We concluded our Year-End webinar series with the 'Year Round Strategies for Year End Filing' webinar. Hosted by Greenshades experts Amber Manual and Hannah Walk, who provided helpful tips and best practices for payroll management to make year-end filing a breeze.

View the webinar replay here:

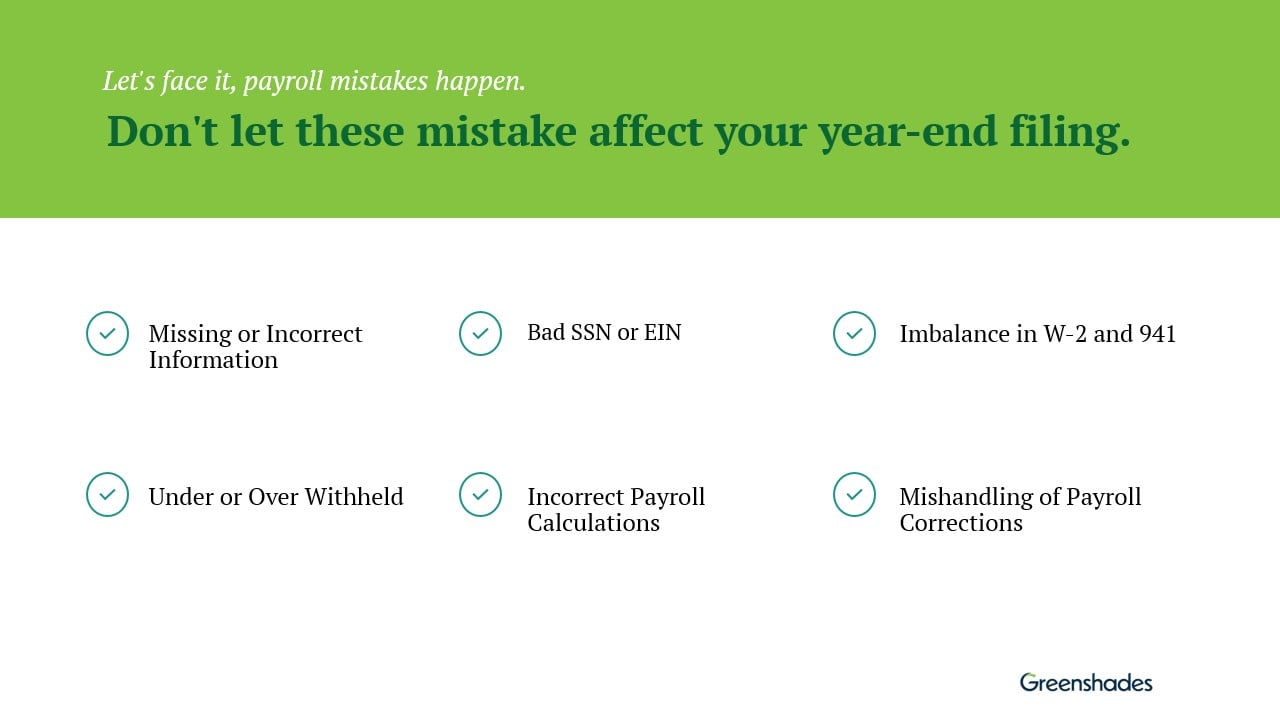

Common Payroll Pitfalls

Our webinar kicked off by identifying frequent payroll errors. It's critical that if issues arise, you address them promptly, informing both the affected employees and relevant agencies.

