Table of Contents:

In a world where the value of work is often dictated by the hours put in, imagine a scenario where compensation is based on the quantity and quality of a worker’s output. For many organizations – particularly those in manufacturing, assembly, transportation, and other similar trades – compensation tied to piecework is an increasingly attractive option.

Let’s explore the dynamics of piecework, including the advantages, challenges, and opportunities to understand if piecework is right for your company.

What is Piecework?

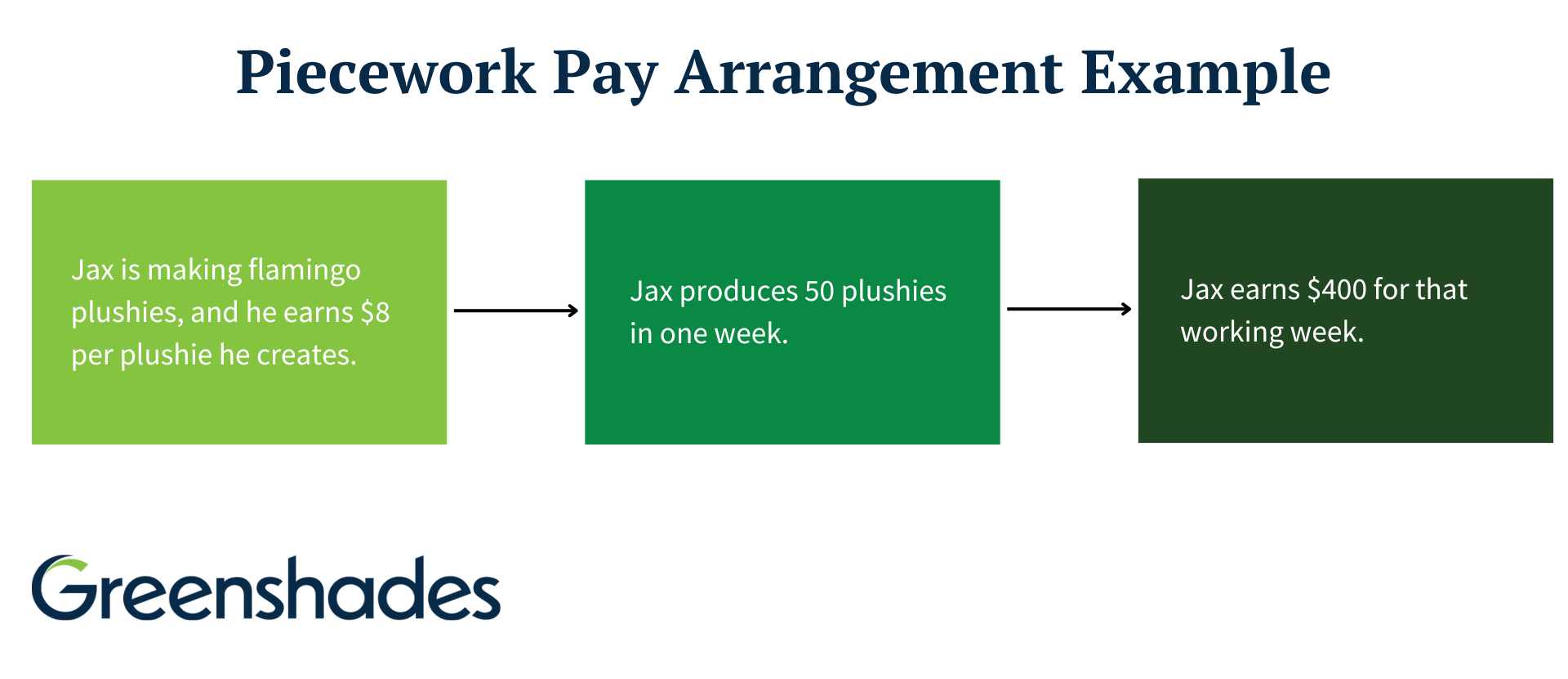

Piecework is the practice of paying workers based on tasks completed, units produced, or other similar quantitative measures. It’s not a new practice, but it is a compelling tool employers can use to incentivize high productivity. At the same time, workers enjoy greater direct control of their compensation.

