Introduction

Greenshades hosted the webinar "Unraveling Year-End Reporting: A Comprehensive Employer's Guide to W-2 and 1099 Forms", led by tax product managers Hannah Walk and Alisha Rocks. This webinar provided insights into W-2, 1099, 1095-C, and other essential forms. It emphasized the importance of timely and accurate returns and how Greenshades streamlines this process.

Watch the On-Demand Webinar here:

Avoiding the Nuances of Payroll and Tax Form Preparation

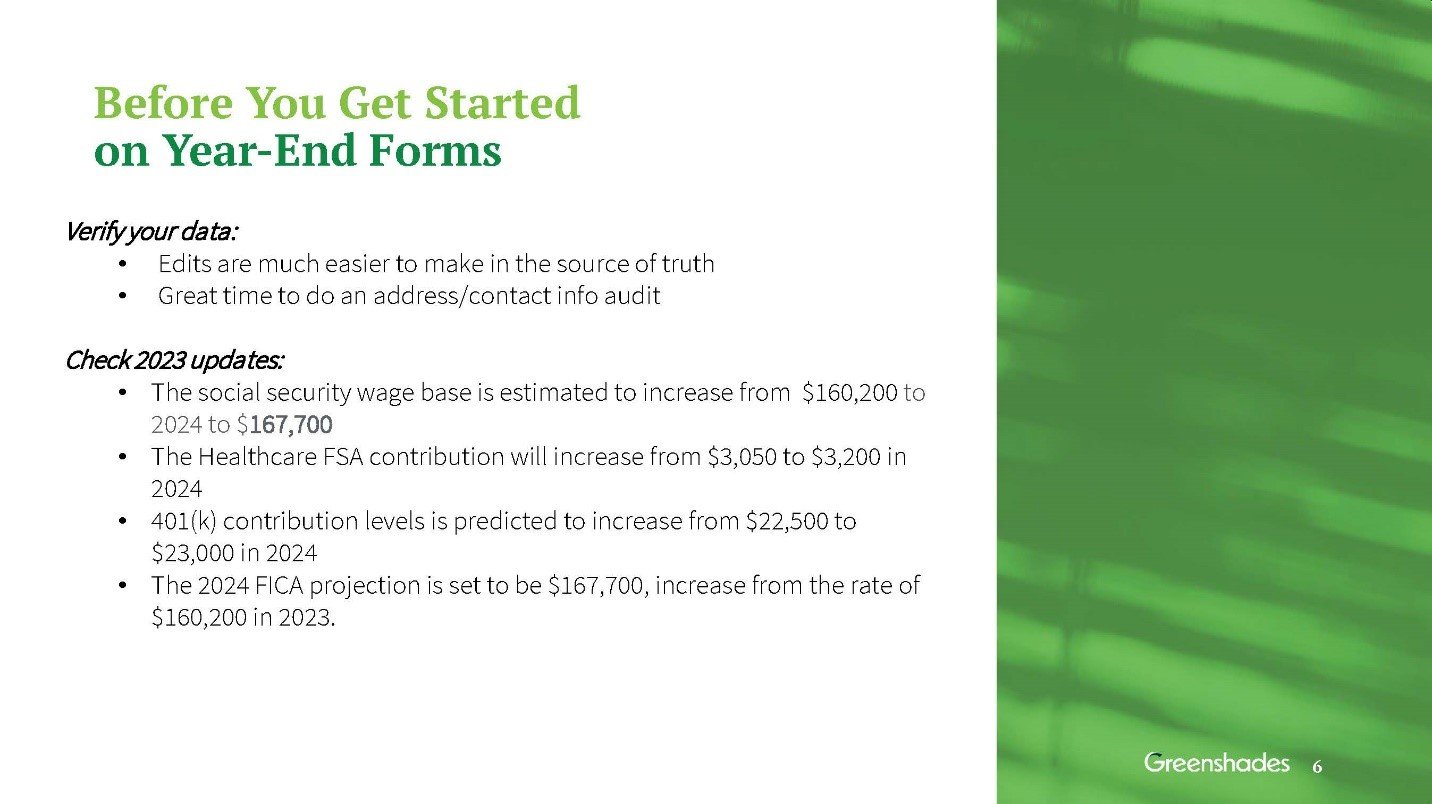

The webinar focused on preliminary data verification, highlighting the value of making corrections early on. Reviewing and verifying key details like addresses, contact information, and totals at this stage helps avoid issues like returned mail or data discrepancies. Confirming updated employee data is crucial to avoid complications.

The webinar explained the importance of reviewing imputed income categories like group-term life insurance, educational assistance, and dependent care benefits. We also overviewed 2023 updates like shifts in the social security wage base and adjustments to Healthcare FSA and 401(k) contributions.

