Introduction

Dive into the world of year-end tax returns with Greenshades' latest webinar in our Year-End series., “Conquer 940/941 Returns: Expert Strategies for Compliance, Savings, and Success," featuring resident tax experts Hannah Walk and Chris Hadden.

Overview of Returns

This webinar provided a comprehensive overview of the different types of returns that are due at the end of the year, including the 941, SUTA/FUTA, and 8027 returns.

Watch the On-Demand Webinar here:

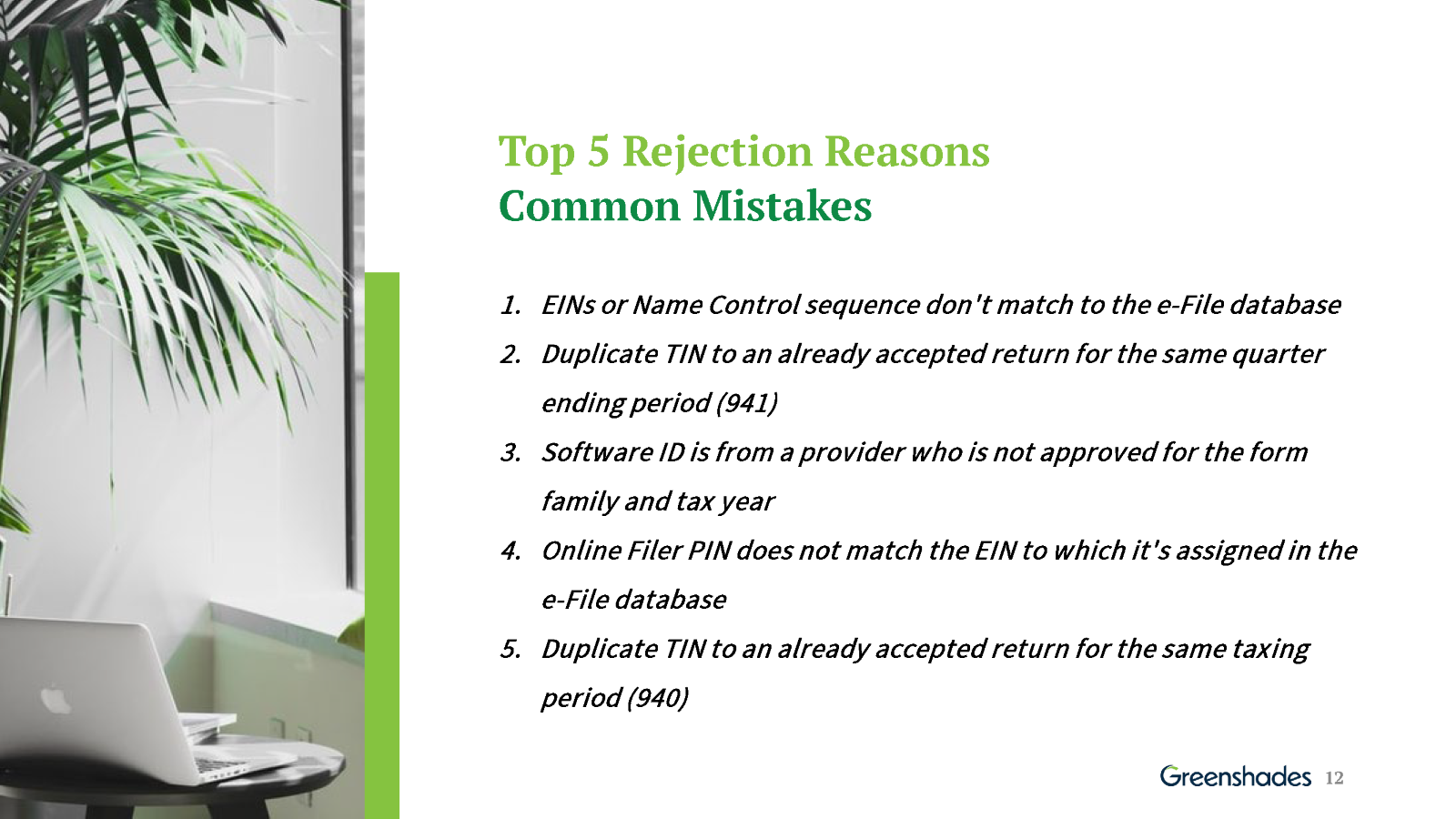

IRS List of Common Form Errors

Hannah Walk discussed the top five reasons for rejections based on the IRS's monthly reports, emphasizing the importance of accuracy in your submissions.

