Introduction

Are you prepared for new e-filing requirements for year-end forms? Dive into Greenshades' third installment in the Year-End series, “Strategies for Successful Electronic Filing and Distribution," featuring resident tax expert John Osberger.

Watch the On-Demand Webinar here:

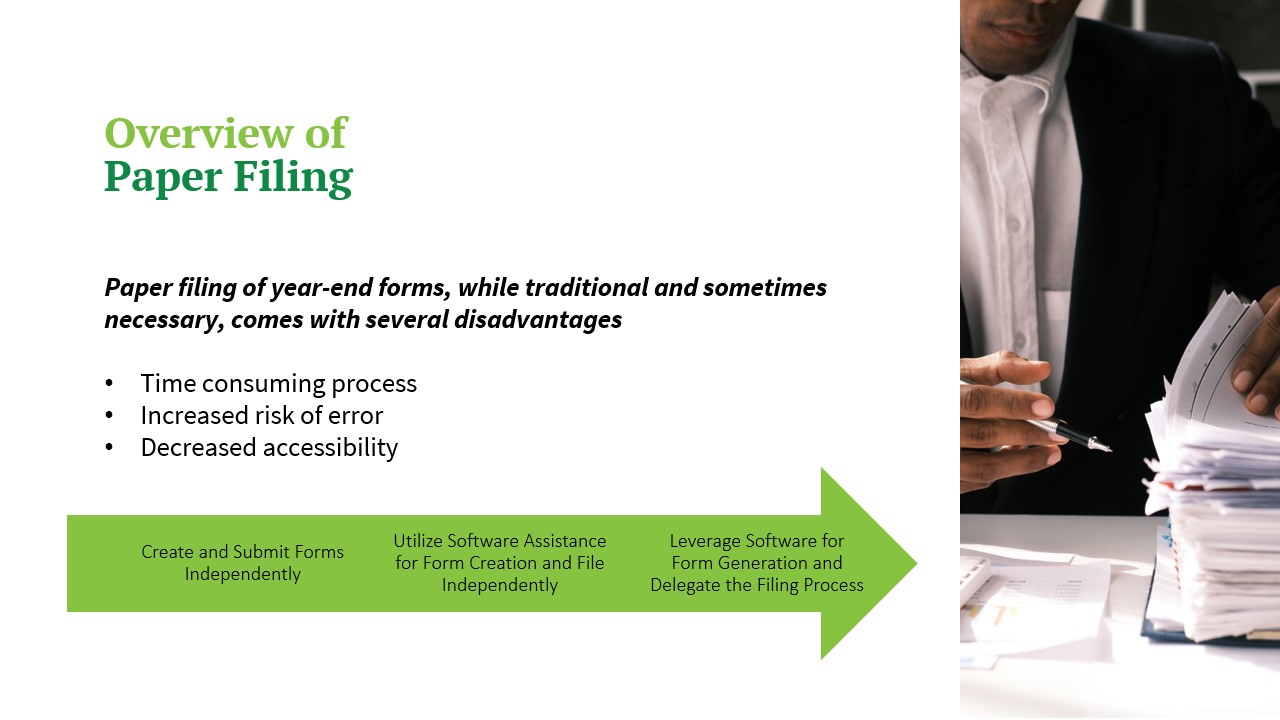

Overview of Paper Filing

Paper filing of year-end forms is the traditional filing method, it comes with several disadvantages and soon may not be an option for many organizations with new e-filing requirements. Continue below for more details about the upcoming change.

- Time consuming process

- Increased risk of error

- Decreased accessibility

Explore options for distributing forms by print and mail utilizing a vendor to reduce administrative burden.

The Evolution of Year-End Form Submission

John Osberger delved into the changes affecting this year's filing season. From January 2024, entities issuing more than 10 information returns, such as 1099, 1095-C, or 1042-S forms, will be required to adopt e-filing methods. It's crucial to reassess your current filing practices and consider embracing advanced technologies to enhance efficiency.

The new 1099 Information Return Intake System (IRIS) is designed to streamline the submission of 1099 forms, aligning with the latest e-filing requirements.

Please note: Obtaining a Transmitter Control Code (TCC) is essential for using this portal unless you partner with an affiliate like Greenshades.

The Advantages of Electronic Filing

John then explored the benefits of electronic filing, which allows for either independent submission of forms or filing via a service provider. The growing preference for e-filing year-end forms is clear, given its numerous benefits and the updates to e-filing requirements:

- Quick and efficient processing

- Accessible from anywhere, at any time

- Immediate confirmation of submission

- Enhanced compliance with regulations

- Simplified record-keeping

He also emphasized broadening your digital capabilities to include not just e-filing but also electronic distribution to employees. Choosing e-filing is a significant step towards reducing the environmental footprint during the year-end filing period.

Key Insights

With the shift towards e-filing requirements, it's more important than ever to evaluate your filing strategies:

- Despite the shift towards e-filing, paper filing remains an option for now. Assess if it's still viable for your organization.

- E-filing's popularity is on the rise. If you're new to e-filing, you don't have to navigate it alone. Seek out support from software solutions like Greenshades.

- Stay ahead of the latest updates for year-end forms, including both federal and state-level changes.

Need assistance with year-end forms? Contact Greenshades today. Discover how our year-end, tax and cloud solutions can support your e-filing requirements.

Q&A

Pricing for Filing and Distribution: The cost will vary based on the specific needs of your organization. For a detailed discussion, contact us today!

When to Start on Your Returns with Greenshades: The Payroll Tax and Year-End forms portal are open once the respective reporting windows open.

→ Click here to download Slide Deck PDF version