Deep Dive into Form W-2, 1099, and 1095-C

A deep dive into W-2 forms revealed their vital role in reporting employee earnings and why timely distribution is imperative. We also covered specifics of forms like W-2G, W-2GU, and W-2PR. Emphasizing the January 31st W-2 deadline ensures employees can complete their own tax filings by April 15th.

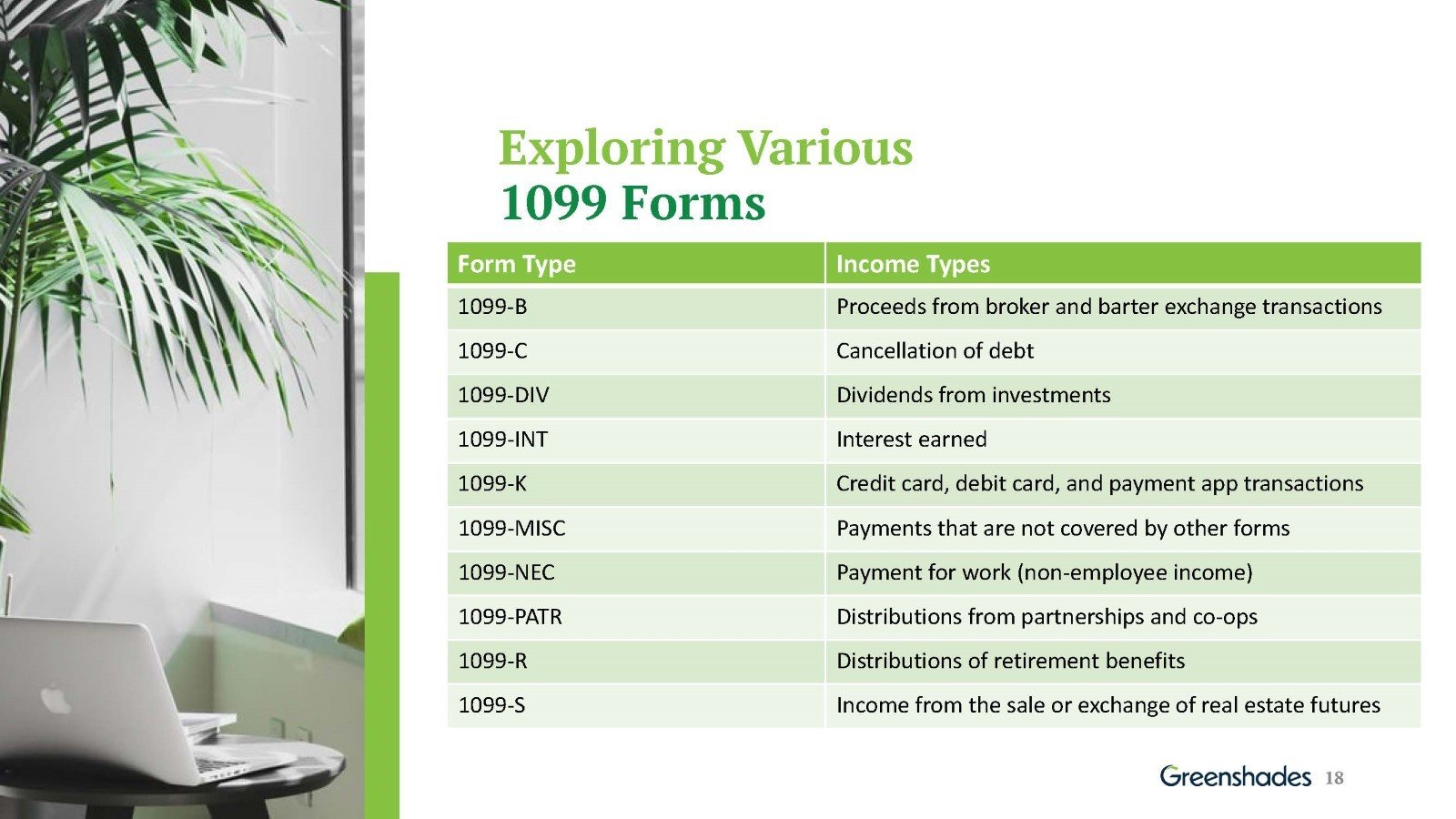

We tackled the intricacies of 1099 forms, focusing on the 1099-DIV, 1099-MISC, and 1099-NEC. We also highlighted key 1095-C deadlines: recipient copies due by March 4, 2024, paper returns by February 28, 2024, and e-filed versions by April 1, 2024.