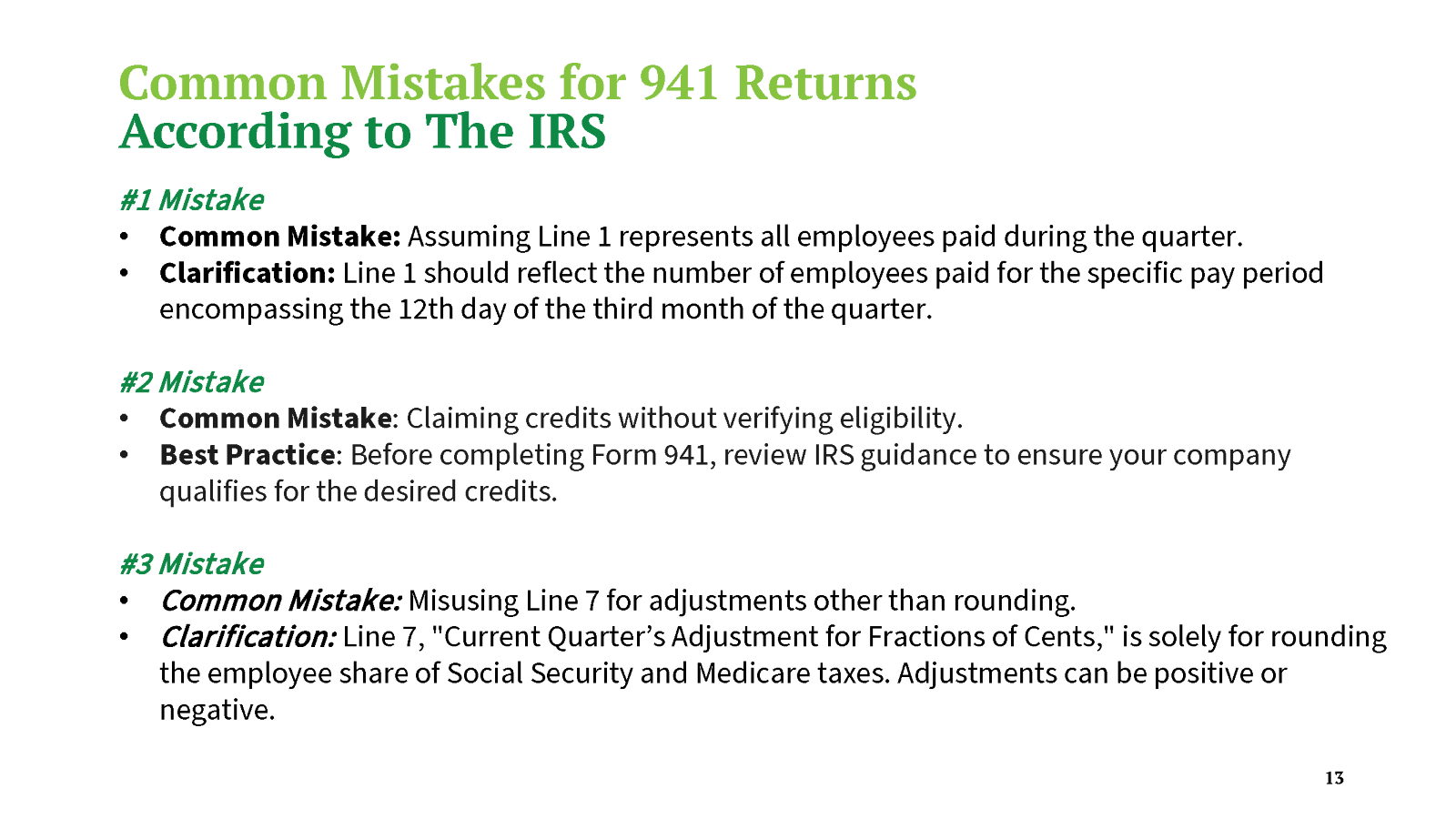

Avoiding Common 941 Mistakes:

Chris covered frequent errors made on Form 941, highlighting crucial aspects like observing the 12th as the quarter-ending payroll date and the correct use of credit boxes. He also stressed the benefits of using software for accurate line 7 totals. Hannah further emphasized the importance of filing individual correction forms for each 94X form that requires amendments, ensuring each is submitted separately.

Critical Deadlines

Our experts reminded attendees of the essential deadlines for various returns.

-Form 940 is due January 31

-W-2 Forms are due January 31

-Form 8027 is due by

- February 28 if you file by mail

- March 31 if you file electronically

Changes for Puerto Rico and U.S Territories

Chris spoke about the streamlined filing process for 940/941 forms for Puerto Rico and U.S Territories, and how Greenshades supports these filings.

The Advantages of Tax Software

In addition to compliance, we explored the transformative impact of tax software on compliance processes. Our experts highlighted how this technology eliminates manual labor and streamlines tasks.

Takeaways

As year-end approaches, it is critical to think beyond year-end forms and evaluate the payroll tax returns you have due.

- Determine the correct forms you must file and stay on top of critical filing deadlines.

- Ensure forms on timely and accurate to avoid fines and penalties for your organization

- Reduce the risk of errors and save your team time by partnering with an expert year-end technology.

Need assistance with payroll tax returns? Contact Greenshades today. Discover how our year-end, tax and cloud solutions can support your e-filing requirements.

→ Click here to download Slide Deck PDF version