The Pros and Cons of Piecework Payroll

The Advantages

- Direct Correlation Between Effort and Earnings: Employees' compensation is directly tied to their output. The greater the quantity or complexity of the items they create, the higher the compensation, ensuring that they are justly rewarded for your dedication and hard work.

- Enhanced Efficiency and Skill Development: This model motivates employees to work more efficiently, fostering personal growth as they grow their skill set. This also benefits the employer by encouraging a more productive work environment.

- Control Over Labor Costs: Piecework gives employers better control over labor costs because all payments are for actual production, which can help manage budgets effectively.

The Challenges

- Balancing Quantity and Quality: The emphasis on production quantity may lead to a prioritization of quantity over quality. Organizations must emphasize the importance of maintaining standards for quality.

- Complexities in Payroll Calculation: Piecework can present challenges in terms of pay calculation, both for employers and employees. Employing a payroll system that can automate administrative processes and provide employees with an easy-to-follow breakdown of their earnings on their paystubs can simplify the process for all parties involved.

- Managing Employee Stress: The stress of meeting production goals can lead to employee burnout. Employers can alleviate this by offering mental health assistance, providing paid time off (PTO), and fostering improved communication between employees and managers.

Is Piecework Right for Your Company?

If you think piecework might be a good option for your company, or if you’re currently paying employees using this methodology and would like to automate the process, there are a couple of critical factors to keep in mind:

Ensuring Compliance with Regulations

Minimum wage, overtime, and other “traditional” compensation concerns must also be followed for piecework employees. Not adhering to FSLA regulations may lead to fines, penalties, and complications for both employers and employees while rectifying errors. So, in addition to capturing the number of units produced, you must also record “on the clock” time. Partnering with a technology solution that can accurately track both unit production and clocked hours, ensures compliance with regulations while enhancing operational efficiency to stay competitive in the market.

Balancing Quality and Quantity in Piecework Compensation

There can be challenges in compensating workers solely based on output quantity. To maintain a balance between quality and quantity, implementing bonuses tied to minimal scrap or rework rates can act as a safeguard to ensure fair compensation. Additionally, the use of premium multipliers can be a strategic tool to ensure that quality remains up to standards.

Another advantage of piecework is its flexibility in allowing varying pay rates for distinct tasks completed. For instance, a worker in a contract assembly facility might assemble a relatively simple product in the morning and a more intricate one in the afternoon. Assigning a higher piece rate for complex and time-consuming tasks can serve as fair compensation, acknowledging the effort required for these tasks while promoting a harmonious outcome for both employers and employees.

Choosing the Right Payroll Platform

Ensure you leverage a system that can automate the application of multiple piece rates in a way that accommodates the diversity of units you produce. Solutions offering a limited range of rates and options will ultimately force you to handle some aspects of production outside the system. That introduces opportunities for pay calculation errors, increased complexity, increased workload for your payroll and HR teams, and gaps in recordkeeping and data.

In addition to piecework arrangements, you might have employees operating in different regions, each with its unique federal, state, and local tax withholdings. Additionally, you may encounter intricate payroll demands like garnishments, shift differentials, per-diem calculations, and other complex withholding scenarios. Make certain that, apart from managing piecework, your system is capable of handling all your diverse payroll needs effectively.

Breaking Down Piecework Pay with Greenshades

While Greenshades plays an instrumental role in streamlining the payment calculation process for piecework employees, here's a brief overview to break it down for you:

How Greenshades Calculates Piecework Compensation

Piecework-based compensation (also known as “piece rates”) is typically set at a fixed amount per unit, premium multipliers can sometimes be leveraged to keep quality degradation in check. Greenshades simplifies the process of calculating payments for employees compensated through piecework pay, making it hassle-free.

