In recent years, payroll professionals like you have faced numerous challenges – pandemic policies, labor shortages, and changing regulations, to name a few. There is no sign of relief either. Payroll gets increasingly complex year after year, and the burden is on organizations to keep up with it all.

The HR Research Institute and Greenshades established the Payroll Security, Regulation, and Innovation Survey in 2022 to study the challenges of payroll and compliance that plagued businesses in 2022 and the challenges they may continue to face in the new year.

Results of the survey revealed that organizations face three significant challenges as the new year begins.

- Compliance is moderately challenging and time-consuming for any company.

- Payroll processing is increasingly complex as working environments evolve.

- Security breaches pose a considerable risk to an organization's overall business operations.

However, businesses have ample opportunity to improve or combat some or all of these challenges, with growing automation capabilities and quality payroll partners to support their efforts.

Overview of the Research

The study ran in the third quarter of 2022 and focused on how remote work, security breaches, fast-changing regulations, and continuous innovations have made payroll more complex. Although most were from North America, HR professionals from around the globe participated in the study. With 233 responses total, the study gathered answers from employees working for a wide range of businesses, from small businesses with fewer than 100 employees to enterprises with 20,000+ employees.

Watch the Remote Work, Security Breaches and More: Why Payroll and Compliance Just Got Harder Webinar Recap

Top 3 Payroll, HR, & Tax Challenges Facing Businesses

- Managing Compliance

Organizations are responsible for maintaining payroll and tax compliance throughout their operations, which means adhering to all federal, state, and local regulations that dictate how employees are paid.

At both the national and local levels, tax policies can change frequently. As these regulations become increasingly complex, accurately running payroll can become a larger and larger challenge.

Keeping pace with these changes is critical to accuracy, completeness, and compliance. As such, businesses must put significant effort into staying up to date with the latest rules. Almost half of our survey responders indicated that compliance is a core focus of their business operations.

However, focusing on compliance and having the necessary resources to succeed are very different. Only about two-thirds of organizations agree or strongly agree that they have all the tools and expertise to manage compliance.

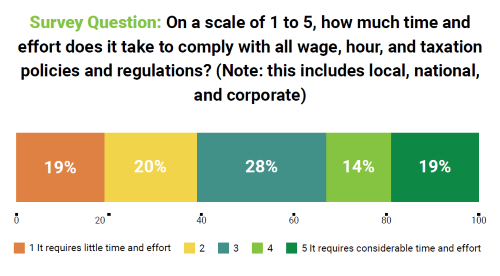

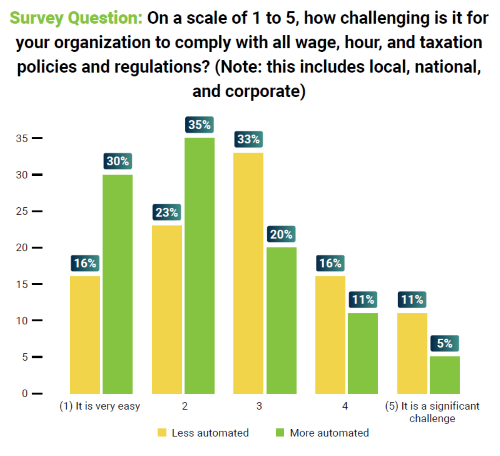

Regardless, organizations must meet all requirements or face penalties. Unfortunately, about a third of respondents say that complying with all wage, hour, and taxation policies and regulations requires substantial time and effort in their organization, which can take focus away from bigger operational concerns or the company's growth.

- Over half of organizations ranked compliance as a 3, 4, or 5 (with 5 being “significantly challenging”)

- 61% of organizations indicated the effort to comply as a 3, 4, or 5 (with 5 being “takes considerable time and effort”)

- Remote work

The COVID-19 pandemic had a drastic effect on working environments. One of the most prominent changes was the increase in remote work. Employees took advantage of work-from-home policies to move closer to family, try out a new city, or travel more overall.

Even though the world has returned to on-site work, many organizations kept remote-work policies to some degree. A large majority of survey respondents, 84%, said that some or all employees could work remotely at least some of the time.

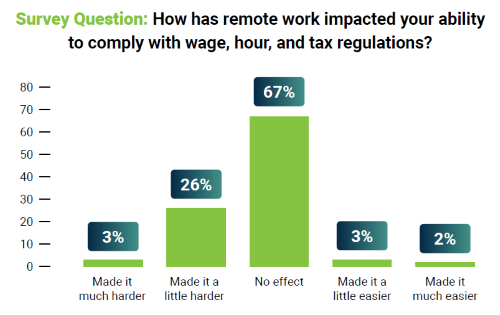

Although many employees enjoy the perks of remote work, it can often strain payroll operations. Regulations regarding payroll taxation vary widely from state to state and even at local levels, making where employees live and work more important than ever.

