In our recent webinar, we explored the critical links between payroll, time tracking, and project accounting that impact business operations. Presenters Brian Maxin, Director of Sales at Journyx, and Chris Hadden, Vice President Revenue Strategy & Operations at Greenshades, discussed best practices and solutions to improve profitability and increase business success with project accounting.

Introduction

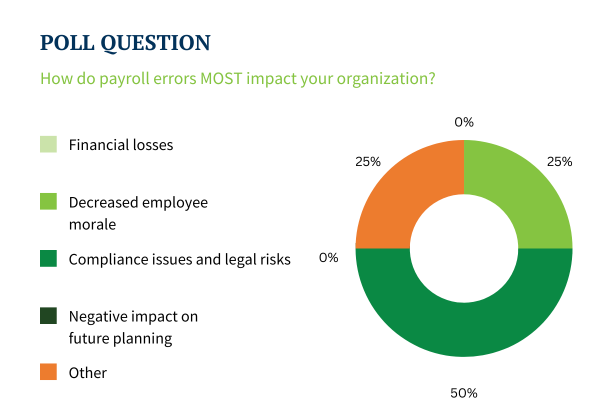

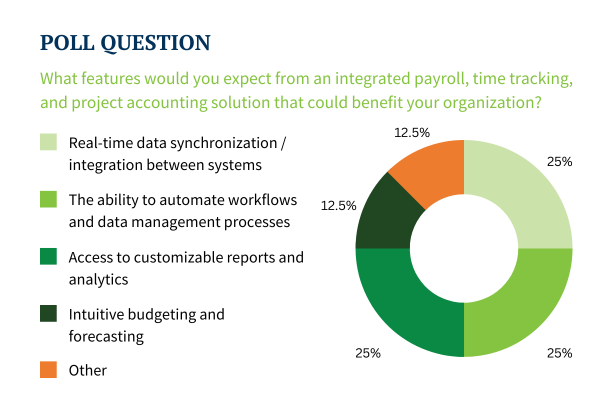

In today's interconnected business landscape, the link between time, payroll, and project accounting creates a profound impact known as the snowball effect. Time and attendance data directly influence payroll, which in turn, can significantly impact project accounting. Recognizing this connection is vital, especially considering the potential costs incurred due to a single type of error.

However, there is also an extraordinary opportunity for organizational success when high-quality data is utilized across these critical business processes. High-quality data gives businesses the tools to gain better tracking, improve reporting, heighten productivity, and overall increase profitability.

Thus, ensuring complete and accurate time and attendance data, coupled with precise and high-quality payroll processing, becomes imperative. Embracing these practices empowers organizations to unlock the full potential of cost and project accounting, optimizing operations and driving the path to success.

1. Ensuring Accurate Payroll

Accurate payroll is not just about paying employees correctly; it plays a pivotal role in upholding the financial integrity of your business for the long term. It is a cornerstone of organizational success, as it ensures precise employee compensation, boosts morale, and fosters a positive work environment.

To achieve a high level of accuracy, implementing the following best practices is essential:

- Consolidate payroll-related data

- Keep employee records up to date

- Complete payroll reconciliations regularly

- Ensure compliance with labor laws

- Reduce manual entry

- Integrate payroll with your time tracking system

By adopting these best practices, companies can significantly reduce errors, enhance accuracy, and ensure that their employees are compensated correctly, ultimately contributing to a more successful and thriving organization.

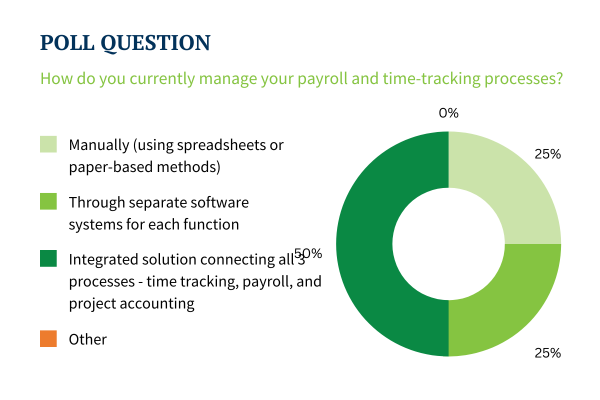

2. Integrating Time Tracking

Time tracking and payroll are intrinsically linked, and a single flaw in the time tracking process can lead to inaccuracies in reporting, compliance issues, budgeting challenges, and potential setbacks for the organization's future. An effective integration provides up-to-date and accurate information for payroll processing, minimizing delays and ensuring that employee hours are correctly allocated.

To achieve successful integration, consider the following best practices:

- Implement a centralized time tracking system

- Synchronize data with the payroll system in real-time

- Implement automated workflows

- Conduct regular data audits

- Empower employees with a self-service portal

- Integrate time tracking with project accounting tools

By following these best practices, organizations can establish a seamless connection between time tracking and payroll, resulting in accurate payroll calculations, improved reporting, enhanced compliance, and increased confidence in the organization's future endeavors.

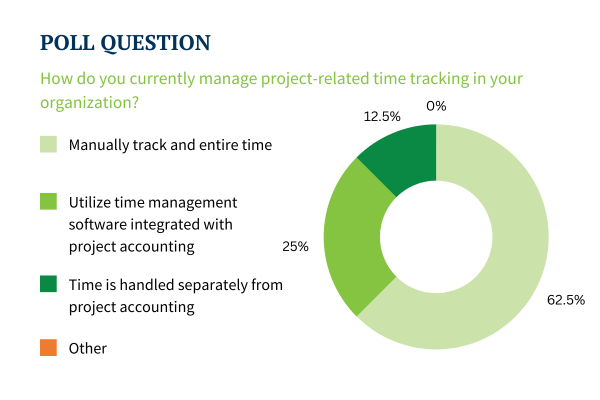

3. Leveraging Project Accounting

Accurate time tracking not only ensures precise payroll data but also becomes the foundation for valuable insights and strategic planning. With reliable data, your team gains the ability to leverage project accounting, setting up your organization for future success and increased profitability.

To fully harness the advantages of project accounting, consider implementing the following best practices:

- Utilize a robust project accounting system

- Clearly define scope and goals

- Conduct regular financial reviews

- Standardize labor codes

- Track time and expenses accurately

- Integrate with other financial systems

By adhering to these best practices, organizations can optimize their project accounting processes, improve financial visibility, make informed decisions, and elevate the overall success of their projects, ultimately paving the way for enhanced profitability and sustainable growth.

Journyx and Greenshades Demo

The webinar conclused with a demonstration of the partnership between Greenshades and Journyx. Watch the full webinar to view the demo and discover more information about these expert tips for recession-proofing payroll and project accounting.