In Greenshades' latest installment of our Year-End series, “Navigating 1099 Reporting,” we were joined by our in-house tax expert Jason Kools and sales engineer Amber Manual. This comprehensive session delved into the intricacies of 1099 reporting, addressing the various forms, common filing errors, compliance updates, and the role of technology in simplifying these processes.

Watch the full webinar above or download the complete webinar deck here.

Understanding Different 1099 Forms

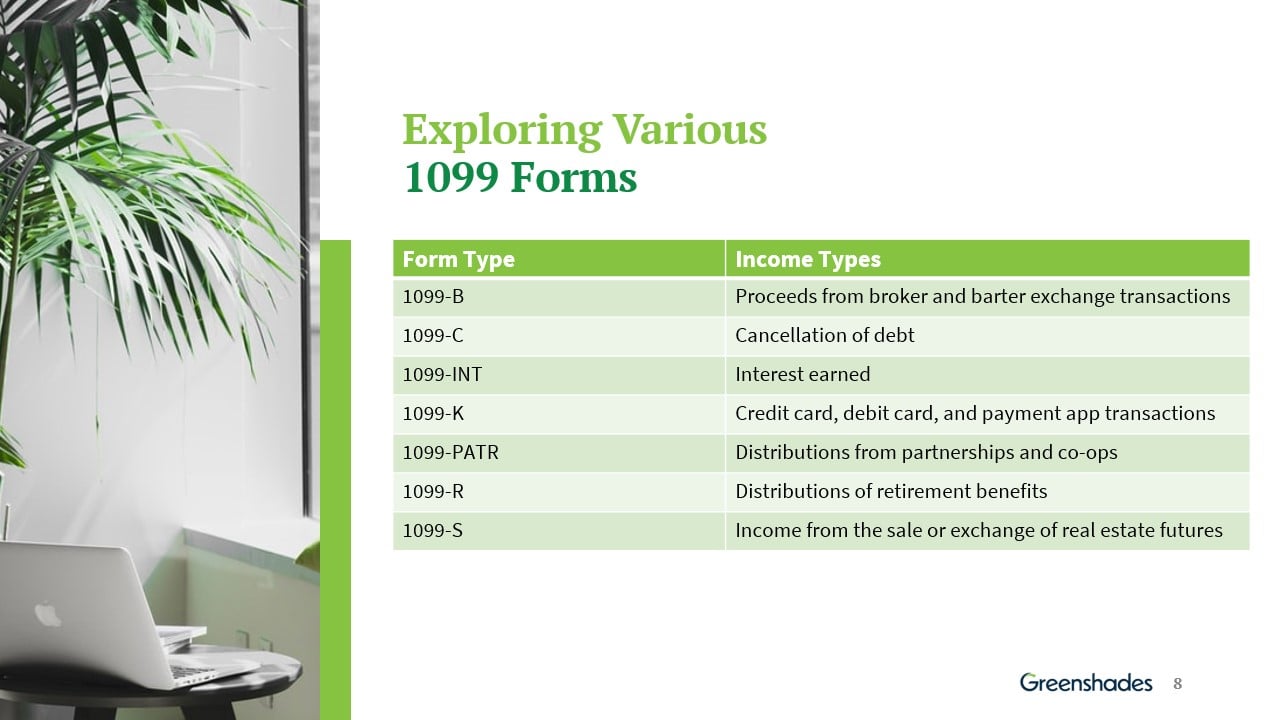

Jason Kools provided an insightful overview of the essential 1099 forms for businesses. Attendees learned about various forms including the 1099-MISC form used for reporting miscellaneous income like fees and commissions, the 1099-NEC for non-employee compensation over $600, and the 1099-DIV for reporting dividends from investments. These forms are crucial for accurate financial reporting and compliance.

