In the latest installment of Greenshades' Year-End series, 'Year-End Forms Unplugged: Your Questions, Expert Answers', we were delighted to welcome esteemed tax and compliance experts Alisha Rocks, Chris Hadden, and Laura Detsch. This interactive session focused on addressing a range of topics submitted by attendees, offering in-depth insights and professional solutions to essential questions about year-end forms.

Watch the On-Demand Webinar here:

E-File Requirements Update

Starting January 1, 2024, the e-filing threshold is reduced from 250 to 10 returns, affecting all returns cumulatively. Check your state requirements for specific mandates.

Introduction of New 1099 Portal

In response to the lowered e-filing threshold, the IRS has launched a new system to facilitate the increased volume of electronic filings.

Deep Dive into 1095-C and 1095-B Forms

We explored the nuances of these forms, essential for reporting health insurance coverage details, including coverage offered, employee contributions, and coverage months. Form 1095-B, crucial for stating minimum health insurance coverage, was also discussed in detail.

Strategies to Avoid Filing Delays

Social Security Administration and IRS Changes to Social Security Verification. As previously communicated - The SSA and IRS have rolled out changes to the SSNV and TINV process. Due to these changes when running SSNV and TINV through Greenshades please allow for a 2-business day turnaround time. Validating this information as early as possible will streamline year-end reporting and year-end form distribution.

- Validation is available through Greenshades Online - Year-End Forms Portal

- Greenshades Tax Filing Center and Greenshades Dynamics Payroll Inspector will also allow the same SSNV process

If you want to ensure you are licensed appropriately - please reach out to Greenshades Sales team. If you are ready to begin the validation process - please reach out to Greenshades Support to get the process started!

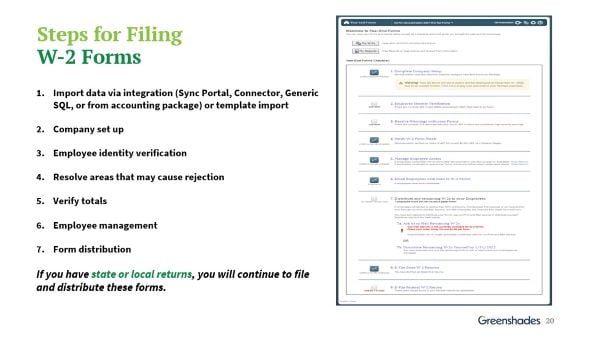

Filing Made Easy with Greenshades

We showcased how Greenshades simplifies filing W-2 and 1099 forms, offering tools for validation, concern checks, and streamlined form distribution.

Q&A

- 1095 ACA Codes: For additional guidance, refer to the IRS website.

- Do I need Paper Forms If Employees View Forms Digitally: No need for paper copies if employees consent to digital receipt.

- E-File Threshold: The e-file requirement is cumulative across all forms.

- Consent for Electronic W2s: Yes, employee consent is required.

- Partial Printing with Greenshades: Selective printing of W-2 forms is possible through the year-end forms checklist.

- 1099 Forms Printing: Greenshades supports printing 1099 forms, even if W-2s are distributed digitally.

- Greenshades Filing Portal Availability: The year-end forms portal is currently open.

- Year-End Forms (YEF) Pricing: Pricing varies; our sales team can provide specific details.

- Support for 940/941s: This service is available outside our year-end form portal.

- State Support for 1099 Filing: Greenshades supports 1099 filing in every required state.

- E-Filing W-2 Forms: Necessary for filing 10 or more returns.

- 1099-K Change Delay: This change is postponed to the next filing year.

- Duration Greenshades Holds Forms: Returns are filed promptly, with some held if necessary.

- Digital Access to 1095-C Forms: Available in the employee self-service portal.

- Paper Form Envelopes: Greenshades provides the correct envelopes for distribution.

- Opting into Electronic W2 Viewing: Employees can change preferences in the self-service portal.

- Contact for W2 Queries for CMIC: CMIC will always be your first point of contact, then CMIC will reach out to Greenshades as needed.

- Separating Compensation Types for 1099: Consult myHRcounsel or another legal provider for advice.

This webinar was an invaluable resource for anyone with questions on how to navigate the complexities of year-end form filing with ease and confidence. Stay tuned for more insights and expert guidance from Greenshades. Have more questions or interested in filing? Contact us today!