latest labor laws and tax regulations, and avoid costly penalties for non-compliance.

What are the challenges cannabis and CBD companies face when it comes to paying their employees?

Cannabis and CBD companies often encounter difficulties in paying their employees due to the varying legality of cannabis across different states in the country. This poses obstacles such as limited access to banking services, restrictions on payment methods, and compliance with state-specific payroll regulations.

To navigate these challenges and ensure timely and compliant payment for employees, cannabis companies can consider the following strategies:

- Cash payment alternatives: Explore alternative payment methods like payroll debit cards or electronic fund transfers (EFT) to provide employees with secure and convenient payment options without relying solely on cash.

- Partnering with cannabis-friendly financial institutions: Seek out financial institutions that specialize in serving the cannabis industry. These institutions understand the unique challenges and can offer banking services tailored to the needs of cannabis businesses, including payroll solutions.

- Compliance with state-specific regulations: Stay updated on the payroll and employment regulations specific to the state(s) where your cannabis company operates. Ensure proper tax withholdings, reporting, and compliance with labor laws to avoid legal complications.

- Professional payroll services: Consider outsourcing your payroll functions to experienced payroll service providers who specialize in working with cannabis companies. These professionals have the knowledge and expertise to handle the complexities of payroll within the legal framework, ensuring accurate and compliant payments.

Utilizing payroll software or platforms designed for the cannabis industry can significantly streamline payroll processes. These specialized tools often incorporate features to address the unique challenges faced by cannabis companies, such as compliance with state-specific regulations and integration with cannabis-specific financial institutions.

Why should cannabis and CBD companies utilize an inhouse payroll solution for payroll processing?

There are three key advantages to using an in-house payroll processor for businesses operating in the cannabis and/or CBD industry.

- Control of Payroll Process: Managing payroll in-house provides the control needed to navigate the unique rules and regulations of the cannabis industry. The biggest advantage of in-house payroll is the ability to control and customize payroll processes to meet your company's unique needs.

- Freedom with Banking: In-house payroll allows businesses to choose how they handle direct deposits, which is especially important given that some banks are hesitant to work with cannabis companies due to the federal illegality of the substance.

- Efficient Cost and Cash Flow Management: Choosing in-house payroll allows businesses to retain funds until necessary, unlike outsourced services which often demand payment per payroll run and prepayment of taxes. Thus, managing payroll internally provides the control, security, and financial efficiency needed to meet the unique challenges of the cannabis industry.

How can HR software solution benefit cannabis and CBD businesses in terms of compliance, employee management, and recruiting?

HR software is a valuable tool for cannabis businesses, providing multiple benefits. Firstly, it automates compliance processes, making it easier to track and manage compliance with labor laws and tax regulations. Secondly, it streamlines employee data management, enabling businesses to efficiently manage employee records, benefits, and performance. Thirdly, it simplifies recruiting by providing tools for posting job listings, screening candidates, and conducting interviews. By utilizing HR software, cannabis, and CBD businesses can enhance compliance, employee management, and recruiting efforts, ultimately contributing to the growth and success of their operations.