As the payroll landscape continues to evolve, Sage Intacct users must stay informed about their payroll options. In our recent webinar, titled 'Command Your Payroll: In-House Strategies for Flexibility & Control for Sage Intacct Users,' led by Chris Hadden, we explored the future of payroll in 2024 and discussed how in-house payroll can assist your team in adapting to emerging trends.

Watch the full replay here:

Download the full webinar deck here.

The webinar began by examining the rapidly changing landscape of payroll and how to proactively adapt to these shifts. Some key trends for 2024 include the support of diverse workforces, the rise of hybrid work arrangements, and the importance of data-driven decision-making.

In-house payroll systems are becoming increasingly vital for businesses seeking flexibility and control. While outsourced payroll solutions automate some activities behind the scenes they often come with challenges like reduced control over business processes, financial management, and unexpected hidden costs.

The webinar delved into the benefits of in-house payroll systems, highlighting their ability to offer enhanced control over payroll processes. This approach allows businesses to manage payroll taxes efficiently, control funds without pre-funding tax accounts, and maintain oversight of cash flow and banking.

Chris also highlighted the advantages of in-house payroll systems, emphasizing the instant access and control they provide over company data, employee information, and business details. He also addressed the potential risks associated with outsourced payroll, including reduced visibility into third-party access to employee data and heightened data breach risks. In-house solutions also offer enhanced cost control, adding to their appeal.

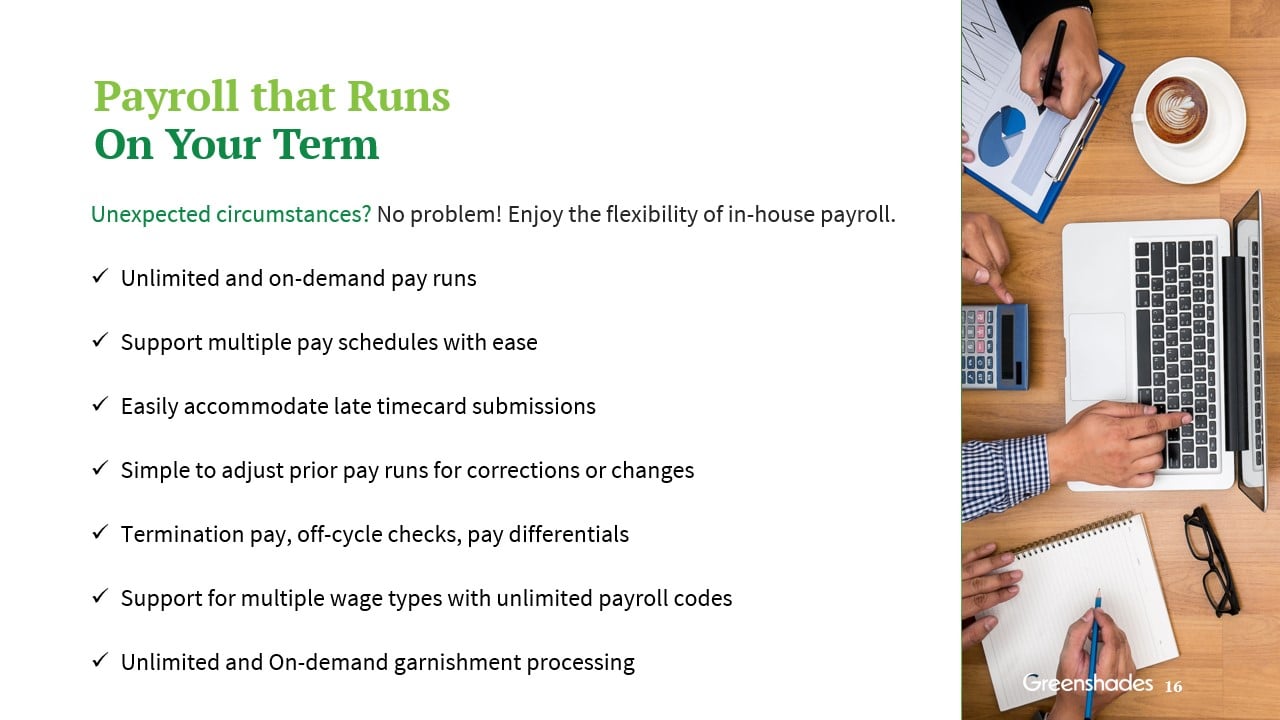

Furthermore, we explored how in-house payroll systems offer a configurable approach, allowing quick adaptation to regulatory changes like taxes, minimum wages, overtime, and benefits, which can vary regionally. These systems ensure timely compliance changes, reducing penalty risks without extra costs.

