*This recap was updated on January 10th, 2023*

John Osberger, Director of Sales at Greenshades, kicks off this year's year-end forms webinar series with Year-End Forms 101. In this webinar, we give a brief overview of the powerful Greenshades Payroll & HR Platform, a high-level look at year-end forms, and how Greenshades can support you during year-end.

This webinar is composed of three topics:

- Introduction to Greenshades

- What are Year-End Forms?

- How Greenshades can support you during year-end

Legal Disclaimer: This content and the webinar series are not formal legal advice, you should always consult your organization’s legal and accounting teams. Greenshades partners with.myHRcounsel to provide affordable, online, and on-demand legal advice.

Watch the replay:

Read the webinar recap:

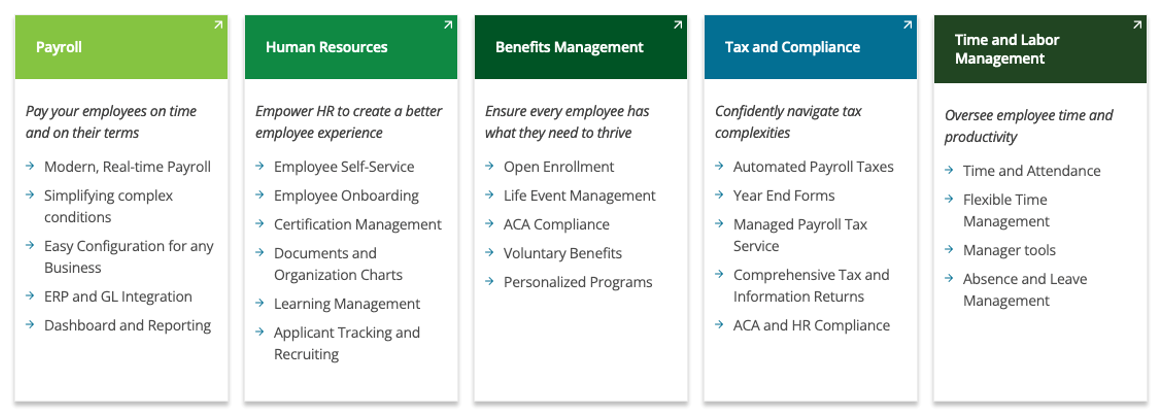

1. About Greenshades

Greenshades offers cloud-based, all-in-one solutions for tax, compliance, payroll, and HR. With over 20 years of experience and over 3,800 mid-sized organizations, Greenshades is a leader in payroll and HR technology.

2. What are Year-End Forms?

The year-end forms process is an annual payroll tax reporting process that serves as a culmination of your financial year. Organizations must calculate, validate, and file taxes to the IRS and other regulatory agencies to meet federal, state, and local requirements. The best way to meet deadlines and avoid penalties is meticulous record-keeping and always having employee information up to date.

Missing deadlines means facing direct and indirect consequences:

- Fines and penalties (these can be costly!)

- Miscalculating taxes or withholdings

- Risk of damaged reputation

- Low employee engagement and morale

What makes 2022 filing different?

While COVID-specific challenges are not as relevant anymore, the IRS is hard to reach when you need assistance, and they are still behind from the pandemic. According to the GAO, the IRS experienced many challenges related to COVID in the 2021 filing season.

- In-person services were suspended and telephone demand increased

- Online information regarding refunds was limited

- Nearly 21 million returns were expected to be stopped for errors

Outsourcing your year-end forms processing can help you prepare for potential delays by helping with record-keeping, tax jurisdiction and regulation changes, legislation changes, and correcting errors before submission.

3. How can Greenshades help

Greenshades offers complete year-end services, a totally turn-key operation.

- Digital processing

- Print processing

- Mailing and postage

- Data validation, formatting, verification and more.

Common challenges for Year-End

Complex Year-End Requirements - Greenshades files, validates, and distributes forms so you don’t need to hire seasonal help or overwork your teams.

Jurisdiction Requirements - Automate tax codes to ensure compliance with federal, state, and local requirements.

Regulatory Changes - The IRS and other regulatory agencies can make last minute changes or not communicate requirements until the end of the year, so preparation is key!

Technology - Ensuring your payroll talent has the best technology is the easiest way to stay compliant, up-to-date, and make year-end a breeze.

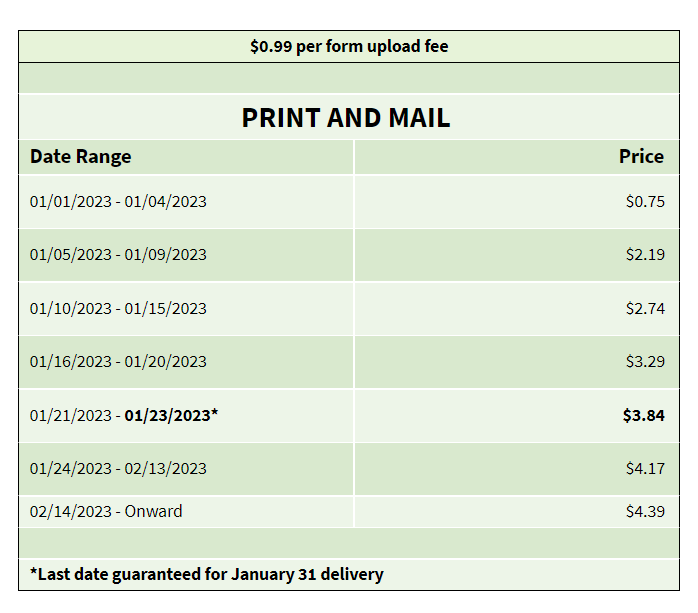

Year-End Forms Pricing

Greenshades can print, stamp, and mail year-end forms for you...including to independent contractors. This process is easy, secure, and ERP-agnostic!

We support multiple form types including:

- W-2

- 1095-C

- 1099

- 1099-MISC

- 1099-NEC

- ...and more

What’s Next?

1. Visit our Resources page!

We've compiled all of our year-end resources into one page for easy access.

2. Check out for our eBook!

Need more information? The Beginner’s Guide to Year-End Forms.

2. Download the deck from the Webinar presentation

Don't want to print Year-End Forms? Contact sales@greenshades.com or visit go.greenshades.com for information.

Watch the entire on-demand webinar, Year-End Forms 101

Visit go.greenshades.com and click on the resources tab, where we keep you in the know about future webinars.