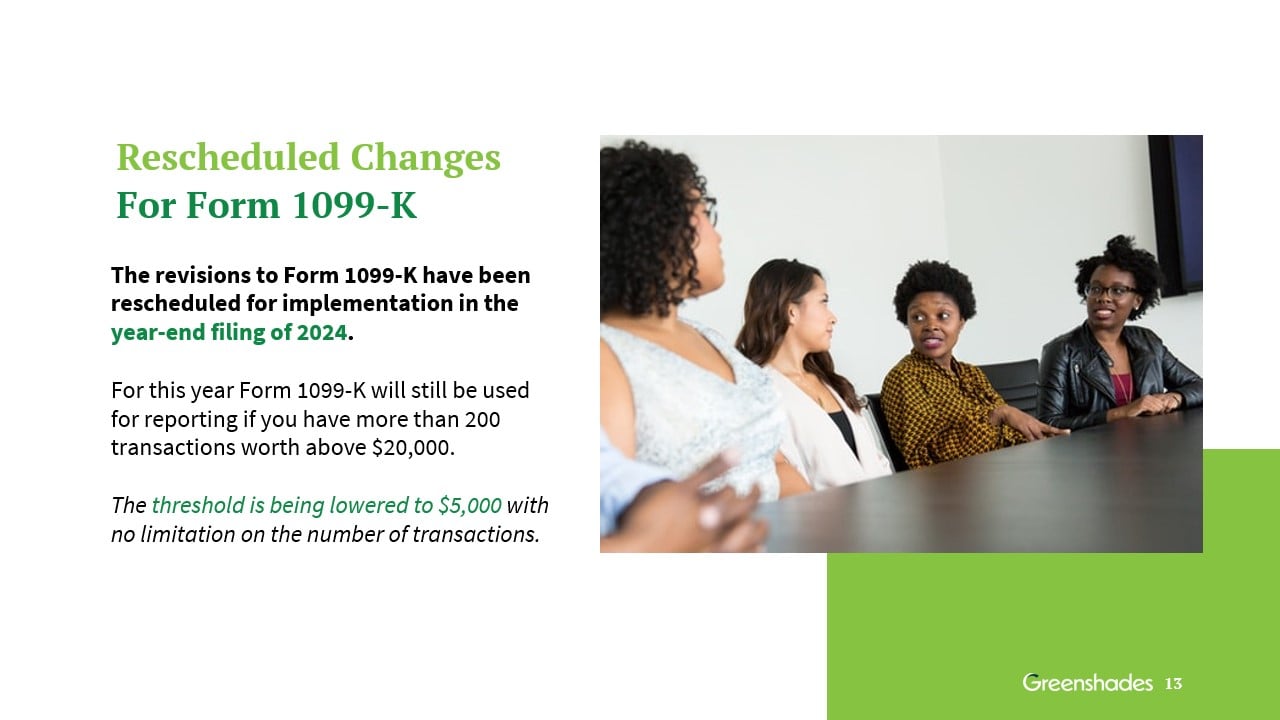

Upcoming Changes in 1099 Filing

A key focus was the upcoming changes in e-filing requirements, effective from January 1, 2024. The threshold for e-filing is set to lower from 250 forms to just 10, impacting a broader range of businesses. The IRS's new Information Return Intake System, designed to facilitate this increase in e-filing, was also discussed. Jason noted the necessity of a Transmitter Control Code (TCC) for accessing this system, a requirement waived if filing through a partner like Greenshades.

