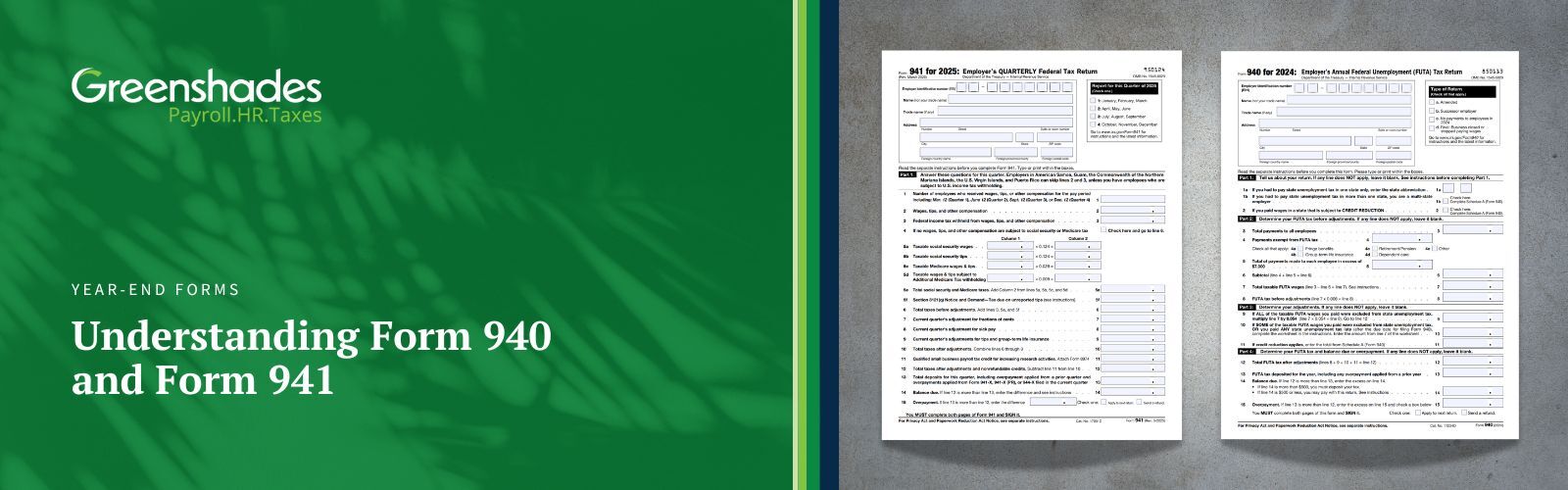

Fulfilling your tax obligations as an employer means understanding IRS Form 940 (Employer’s Annual Federal Unemployment (FUTA) Tax Return) and Form 941 (Employer’s Quarterly Federal Tax Return). These forms are critical for reporting federal unemployment and employment tax liabilities. Even small mistakes can lead to penalties or compliance issues.

Note: This information is for informational purposes only and does not constitute formal tax, legal, or compliance advice. Always consult with qualified tax advisors, legal counsel, and your organization’s internal teams for guidance specific to your situation. Additional regulations may apply. For the most accurate and up-to-date information, refer to official government resources and regulatory agencies.

Knowing the differences between these forms and the most common pitfalls helps you simplify your process and file accurately and on time throughout the year.

What’s the Difference Between Form 940 and Form 941?

Form 940 – Annual FUTA Return

Employers use Form 940 to report the Federal Unemployment Tax (FUTA), which funds unemployment compensation programs.

- Employer-only tax: FUTA is not deducted from employee wages.

- Taxable wage base: Only the first $7,000 paid to each employee annually is subject to FUTA tax.

- Credit reduction states: Employers in certain states may owe more if their state has outstanding federal loans.

Due date: The due date for filing Form 940 each year is January 31. However, if you deposited all your FUTA tax when it was due, you may file Form 940 by February 10.

Note: The due date for tax year 2025 is February 2, 2026, since January 31 falls on a Saturday.

(Instructions for Filing Form 940, IRS)

Form 941 – Quarterly Employment Tax Return

Employers file Form 941 each quarter to report:

- Federal income tax withheld from employee wages

- Both the employer and employee shares of Social Security and Medicare (FICA) taxes

- Any applicable adjustments or credits (e.g., COBRA premium assistance, sick leave credits in prior years)

Form 941 reconciles the amounts employers have deposited throughout the quarter with the actual taxes due.

Due Dates: Your Form 941 is due by the last day of the month that follows the end of the quarter.

| The Quarter Includes . . . | Quarter Ends |

Form 941 Is Due

|

|

1. January, February, March

|

March 31 | April 30 |

|

2. April, May, June

|

June 30 | July 31 |

|

3. July, August, September

|

September 30 | October 31 |

|

4. October, November, December

|

December 31 | January 31 |

(Instructions for Form 941, IRS)

Common Mistakes to Avoid When Filing Forms 940 and 941

Even experienced payroll teams can run into issues. Here are the most common errors and how you can prevent them.

Incorrect or Incomplete Information

Always double-check your EIN, business name, and address. Even a small typo can cause IRS mismatches or delay your processing. Incorrect identifying details are one of the main reasons forms get rejected.

Calculation Errors

Errors often arise when calculating taxable wages or applying FUTA credits.

- Employers pay a FUTA tax of 6% on the first $7,000 of each employee's wages.

- Employers usually receive a 5.4% credit for paying state unemployment taxes, which reduces the effective FUTA rate to 0.6%. This rate can vary by state. Review the Instructions for Form 940 and use automated payroll software to help avoid manual miscalculations.

Late or Missing Filings

Missing deadlines can trigger penalties and interest. The IRS may charge you for failure to file and failure to pay, and sometimes both. Penalty rules can be complex, so check the IRS page for more information.

Set up alerts or rely on automated workflows to stay ahead of quarterly and annual due dates.

Misclassification of Workers

Incorrectly labeling an employee as an independent contractor can cause major payroll and tax compliance issues. Review IRS guidelines on worker classification or submit Form SS-8 if unsure.

Neglecting to Sign and Date the Forms

Unsigned forms—even if otherwise perfect—may be considered invalid. If filing electronically, use your IRS-authorized e-file signature PIN.

How to Handle Corrections

Mistakes happen. Correcting them quickly and accurately helps you avoid additional penalties.

- Form 941 Corrections: If you discover an error on a previously filed Form 941, use Form 941-X to make corrections.

- Form 940 Corrections:There’s no separate “940-X” form. To correct an error, simply check the “Amended Return” box on the top of your Form 940.

Simplify the Process with Payroll Automation

Staying compliant doesn’t have to be stressful. Payroll software solutions like Greenshades help you:

- Automate tax calculations to reduce manual entry errors

- Receive alerts for upcoming filing deadlines

- Generate detailed reports for faster reconciliation and audit readiness

With automation and built-in compliance checks, Greenshades helps employers file with confidence and spend less time worrying about year-end forms.