*This webinar recap was updated on January 12th, 2023.*

Chris Hadden, CPP, Vice President of Revenue Strategy & Operations at Greenshades, presents 2022 Compliance Considerations, as part of our Year-End Forms Webinar Series. Compliance is an essential part of a successful year-end. Non-compliance can bring major risks like data losses, a damaged reputation, security breaches, lost customers, and even financial fines and penalties. The best way to mitigate these risks is to stay vigilant and compliant. This webinar includes a high-level overview on navigating different tax filing requirements, form distribution, and the software and service that can make your year-end process run smoothly and securely.

This webinar is comprised of five significant topics:

- Things to do now

- What’s new with the W-2

- What’s new with the 1099

- 1099 Combined Federal/State Filing Program

- What about 1095-C?

Legal Disclaimer: This content and the webinar series are not formal legal advice, and you should always consult your organization’s legal and accounting teams. Greenshades partners with myHRcounsel to provide affordable, online, and on-demand legal advice.

Watch the replay:

Read the recap:

1. Things to do now

There are ways to help you stay compliant as we move into year-end and get closer to filing. Here are 4 things to do right now:

- Check the Wage Base

The 2022 Social Security Wage Base is $147,000. Employee social security withholdings should not exceed $9,114 in 2022. The 2023 Wage Base will be $160,200.

The 2022 maximum employee deferral contribution (49 years or younger) is $20,500; in 2023, this number will increase by 2k ($22,500).

The 2022 employee catch-up contribution limit (50 years or older) is $6,500; in 2023 this number will increase by 1k ($7,500). Keep in mind that the catch-up contribution limit for participants 50 or older applies from the start of the year to those who turn 50 at any time during the year.

- Check for Additional Medicare Tax Withholding

Employee only withholding of 0.9% (in addition to the standard 1.45%) on all wages over $200,000 in a calendar year. There is no employer portion of the Additional Medicare Tax.

- Review Imputed Income

Imputed income includes benefits that aren’t included in an employee’s wage or salary, but they still pay taxes on. For example: :

- Group-term life insurance coverage in excess of $50,000 (or $2,000 for dependents)

- Educational assistance over $5,250 per year

- Dependent Care assistance in excess of $5,000

- Adoption assistance (is exempt from Income tax withholding but not Social Security or Medicare)

Pay special attention to highly compensated employees who may not be eligible for the tax–exempt fringe benefit:

- The employee was a 5% owner at any time during the year or the preceding year

- The employee received more than $130,000 in pay for the preceding year (you can ignore this one if the employee wasn’t also in the top 20% of employees when ranked by pay for the preceding year)

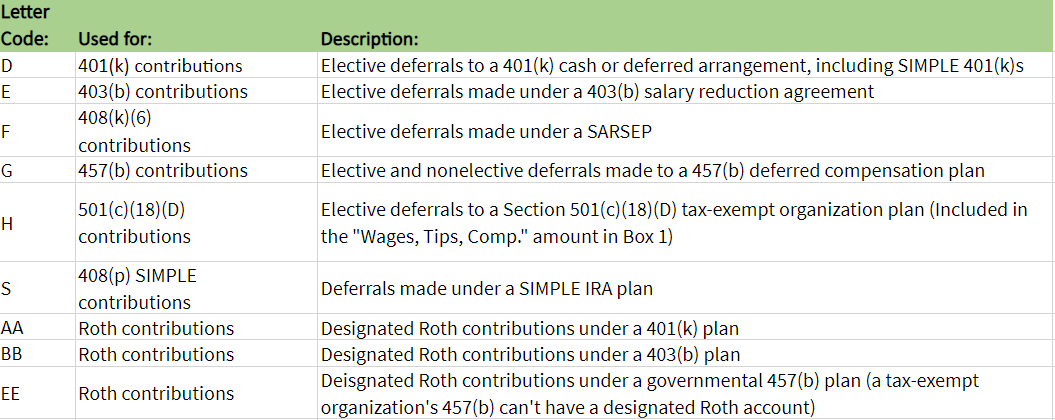

Box 12 Codes:

2. What's new with the W-2

Truncated SSNs (social security numbers) are allowed on the W-2

Truncate, by definition, is shortening something by removing part of it.

