Greenshades can ease the burden of some of the biggest challenges that come with the year-end process.

The IRS has recently issued final regulations that amend the filing rules for W-2, 1099, and other information returns. These changes officially took effect on February 23, 2023. The new regulations now require businesses to electronically file their returns if they file 10 or more returns in a calendar year.

These new regulations may have significant implications for your business, and being informed and compliant with IRS filing requirements is crucial to avoid potential penalties. By choosing to e-file with Greenshades, you can avoid the headache!

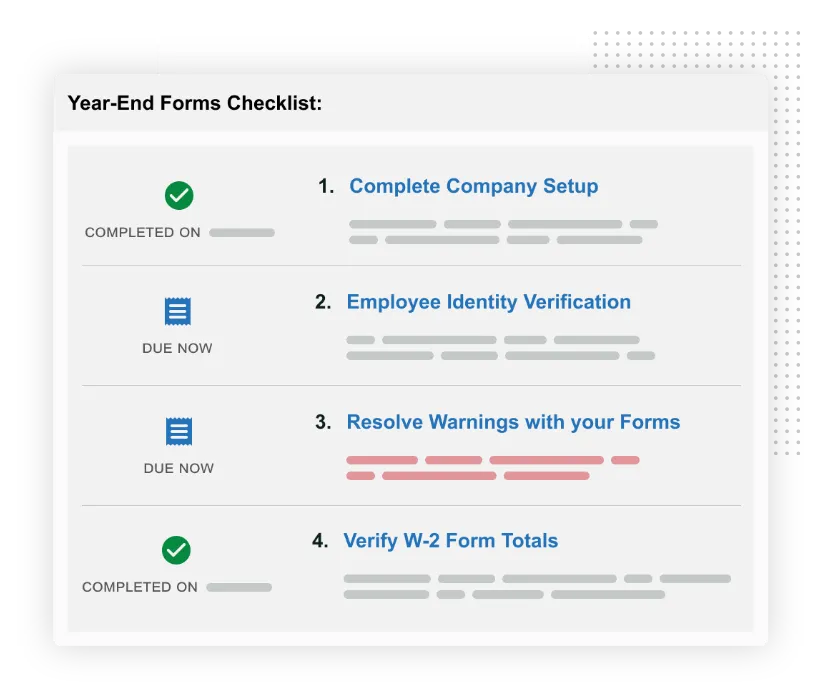

Annually, businesses must calculate, validate, and file taxes to the IRS and other regulatory agencies. The year-end forms process serves as a culmination of your financial year. Organizations must complete this process to meet federal, state, and local requirements.

Greenshades processes, files, and prints W-2, 1099-MISC, 1099-NEC, 941, ACA, 1095, and 1040s.

Understand the completion process and importance of year-end forms.

Learn how to automate and simplify complex payroll taxes.

Learn how the deskless worker is changing the forefront of businesses and how to support them.

See how Greenshades can solve all your Payroll and HR challenges.