Introduction

In a recent live webinar, "Payroll Compliance in the Digital Age," two industry experts from Greenshades Software, Jerika Holton and Amber Manuel, explored the world of payroll compliance and how organizations are making the transition from manual to automated processes. Let's dive into the key takeaways from this session.

Watch the On-Demand Webinar here:

Common Misconceptions About Automation

As we embrace automated payroll compliance, it's essential to address some common misconceptions about automation. These misunderstandings often hinder organizations from fully utilizing all the benefits automated processes have to offer.

- Fear of Job Loss

One significant misconception is the fear of job loss due to automation. However, it's important to emphasize that automation is not about eliminating jobs but about enhancing efficiency. By automating routine and repetitive tasks, employees can focus on more meaningful and strategic aspects of their roles. Automation is here to augment human capabilities, not replace them.

- Lack of Flexibility

Some may think that automation systems are rigid and one-size-fits-all. In reality, modern automation tools are highly adaptable and configurable to meet your organization's specific needs. Whether you have unique compliance requirements, multi-state operations, or complex payroll structures, automation can be tailored to suit your circumstances.

- Costly Implementation

The idea that implementing automation is prohibitively expensive is another misconception. While there may be upfront costs associated with adopting automation technology, the long-term benefits often far outweigh these initial expenses.

- Increased Complexity

Contrary to the belief that automation complicates processes, it actually simplifies them. Automation systems are designed to handle complex calculations and compliance rules seamlessly. They reduce the potential for errors that can occur with manual data entry and calculations, making payroll compliance smoother and more efficient.

- Concerns About Updates

Some organizations worry about keeping up with compliance changes when using automation. However, the opposite is true. Automated systems are equipped to track and incorporate updates promptly.

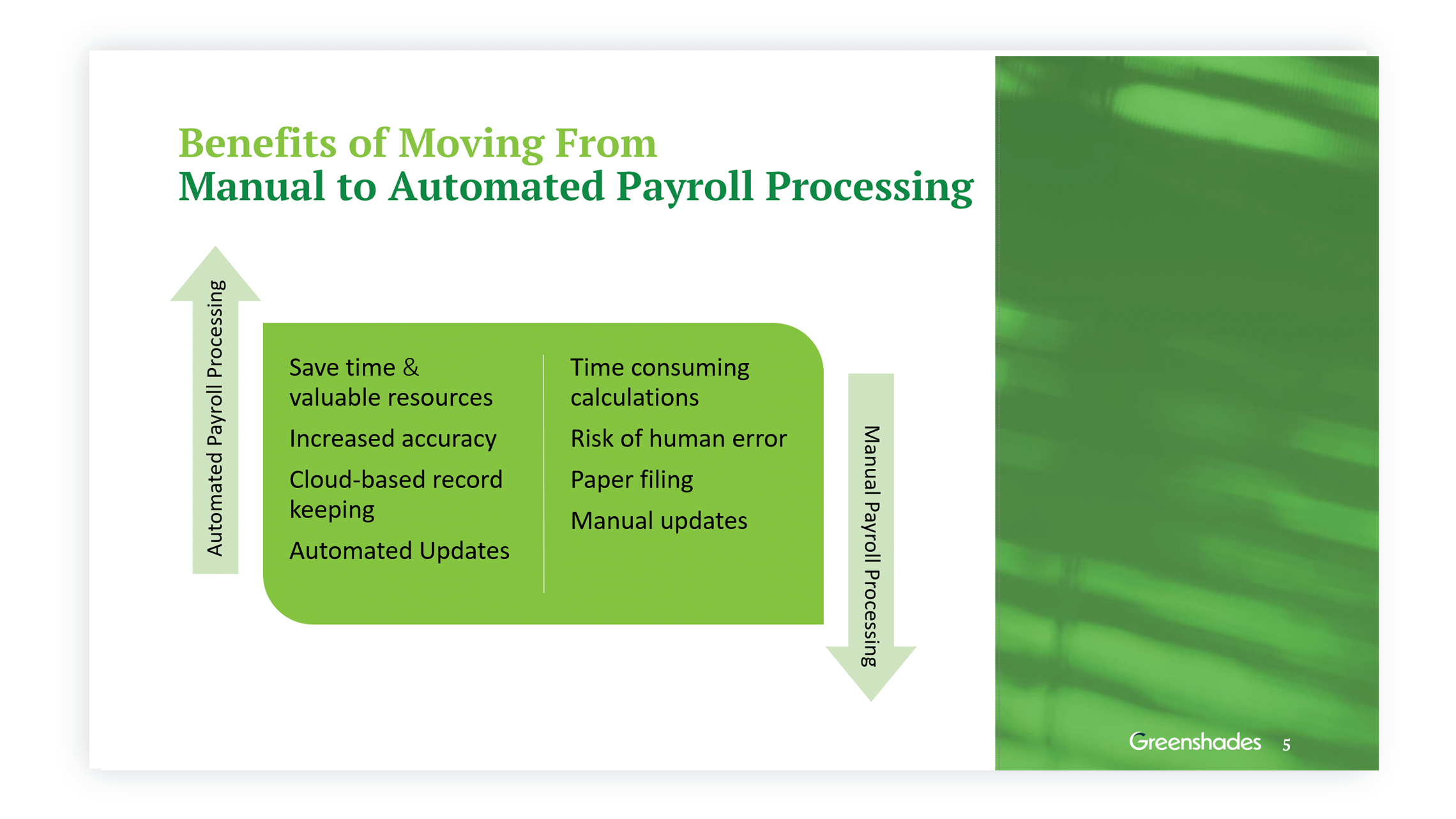

Advantages of Automation

Now that we've debunked common misconceptions about automation, let's explore the numerous advantages it offers.