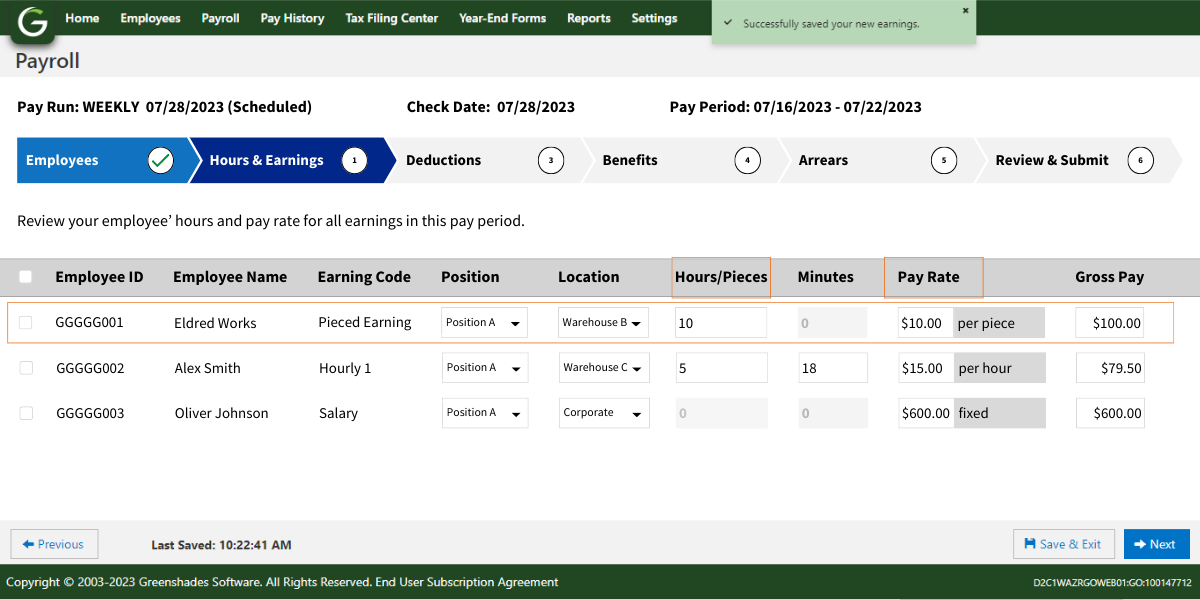

Here's how it works in Greenshades Payroll:

- Set up payroll earning codes that determine pay by rate multiplied the number of "units" to accurately account for piecework.

- For added precision, administrators have the flexibility to change the naming convention from "units" to one that fits their business.

- During the pay run, assign pay codes to employees, enter the rate and number of units, and review the details before finalizing the payroll.

- Employees gain complete transparency regarding their earnings, as they receive a breakdown of the units they've produced separately from their other earnings (i.e. hourly, salary, etc.)

Shifting to Piecework-Based Compensation

Now that you understand the intricacies and potential advantages of piecework, the next step is implementation. With the right strategies and tools, like Greenshades Payroll, the shift can prove transformative for both employers and employees

Adopting a piecework-based compensation model can lead to substantial savings, efficiency improvements, and increased employee satisfaction. This model, especially when integrated with a platform like Greenshades, which is tailored for accuracy, transparency, and meeting the unique needs of your organization, can significantly enhance your compensation strategy

- Flexible Configuration: Customize the way you calculate and label 'units' worked to match your unique business needs.

- Streamlined Processing: Piece Rate Earnings are seamlessly integrated into payroll calculations, with no impact on hourly-based rules or calculations like overtime or double time.

- Comprehensive Reporting: Pay History pages and pay stubs will neatly separate hourly pay from piece rate earnings.

- Import Efficiency: Easily import Piece Rate Earnings to the Pay Run Wizard and internal imports for Pay History.

Switching to piecework compensation can significantly refine your payroll strategy, with Greenshades as your ally, we will work through scenarios that make the best sense for your operation. Are you ready to step into a new phase of payroll processing and employee compensation? Contact us today to redefine your payroll experience and empower your workforce.