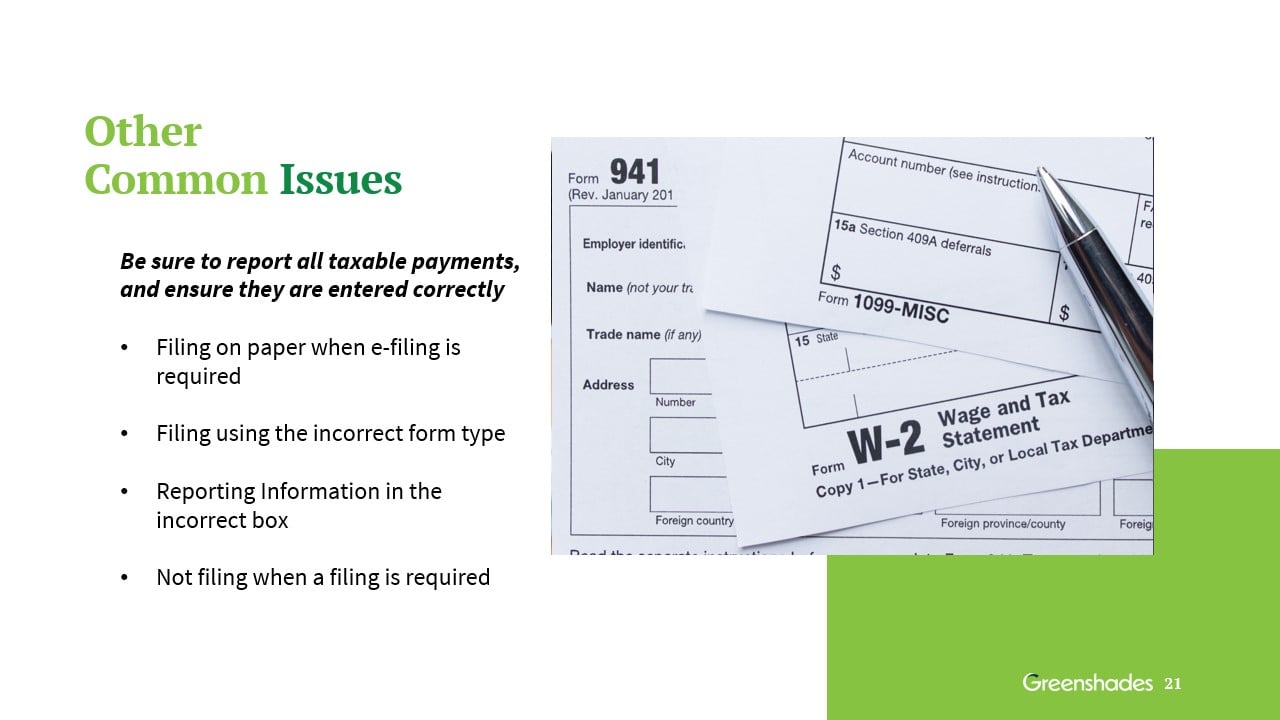

Addressing Common 1099 Filing Challenges

The audience also learned about the common challenges in 1099 filing, emphasizing the importance of correct timing. Filing too early or too late can lead to processing delays or fines. It is also important to verify Taxpayer Identification Numbers (TINs), which must be accurately provided on all tax-related documents. Additionally, correct vendor addresses are essential to avoid delays in the delivery of year-end forms like W-2, 1099, or 1095c, especially if you rely on postal delivery.