What does this mean? This means that an employer may truncate an employee’s social security number – however ONLY on recipient copies, for example, (XXX-XX-1234). Keep in mind you CANNOT use truncated SSNs on Copy A if filing on paper or in electronic files to the SSA.

Employer Identification Numbers (EIN) may never be truncated, and you should always check with your state to see if it allows or restricts the truncation of social security information.

File On Time

Recipient Copies and filing copies (whether on paper or electronic) are due January 31, 2023.

You should consider electronic filing with the SSA even if you do not have the form count that would make it required. Promoting electronic consent and distribution of W-2 is a great way to reduce liability and avoid issues with delivery (I.e., misdelivered, missing, or late recipient copies) while also reducing the accessibility of information through mail fraud.

The Taxpayer First Act allows for increased electronic filing of IRS forms including W-2s. In 2022, if you send 100 or more W-2s to the SSA, you must file them electronically. In 2023, that limit is lowered to 10.

Disclaimer: This information is pending as the IRS has not issued final regulations, and the threshold for electronic filing is currently 250 or more W-2s. There has been an effort to lower the threshold for years now, and it appears to be getting closer. However, the IRS regulations have not been updated yet and if you choose not to file electronically, proceed with caution.

Please be aware of increased penalties as deadlines are crucial and immovable.

- $50 per form if filed within 30 days of the due date

- $110 per form if filed after 30 days but before August 1

- $290 per Form W-2 if you file after August 1, do not file corrections, or do not file required Forms W-2

- $580 per form for intentionally disregarding filing

3. What's new with the 1099

Truncated identification numbers for other form types

Similar to the truncated SSNs on the W-2s, taxpayer identification numbers can be truncated on recipient copies only (copy B):

- Form 1095-C

- Form 1098 series (except Form 1098-C)

- Form 1099 series

- Form 5498 series

Keep note that you may never truncate your own identification number (EIN).

Types of identification numbers that can be masked include:

- Payee’s Social Security number (SSN) XXX-XX-1234

- Individual taxpayer identification number (ITIN) XXX-XX-1234

- Employer identification number (EIN) XX-XXX1234

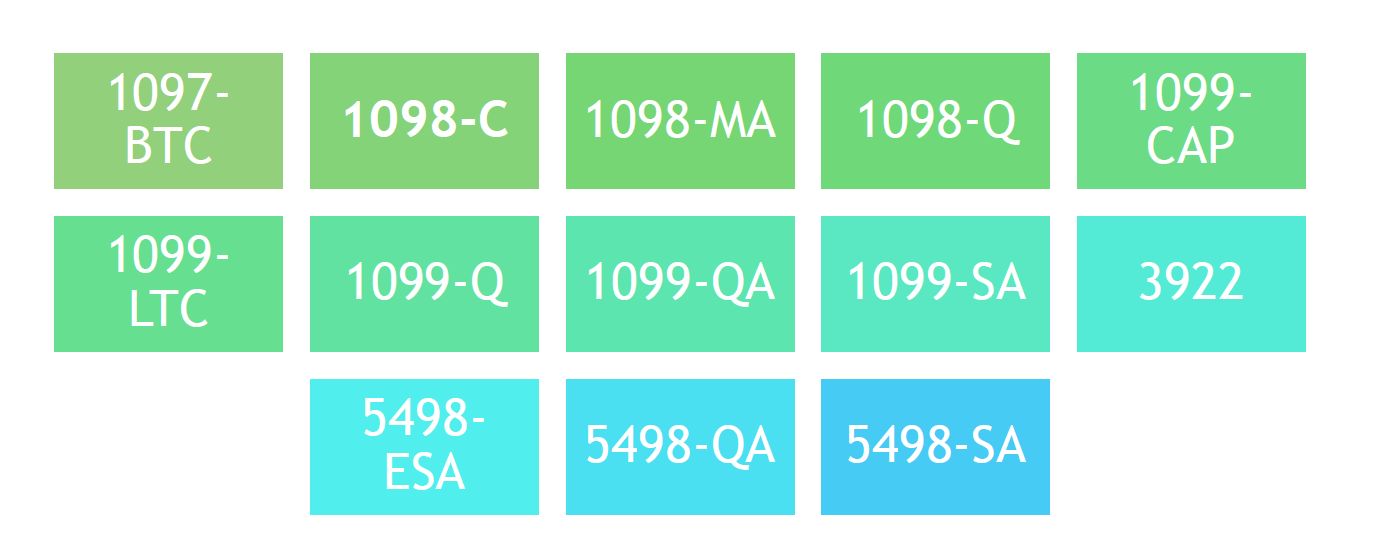

Some 1099 type forms are now fillable PDFs

On www.irs.gov, the following form types can be submitted to the IRS through a fillable PDF and in black and white (copy A).

The Taxpayer First Act

The Taxpayer First Act allows for increased electronic filing of IRS forms including 1099s.

In 2022, if you send 100 or more 1099s to the IRS, you must file them electronically.

Disclaimer: Like stated above, this information is pending the IRS issuing final regulations.

When are 1099s due?

- 1099s are due to recipients on January 31st.

- Filing must be to the IRS by February 28, 2023, for paper returns or March 31, 2023, if filing electronically.

- 1099-NEC recipient copies and IRS files are due January 31, 2023.

4. The Combined Federal/State Filing Program (CF/SF)

The program is set up to simplify information returns filing for issuers. Through CF/SF, the IRS electronically sends information returns (original and corrected) to participating states. The following information returns may be filed under the CF/SF Program:

- Form 1099-B, Proceeds from Broker and Barter Exchange Transactions

- Form 1099-DIV, Dividends and Distributions

- Form 1099-G, Certain Government Payments

- Form 1099-INT, Interest Income

- Form 1099-K, Payment Card and Third-Party Network Transactions

- Form 1099-MISC, Miscellaneous Information

- Form 1099-NEC, Nonemployee Compensation

- Form 1099-OID, Original Issue Discount

- Form 1099-PATR, Taxable Distributions Received From Cooperatives

- Form 1099-R,Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

- Form 5498, IRA Contribution Information

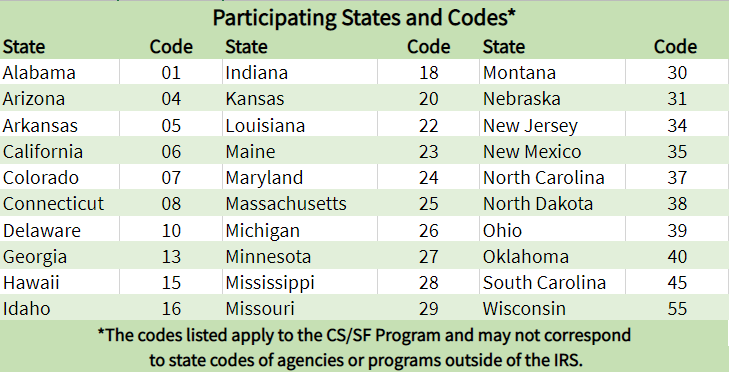

These are the states participating in CF/SF:

More about the Combined Federal/State Filing program

Keep note that filing through the program does not guarantee the state filing requirements are met. The company is responsible for validating that submission through the Combined Federal/State Filing Program will satisfy all of their 1099 filing requirements:

- The expectation is that the companies will register (if necessary) with each state that they are expecting to receive their 1099 data through the IRS program

- Most states require that returns that have state withholding be also submitted directly to the state

- Filing through the IRS program does not automatically register the companies as combined filers with the states

Greenshades creates files that are compliant with reporting through the Combined Federal/State Filing Program:

- We do not sell or support state level 1099 reporting directly through the state

- We cannot validate the receipt or acceptance of the state 1099 data through the IRS program

The IRS will report to all states that have a “B” record in the e-file

The “B” Record includes payment information including State Income Tax Withheld and Local Income Tax Withheld. These fields are for the convenience of filers, as the information will not be used by the IRS.