The Value of Year-End Form Software

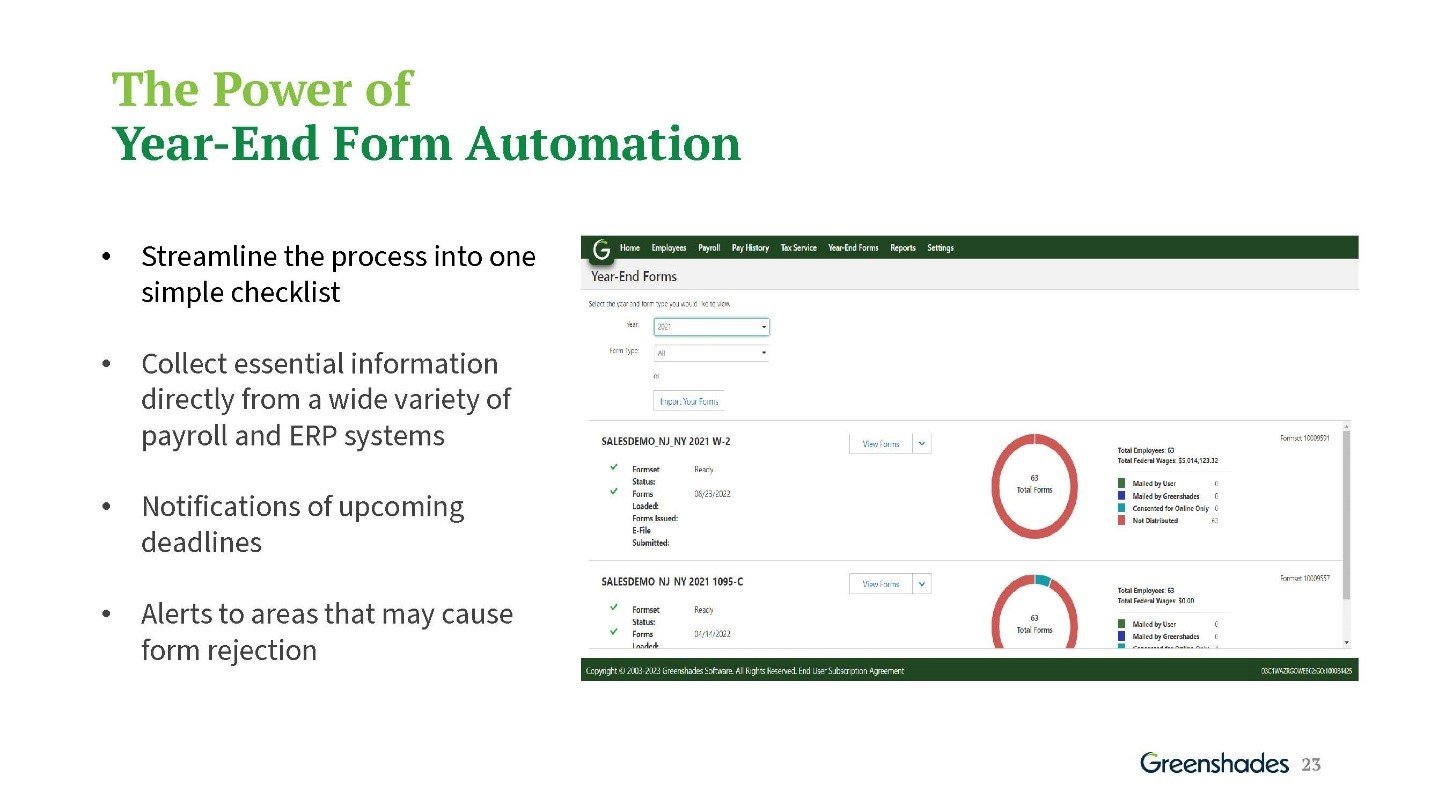

The webinar also explained the capabilities of tax software like Greenshades for streamlining the filing process. Features like deadline alerts, rejection notifications, SSN and TIN verifications, and automated form distribution are invaluable.

Starting in January 2024, companies submitting over 10 information returns (like 1099, 1095-C, and 1042-S) must file electronically. Reviewing your filing strategy and considering a technology provider can ensure an efficient process.

The webinar concluded by highlighting the efficiency of electronic distribution, like integration with TurboTax, for seamless employee W-2 data imports. It also covered the convenience of 24/7 access through the employee portal and timely returns during economic uncertainty.

Key Takeaways

Unraveling the complexity of year-end forms doesn't have to be a complicated process. When you understand these key points, your year-end process can be stress-free.

- Understand Year-End Forms: Determine the correct forms you must file and stay on top of critical filing deadlines.

- Utilize Technology to Automate the Process: Reduce the risk of errors and save time for your team by partnering with an expert year-end technology.

- Avoid Compliance Errors: Ensure forms on timely and accurate to avoid fines and penalties for your organization, and to allows you employees time to file 1040.

Contact Greenshades today to make your year-end forms season a breeze. Our team is ready to help show you how our cloud-based solutions can help you ensure compliance and give valuable time back to your team. Take advantage of Greenshades Year-End Forms and connect with our experts today.