January is right around the corner! Are you ready for year-end?

We know your time is precious, which is why Alisha Rocks, Tax Product Manager at Greenshades, presents 15 Tips in 15 Minutes as part of our Year-End Webinar Series.

This webinar was broken up into two sections:

- Intro to Greenshades

- 15 Tips

Download the 15 Tips in 15 Minutes slide deck.

Watch the webinar replay here:

Read the webinar recap here:

About Greenshades

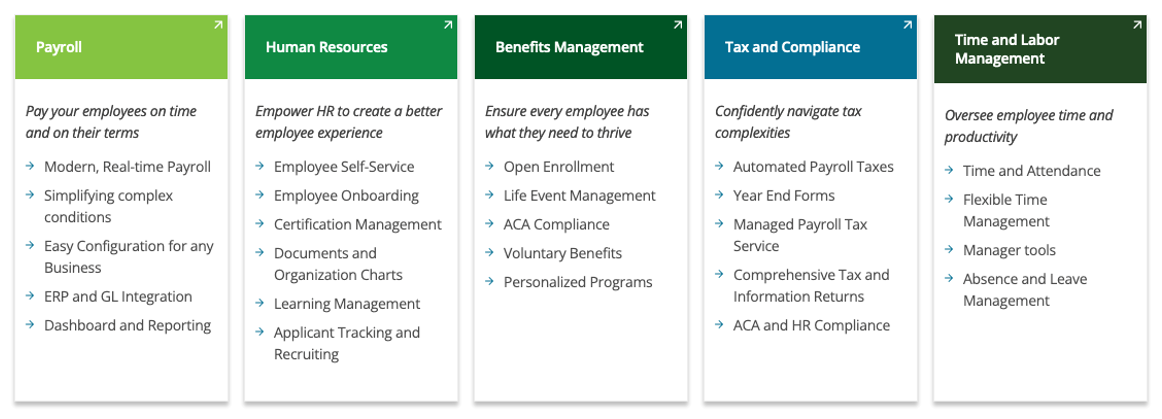

For more than 20 years, Greenshades has been supporting mid-sized businesses with their tax, payroll, and HR needs.

Centered around compliance, Greenshades offers a complete cloud-based solution from payroll and onboarding to benefits management and year-end forms.

Greenshades started as experts in tax and compliance before adding payroll and HR solutions, which means if you're looking to outsource your year-end forms, look no further.

Take Note

- These tips are in no particular order

- These tips may not be applicable to all companies or situations

- This is not formal legal advice, always consult your local counsel

- Greenshades partners with myHRCounsel to provide customers with affordable, online and on-demand legal advice

- As always, you can reach out to Sales or Support with any questions

15 Tips

Tip #1 Reconcile 941s and W-2s before filing

Always reconcile W-2s and 941s before filing; your quarterly 941s and annual W-2 totals should match. You should double check wages paid under FFCRA and review voided checks and manual transactions to make sure they were properly recorded. The biggest takeaway is that your totals should always match.

Tip #2 Prevent penalties for no-match information returns

Use the SSN and TIN verification tools in Greenshades year-end forms to review your recipient tax IDs before you distribute forms. Ensure you have W-4 and W-9 copies for all of your employees and vendors.

Tip #3 Review benefits and adjust for imputed income

This is an important area to keep in mind and something that is easily forgotten. Depending on the industry and benefits offered to employees, this may not be applicable to every employer. Calculating imputed income for life insurance coverage over $50K can be tricky sometimes, so it's important to research and understand the requirements. Greenshades Benefits software handles this calculation, which can be a huge time saver.

Tip #4 Check the wage base

The 2022 social security wage base is $147,000. Employee social security withholding should not exceed $9,114 in 2022. And the 2023 Social Security wage base will be $160,200.

