For any business, keeping employee satisfaction high and driving deep engagement amongst workers is essential to attract and retain top talent. "Traditional" benefits such as health insurance and retirement funds may not be enough to incentivize workers nowadays. As a result, many organizations seek creative and unique ways to recruit talent to their teams.

Organizations are discovering that their payroll system provides multiple opportunities to show employees that they are valued. Whether you own a small business or work within a large enterprise's HR department, you can leverage your payroll system to increase the productivity and satisfaction of your workforce.

How to Leverage Payroll as a Benefit

The interest in innovative payroll add-ons as employee benefits has become increasingly popular in recent years. According to the Payroll Security, Regulation, and Innovation Survey 2022, about two-thirds of organizations currently offer at least one payroll-related add-on to their employees. In addition, most respondents felt these add-ons have a positive impact.

There are many ways to leverage payroll to drive employee satisfaction, but here are five unique ways your business may want to explore.

- Access to pay on-demand (also known as “Earned Wage Access”)

Earned Wage Access (EWA) allows workers to access their earned wages before their regularly scheduled payday. This option is a valuable benefit for workers struggling to make ends meet between paychecks or who need access to additional funds for unexpected expenses.

- Ability to make charitable donations via payroll deduction

Americans make significant charitable contributions to nonprofits every year. While donating to those in need is mainly driven by kindness, individuals also enjoy substantial tax breaks with their donations. Most Americans wait until the end of the year to make their contribution. With the extra expenses that come with the holidays, workers may be unable to donate as much as they originally planned – impacting their potential tax break and the nonprofit in need.

By allowing workers to make charitable donations via payroll deductions, organizations provide an easy way for employees to spread their gifts over the year. This opportunity enables workers to budget for the size of the gift they intend to make and can take the pressure off making a lump sum payment at year-end.

- Choice to use pay card services

A pay card is another way to distribute an employee's paycheck in lieu of direct deposit or paper checks. During the payroll process, a pay card vendor facilitates the transfer of the employee's earned wages onto a card that is used just like a debit card.

Putting a worker's wages on a card saves them the hassle of going to a bank to deposit a check. It is especially advantageous for those without a bank account, as pay cards provide an easy way for workers to access their wages. In addition, pay cards can come with additional benefits such as online bill pay, mobile banking, cashback rewards, and more.

- Option to pay for purchases via payroll deduction

An "employee purchasing program" provides a convenient way for workers to buy and pay for certain goods and services. The most common use of this program is for workers to pay for health insurance. However, these programs can be leveraged for much more.

By offering the option to pay for certain purchases via payroll deduction, workers have an alternative to utilizing a credit card to make the same purchase. Most programs are offered interest-free, which can be a great alternative to dealing with high-interest payments on a credit card.

- Receive pay in cryptocurrency

Cryptocurrency has gained significant interest in recent years, and some employees are seeking ways to receive their wages in such a form. The value of cryptocurrency fluctuates over time, so individuals can earn additional profits on their paychecks if the value trends upward. If a worker wishes to make an investment in cryptocurrency, this is a great way to offer them the opportunity.

What Other Businesses are Doing

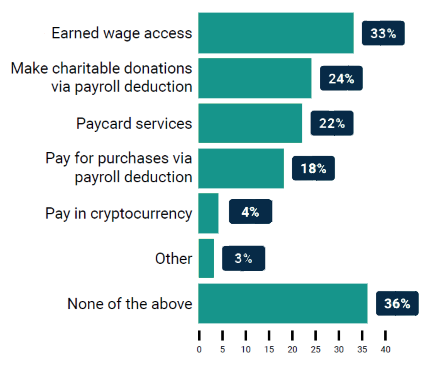

In the Payroll Security, Regulation, and Innovation Survey 2022, participants were asked about their organization's current use of payroll add-ons. When asked, "which payroll-related add-ons does your organization currently offer employees?" the most popular response was Earned Wage Access with 33%. Only about a third of respondents indicated their organization is not currently utilizing any form of payroll add-on, emphasizing the trend towards leveraging payroll for so much more.

In Conclusion

Attracting and retaining the right talent can be a challenge for any organization. It is advantageous for businesses to explore the opportunities that exist within their current systems to offer additional benefits to their workers. Payroll, first and foremost, is about getting people paid, but the opportunities that exist beyond that are immeasurable.