Nearly 30% of organizations said remote work has made it harder to comply with wage, hour, and tax regulations, as having any number of remote workers poses additional challenges for organizations. Companies with no remote workers are twice as likely to find compliance very easy compared to companies where all workers are remote at least some of the time.

- Security Breaches

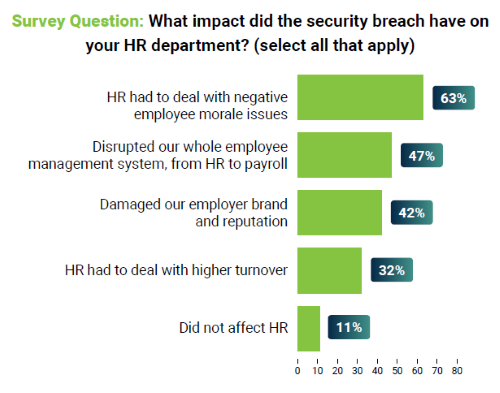

In the past two years, 13% of organizations that responded to the survey indicated they were impacted by attendance, schedule, and/or payroll system security breaches. While thirteen percent may seem like a low number, the consequences of these breaches were significant, as almost half said their teams experienced a major disruption to their services. Only 15% said they were able to handle the breach with ease.

The Impact of a Breach

Repercussions from a security incident can extend far and wide.

- On the employee side, morale can be drastically affected. Nearly a third of organizations that experienced a breach stated that the incident led to higher turnover.

- On the HR side, payroll processes can get tedious. If the team must shift to manual pay runs or paper documentation, the chance for errors increases drastically. Organizations with an automated or outsourced approach to payroll may feel the effects even more.

- On the business side, a company can suffer a hit to its reputation. Our survey revealed that 42% of those who had security breaches experienced a decline in their brand's favor.

Top 3 Potential Strategies to Combat Payroll, HR, & Tax Challenges

- Automated Systems

Tackling the challenges of compliance can be a significant burden on businesses. Only 16% of organizations disagree or strongly disagree that they have the tools and expertise necessary to manage compliance.

For those organizations that feel unequipped and need help with compliance, automation provides significant promise for easing that burden. Organizations with more highly automated systems are:

- Almost four times more likely to say that compliance takes little time and effort

- Almost two times more likely to say that they do an above-average job of tracking regulatory changes

In general, automation is strongly associated with easier compliance.

- Updating Policies and Procedures

When a security breach happens, organizations first need to put out the fire. Then they can focus on repairing some of the damage. According to our survey, many organizations respond to security breaches with improved training and policies.

Nearly three-fourths of those who faced security breaches in the past two years responded by improving worker training and preparedness. Many companies focused on reviewing internal policies and those of providers supporting their day-to-day operations.

To make improvements to their security systems, many organizations made significant changes.

- 67% changed security policies

- 44% changed payroll providers

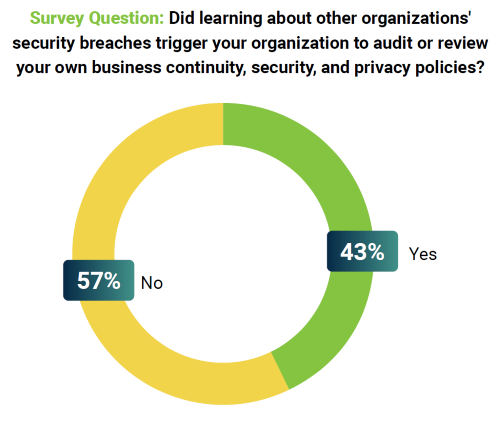

Even though most of our survey respondents did not experience a major security breach at their company, many indicated that learning about another organization's incident led to an audit or review of their own security.

Being proactive can be advantageous for a business's operations. Fewer than a third of the less secure organizations reviewed their policies when they learned about security breaches at other companies. By not acting, these organizations faced an increased likelihood of experiencing a security breach of their own.

- A Good Partner

Handling these challenges in-house may pose a significant challenge for many organizations. Performing security reviews and setting up automated payroll and tax processes may take more resources than a company has readily available.

Finding a partner to provide those resources is the key to getting there. The right payroll provider should be able to monitor regulatory changes, update policies and procedures, and adjust when changes occur.

With additional support, organizations should feel prepared to set up automation for some of their processes. Automation can be a game-changer for many businesses, but the process can be time-consuming to ensure efficiency and accuracy.

Overall, organizations must be diligent when selecting a partner for the job. The right partner will provide the tools, support, and solutions to take business operations to the next level.

Learn More

Payroll is getting increasingly complex year after year and will continue to do so in the future. Even though organizations face multiple operational challenges, there are ways to combat those challenges with technology.

Read more about the state of payroll issues and what other organizations are doing to handle each challenge in the Payroll Security, Regulation, and Innovation Survey 2022 research report.