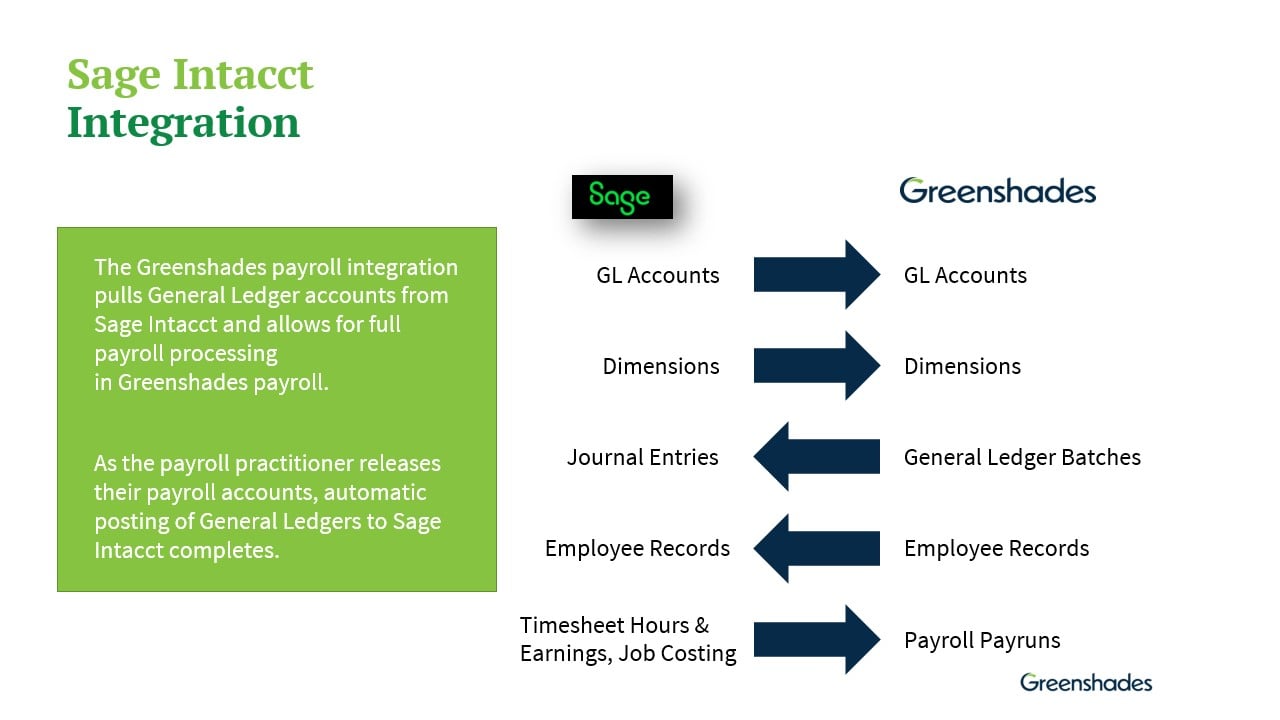

The webinar concluded with insights on evaluating providers and understanding if an in-house system aligns with your business needs. It emphasized the balance between automation and compliance while maintaining internal control. For those considering Greenshades, it integrates seamlessly with Sage Intacct.

Key takeaways from the webinar include:

- Remain in Control: Assess the importance of process control within your organization.

- Experience Enhanced Flexibility: Discover how our configurable software aligns to your exact payroll needs and processes.

- Choose Your Right Solution: Evaluate internal processes to select the best solution.

Interested in how Greenshades' in-house payroll solution can be customized for your organization? Contact us today!

Q&A

Greenshades Flexibility: The Greenshades solution offers configurability, with aspects like the General Ledger and payroll codes, among others. Our development team considers customer feedback as a crucial input for developing new features and enhancing the software.