- Productivity Enhancement

Automation significantly boosts productivity. It eliminates the need for repetitive, time-consuming tasks, allowing your team to allocate their time to more valuable, strategic activities. In essence, automation empowers your employees to be more productive and efficient in their roles.

- Error Reduction

One of the most significant benefits of automation is its ability to reduce errors. Automated systems are meticulous in their calculations and data handling, minimizing the risk of costly mistakes in payroll processing. This not only ensures accurate payments but also enhances employee satisfaction.

- Built-in Compliance

Automation systems come equipped with built-in compliance rules. They constantly monitor your payroll processes, alerting you to potential compliance issues before problems arise. This proactive approach ensures that your organization remains compliant with changing regulations, reducing the risk of costly fines and penalties.

- Cost Savings

The time saved through automation directly translates into cost savings. By streamlining payroll processes, automation reduces the hours spent on manual data entry and calculations. These cost savings can be reinvested into other critical areas of your organization.

- Reduced Administrative Burden

Automation simplifies and streamlines administrative tasks, reducing the burden on your HR and payroll teams. This not only improves efficiency but also enhances job satisfaction among your employees, allowing them to focus on more rewarding aspects of their roles.

2023 Payroll Compliance Updates

Jerika and Amber provided insights into some recent and upcoming payroll compliance updates, including changes in minimum wage requirements, location-specific updates, and forecasts for 2024.

Recent Changes in Minimum Wage

- Oregon: Increased to $14.20 from $13.50, with variations based on location.

- Washington DC: Set at $17 per hour, the highest in the United States.

- Nevada: Increased to $11.25 or $10.25, depending on health plans.

- Stay Informed: Keep track of minimum wage changes, as they vary by state.

Location-Specific Updates

- Indiana: Increased dependent exception for first-time dependents.

- Illinois: Updated individual income tax personal allowance exception.

- Nevada: Requirement for earned wage access licensing.

- Washington: New lump sum reporting requirements.

2024 and Beyond

- Social Security wage base: Set to increase to $167,700 in 2024.

- Healthcare FSA contribution: Rising to $3,200 in 2024.

- 401k contribution levels: Predicted to increase to $23,000 in 2024.

- FICA projection: Expected to rise to $160,200 in 2024.

- Proposed overtime updates by the Department of Labor.

HR Compliance Beyond Payroll

Payroll compliance doesn't stop at processing paychecks; it extends to various HR aspects. The following considerations were highlighted:

- Onboarding Efficiency

One of the key takeaways from the webinar was the significance of efficient onboarding processes. Jerika and Amber emphasized that automation plays a pivotal role in this aspect. With the right automated system, collecting essential documents such as W-4s and I-9s from new hires becomes a breeze. This not only streamlines the onboarding process but also ensures that HR teams are equipped to handle compliance from day one.

- Employee Classification Simplified

Accurate employee classification is paramount for tax withholding and reporting. Our experts highlighted the importance of automation in managing this aspect effectively. By utilizing automated systems, you can classify employees accurately and ensure that taxation aligns with their status. It's a critical step in avoiding compliance pitfalls.

- ACA Compliance Made Easy

The Affordable Care Act (ACA) compliance can be a daunting task for employers, particularly those with over 50 employees. Automation simplifies ACA tracking and reporting. With automated alerts and monitoring, you can ensure proper coverage, complete year-end reporting, and navigate this complex compliance landscape with confidence.

- Cloud-Based Record Keeping

HR compliance extends to maintaining employee records. The Equal Employment Opportunity Commission (EEOC) mandates that these records are kept for at least one year. Our speakers emphasized that automated systems provide efficient cloud-based record keeping, ensuring compliance with these regulations.

- Managing Certifications and Licenses

Certain positions require employees to hold specific licenses or certifications. Tracking these documents is crucial to HR compliance. Jerika and Amber discussed how automation can assist in managing certifications and licenses, sending alerts for expirations, and ensuring that employees remain qualified for their roles.

Conclusion and Next Steps

Automation is critical for streamlining payroll and ensuring compliance in today's digital landscape. To learn how Greenshades' solutions can benefit your organization, schedule a personalized consultation with our payroll experts.

Contact Greenshades today to discuss how automation can drive productivity, minimize errors, and keep your organization compliant. Our team is ready to evaluate your processes and provide customized solutions to take your payroll capabilities to the next level. Seize this opportunity to connect with our experts and propel your organization forward.