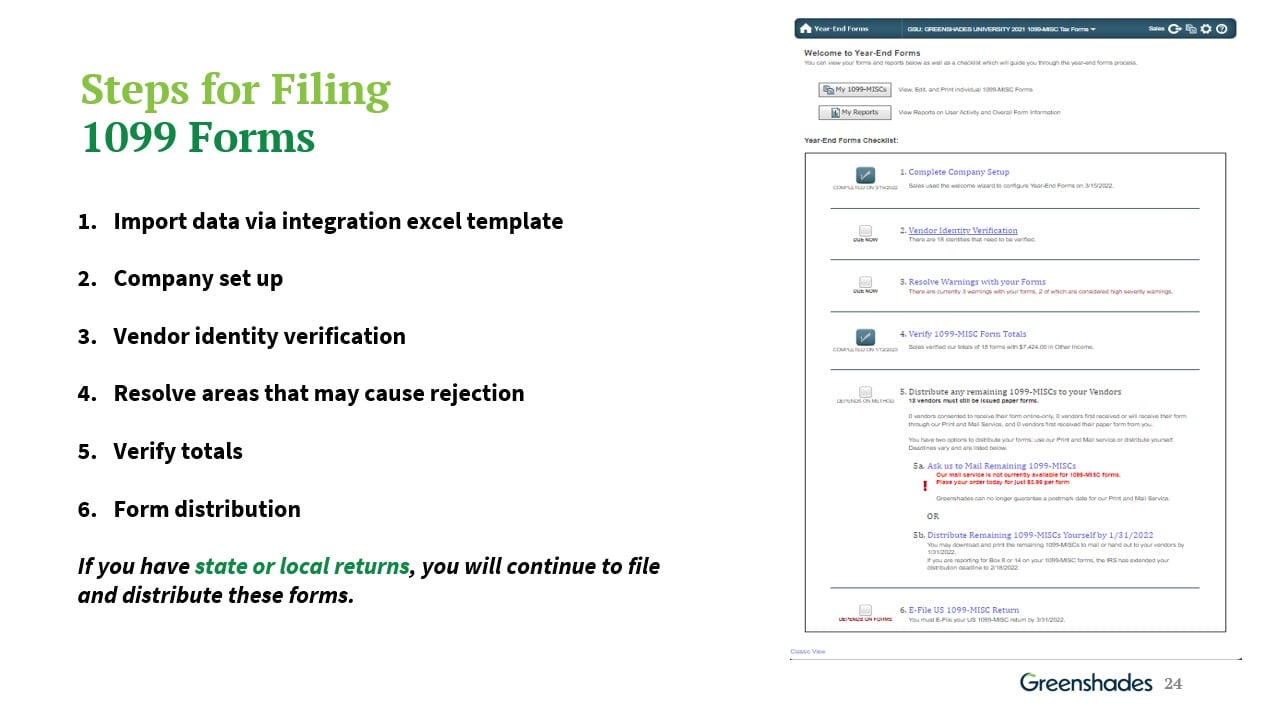

Streamlining Tax Filing with Year-End Software

Participants gained insights into how tax filing software can significantly streamline the tax process. They learned that employing a comprehensive checklist, which not only verifies information but also sends timely alerts for deadlines and conducts essential compliance checks like verifying Social Security Numbers and TINs, can greatly enhance both the efficiency and accuracy throughout the filing season.

Conclusion

The webinar concluded with a reminder of the importance of determining the correct 1099 forms, staying on top of filing deadlines, and partnering with expert year-end technology providers like Greenshades to reduce errors and avoid penalties.

If you're interested in leveraging Greenshades' to enhance your year-end form filing season, reach out to us today.

Q&A

- When Year-End Forms Will Be Open: The Greenshades year-end site is set to go live around December 31, 2023, enabling you to start uploading and filing from January 1, 2024.

- Notifications and Vendor Verification: Stay tuned for updates on when forms are ready. We are also working on improving vendor verification processes to avoid delays.

- Schedule and Cost Availability for Greenshades Year-End Forms: The Greenshades year-end pricing guide for the 2023 tax season is now available. Contact our sales team for detailed pricing information.

- 1099 Submission Cut-Off Date: While Greenshades doesn’t impose a cut-off date for submitting 1099s, it's crucial to adhere to IRS deadlines. For print and mail services, the cut-off is January 23, 2024. Services are available after this date, but delivery by January 31 cannot be guaranteed.

- Setting Up for 1099 Filing with Excel if You are Not a First Time User: If you've previously filed Year-End forms with Greenshades, no additional setup is required for uploading forms via Excel.

- Setting Up 1099 Capability if you Use W-2s: If you're already using Greenshades for W2s, adding 1099 capability involves downloading the correct 1099 template from GreenshadesOnline. For data pulled from other systems, contact our support team for assistance with the correct data connection.

- Verifying GP is Synced to Greenshades for 1099 Filing and Training: To ensure GP is correctly synced for 1099 filing, reach out to our support team. They are also available to provide additional training and resources on 1099 filings.

- Updating Elite Files for 1099 Filing: If you're using Elite for generating 1099 files, you'll need to switch to the Greenshades template for uploading forms. This template is expected to be available around the third week of December.