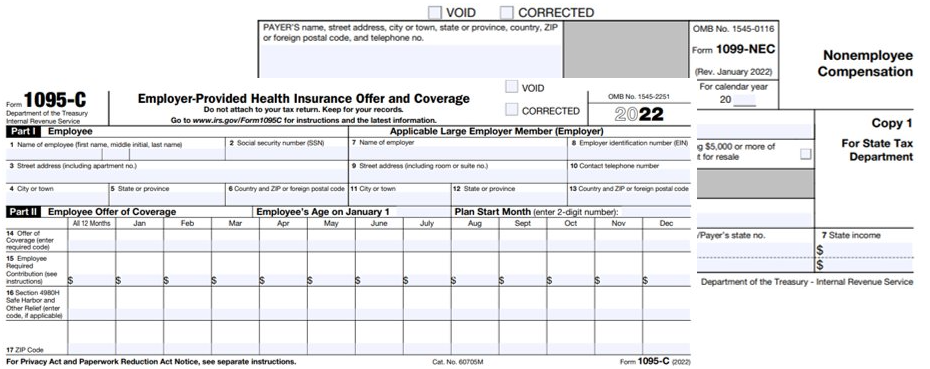

Tip #5 Use the correct 1099

There are multiple 1099s; the most common are 1099-MISC (which stands for miscellaneous income) and 1099-NEC (which stands for non-employee compensation). 1099-NEC is used for independent contractors, gig workers, and other non- W-2 employees. You used to report non-employee compensation on 1099-MISC, but it has since split, so make sure you use the right 1099.

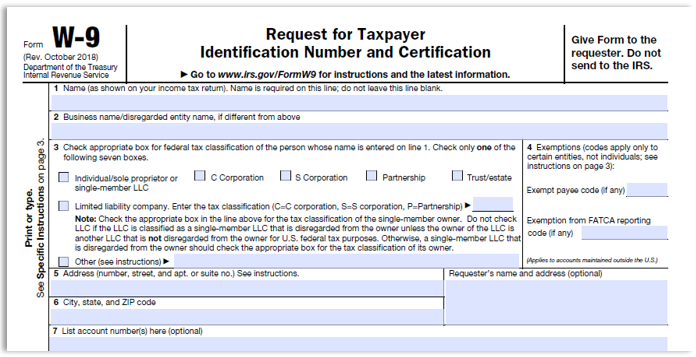

Tip #6 Get a properly completed W-9

Don't forget to get a properly completed W-9! If you are unable to get a correct TIN/EIN, be sure to start back-up withholding at the 2022 rate of 24%. If you do need to backup withhold on a contractor, remittances get reported/reconciled on Form 945. If backup withholding was required, don't forget to report it on the 1099-NEC or 1099-MISC.

Tip #7 Review!

Review Administrators in Greenshades Online and the Year-End forms portal to ensure only current employees have access to forms and employee data. A quick audit of 401(k) contributions for excess contributions is also important, especially with employees that are engaging in catch-up contributions.

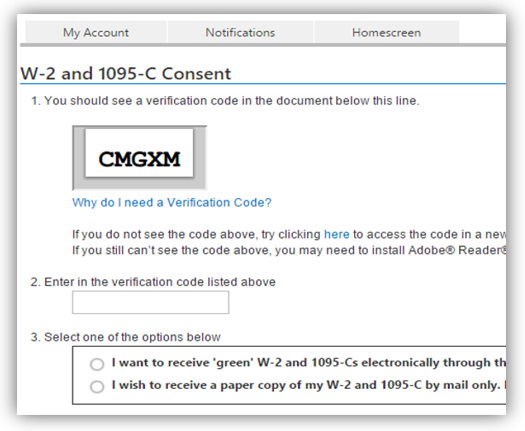

Tip #8 Use electronic consent to streamline your year-end

Educating employees on the ability to receive their W-2s and 1095s electronically is great because for employers, electronic distribution is the fastest & most affordable distribution method. Remember that you cannot force employees to accept electronic distribution and must mail paper forms to those that do not consent or request paper copies.

Tip #9 Consider concierge support

Take advantage of our concierge support! All Greenshades products include unlimited customer support, however, we offer an enhanced support model for companies that need additional support.