- The IRS will push out the information to all states that have records in the company's file

- The IRS does not track or validate if the company was registered in the receiving state program

- There are no receipts provided for the files submitted through the Combined Federal/State Filing Program

1099 record must include the “K” record

- The “K” Record is the state level 1099 totals

- Without the “K” Record, the IRS will not forward the information to the states

For states that do not participate in the Combined Federal State Program, many will take the IRS Pub 1220 formatted file WITH the “B” and “K” records, filed directly to the state.

When does the IRS report to the states?

The CF/SF Program files are provided to participating states six times a year approximately:

- Calendar Week #14 (Early April) -includes data processed from weeks 1 –13

- Calendar Week #20 (Early May) -includes data processed from weeks 14 –19

- Calendar Week #25 (Mid-June) -includes data processed from weeks 20-24

- Calendar Week #30 (Late July) -includes data processed from weeks 25-29

- Calendar Week #37 (Early Sept) -includes data processed from weeks 30-36

- Calendar Week #51 (Late Dec) -includes data processed from weeks 37-50

*Runs are not cumulative, meaning the files are separate and distinct.

5. How about 1095-C?

Instructions are still in draft

Electronic filing is required for employers with 250 returns or more.

- An ALE Member must furnish a Form 1095-C to each of its full-time employees by January 31, 2023, for the 2022 calendar year.

- For calendar year 2022, Forms 1094-C and 1095-C are required to be filed by February 28, 2023, or March 31, 2023, if filing electronically.

Year-End Forms with Greenshades

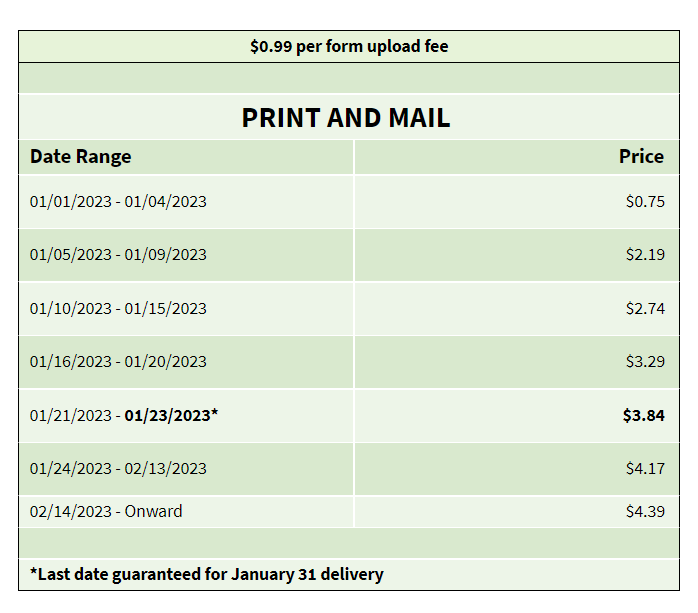

Greenshades can print, stamp, and mail year-end forms for you...including to independent contractors. This process is easy, secure, and ERP-agnostic!

We support multiple form types including:

- W-2

- 1095-C

- 1099

- 1099-MISC

- 1099-NEC

- ...and more

What’s Next?

1. Check out our Year-End Resources page!

We've compiled all of year-end forms resources on one page for easy access.

2. Don't know where to start?

The Beginner’s Guide to Year-End Forms is available now!

3. Download the deck from the Webinar presentation

Compliance Considerations 2022 Slide Deck PDF

Need help with compliance and mitigating risks during year-end? Contact sales@greenshades.com or visit go.greenshades.com for information.

Watch the full webinar, 2022 Compliance Considerations.

Visit go.greenshades.com and click on the resources tab, where we keep you in the know about future webinars.