1. Take Action Before Payroll

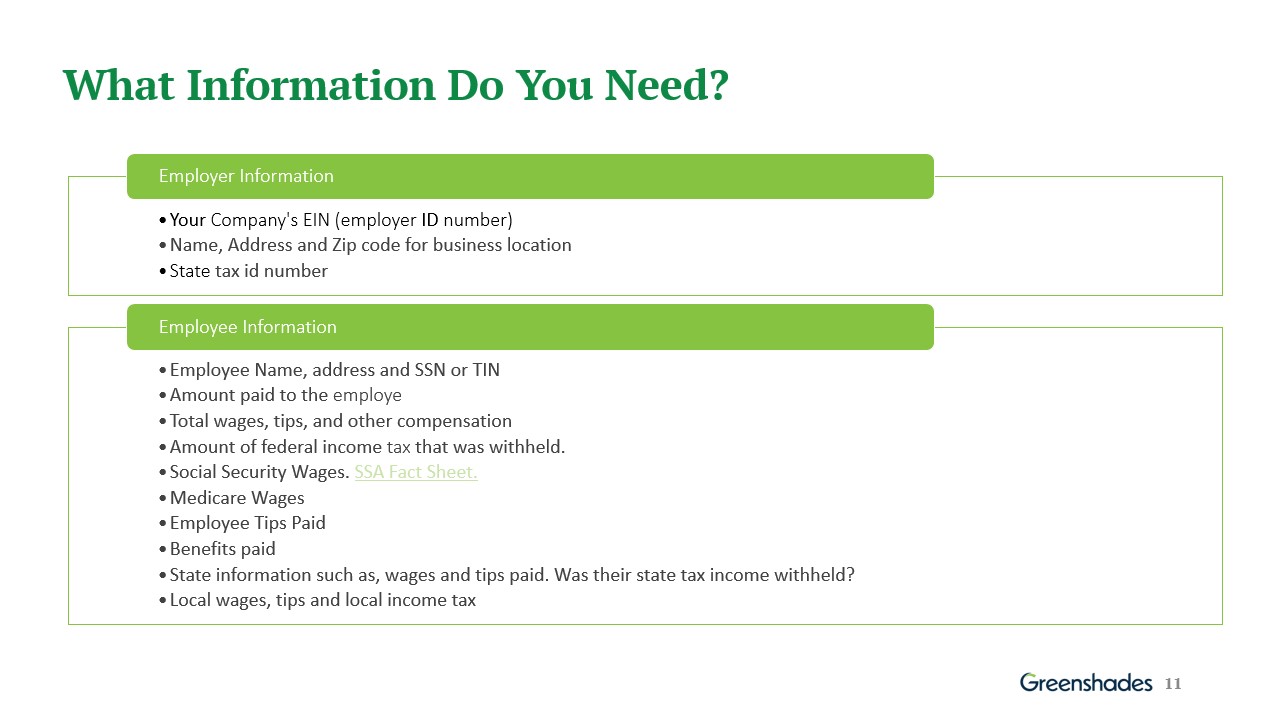

We walked through actionable steps you can take from day one to allow for seamless filing. Effective payroll management begins with proper onboarding. Providing employees with access to a self-service portal is essential for maintaining up-to-date personal information, such as SSNs and addresses, to minimize filing rejections.

2. Keep Accurate Payroll Records

Accurate record-keeping is vital for compliance and resolving discrepancies, especially during year-end.

- Conduct review after each pay run to identify and rectify errors early.

- Cancel and reprocess payroll for affected employees upon detecting errors.

- Notify relevant parties, including government agencies if necessary.

- Maintain detailed records and run reports to track amendments.

3. Maintain Compliance Year Round

It is important to stay on top of compliance changes in calculating tax withholdings. Incorrect calculations of overtime are a common pitfall to keep an eye on. We also discussed the importance of reporting all taxable income, and ensuring it entered correctly.

- Generally, all income is taxable

- Correctly classify employees and file the correct form

- Most income you earn is reported to the government on year-end forms

- Mismatched income may lead to issues later

It is key to stay on top of compliance changes in calculating tax withholdings. Incorrect calculations of overtime are a common pitfall to keep an eye on. Another key point is to be sure to regularly update W-4 forms, especially after significant life changes, this is crucial to avoid tax issues. The session also covered adherence to FLSA guidelines, accurate tax withholdings, ADEA payroll record-keeping, garnishment payments, and meeting critical deadlines.

4. Leverage Technology for Payroll Management

Leveraging technology in payroll management is a helpful tool for year-round efficiency. Automation, compliance checks, and streamlined integration with year-end form software are instrumental in ensuring successful payroll operations. Be sure to partner with a solution that can handle your unique payroll requirements.

Comprehensive Overview and Support

"Year Round Strategies for Year End Filing" provided tips to help you manage the payroll process to ensure a stress-free filing season. Emphasizing the importance of accuracy and compliance, Greenshades payroll, HR, and tax solution streamlines payroll processing, helps to ensure compliance and minimizes errors, regardless of the complexities involved.

For more insights on how Greenshades can assist your team with payroll processing and filing year-end forms, visit our website.

Q&A

Withholding FICA for F1 Student Visa: We advise seeking guidance from a legal professional to ensure you're taking the correct approach.