Tip #10 Streamline year-end by outsourcing forms production

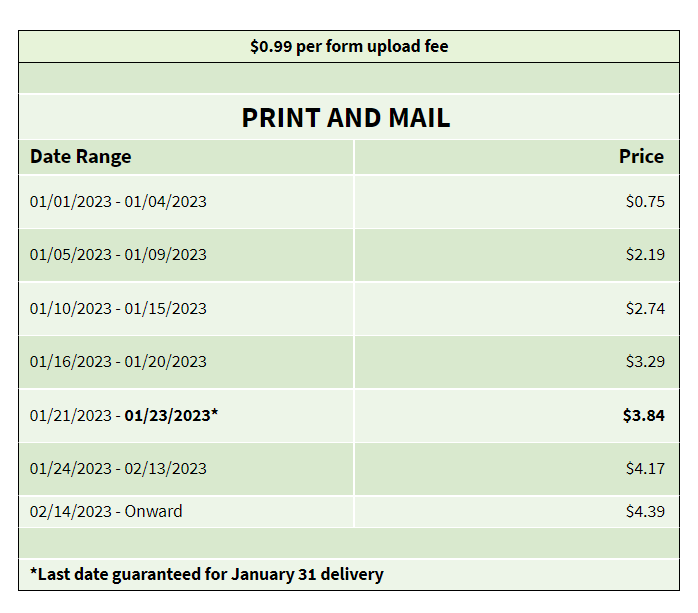

January can be stressful! Use Greenshades to create and distribute year-end forms with easy production and cost effective mailing options without putting your staff, reputation, and funds at risk.

Tip #11 Archive!

Archiving is so important! There are a couple of ways to archive with Greenshades: 7-year archive enrollment, during the initial upload process, the ability to download all forms locally at no additional cost, individual year archive options , and CD Archive requests, that Greenshades fulfills and mails right to your home or office.

Reach out to our Sales team for archiving options and pricing.

Tip #12 Be aware of the paper shortage!

The paper shortage is looming; if you print your own forms, be aware. An increased demand and low supply will mean competition for resources like paper. Shipping delays from FedEx or UPS, winter storms, and other factors could also lead to late distribution penalties.

Tip #13 Remind employees to update their info in Q4

Reminding your employees to update their personal info in Q4 to prepare for year-end forms will save a lot of stress come January. Information like mailing address, personal contact information, emergency contacts, dependent Information, beneficiary Information for 2023 benefits, and distribution preferences for year-end forms should all be updated in Q4.

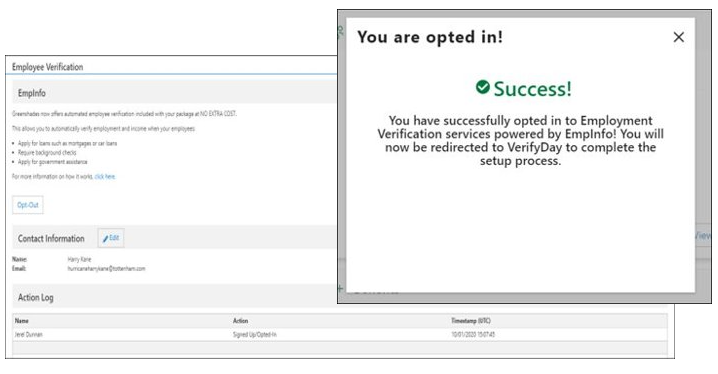

Tip #14 Sign up for employment and income verification

Use EmpInfo through Greenshades at no additional cost to streamline employment and income verification for Greenshades Online users. Using this service can automate these verifications and save your team time and money!

Tip #15 Get started early

Get started early! Avoid stress by getting started early and work with Greenshades to complete, file, and distribute year-end forms. The sooner the better because the closer to January 31st the more costly.

Year-end can be stressful, Greenshades is always here to help and support you.

Don't know where to start? Check our Beginner's Guide to Year-End Forms eBook.

Questions about your specific year-end processes or forms? Contact sales or support.

Want to learn more about Greenshades? Visit go.greenshades.com and click on the resources tab to stay in the know about future events, webinars, and blogs.