As the landscape of tax regulations evolves, staying current with the latest year-end filing requirements—especially for 1099 forms—is crucial for every business.

Note: This information is for informational purposes only and does not constitute formal tax, legal, or compliance advice. Always consult with qualified tax advisors, legal counsel, and your organization’s internal teams for guidance specific to your situation. Additional regulations may apply. For the most accurate and up-to-date information, refer to official government resources and regulatory agencies.

Below, we dive into details regarding each 1099 Form and specific updates for 2025. For your convenience, we included a link to the 'About Form' on the IRS website so you can dig into additional details if necessary.

About Forms 1099

The 1099 series of forms reports various types of income paid to individuals or businesses other than wages, salaries, and tips. Each version serves a specific purpose:

- 1099-NEC: Reports nonemployee compensation of $600 or more paid to independent contractors, freelancers, and vendors. (About Form 1099-NEC, IRS)

- 1099-MISC: Reports other types of payments such as rents, royalties, prizes, or attorney fees. (About Form 1099-MISC, IRS)

What is the difference between Tax Forms 1099-NEC and 1099-MISC? Find out here.

- 1099-INT: Reports interest income of $10 or more from bank accounts, loans, or investments. (About Form 1099-INT, IRS)

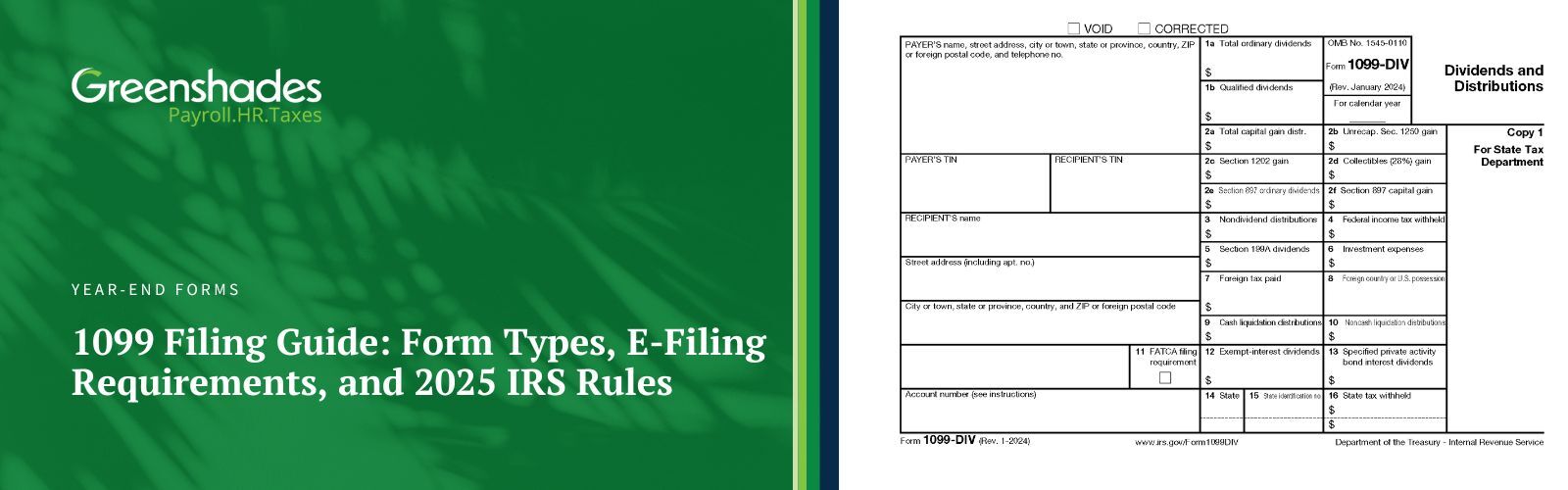

- 1099-DIV: Reports dividends and distributions from stocks, mutual funds, and other investments. (About Form 1099-DIV, IRS)

- 1099-R: Reports distributions from retirement accounts such as pensions, annuities, or IRAs. (About Form 1099-R, IRS)

- 1099-B: Reports proceeds from the sale of securities, such as stocks or bonds. (About Form 1099-B, IRS)

- 1099-G: Reports government payments like unemployment compensation, state tax refunds, or agricultural subsidies. (About Form 1099-G, IRS)

- 1099-K: Reports payment transactions from third-party platforms like PayPal, Venmo, or Square (see “What’s New” below for 2025 updates) (About Form 1099-K, IRS).

While W-2s report wages paid to employees, 1099s are used for payments to non-employees—independent contractors, freelancers, or service providers.

Form 1099 Updates for 2025

The IRS has issued several key updates affecting year-end reporting and form usage:

1. 1099-K Thresholds Revert to Pre-2021 Rules

As a result of the One Big Beautiful Bill Act (OBBBA), the lowered $600 reporting threshold for Form 1099-K will not take effect. Instead, the previous thresholds are reinstated.

A Third-Party Settlement Organization (TPSO) must file a 1099-K only if:

- The recipient received over $20,000 in gross payments and

- Completed more than 200 transactions in the calendar year.

(Jump to Section 70432 of the One Big Beautiful Bill Act (OBBBA) for more information)

⚠️ Note: Some states may have their own 1099-K thresholds, which may differ from the federal limits. Always confirm state-specific requirements.

2. 1099-R Updates

Updates to Form 1099-R for 2025 include:

- Box 7: A new Code Y has been added to indicate Qualified Charitable Distributions (QCDs).

- Automatic Rollover Limit Increase: Beginning January 1, 2024, the automatic rollover amount increased from $5,000 to $7,000.

3. E-Filing Threshold Reminder

Businesses filing 10 or more information returns of any type (W-2s, 1099s, etc.) must file electronically. This rule makes e-filing solutions more critical than ever for accuracy, speed, and compliance.

Ready to Simplify 1099 E-Filing?

Greenshades offers a smarter, faster, and more compliant way to file your 1099s.

Save Time and Money

Reduce manual work, eliminate printing and mailing costs, and submit instantly through our secure e-file integration with your payroll and accounting systems.

Improve Accuracy and Security

Built-in data validation helps prevent common errors and ensures sensitive information stays protected—no lost or misplaced paper forms.

Maintain Compliance

Stay current with IRS rules, state-level differences, and submission deadlines—all from one intuitive dashboard.

With Greenshades, compliance doesn’t have to be complicated. Automate your 1099 filing, streamline your workflows, and gain confidence heading into year-end.